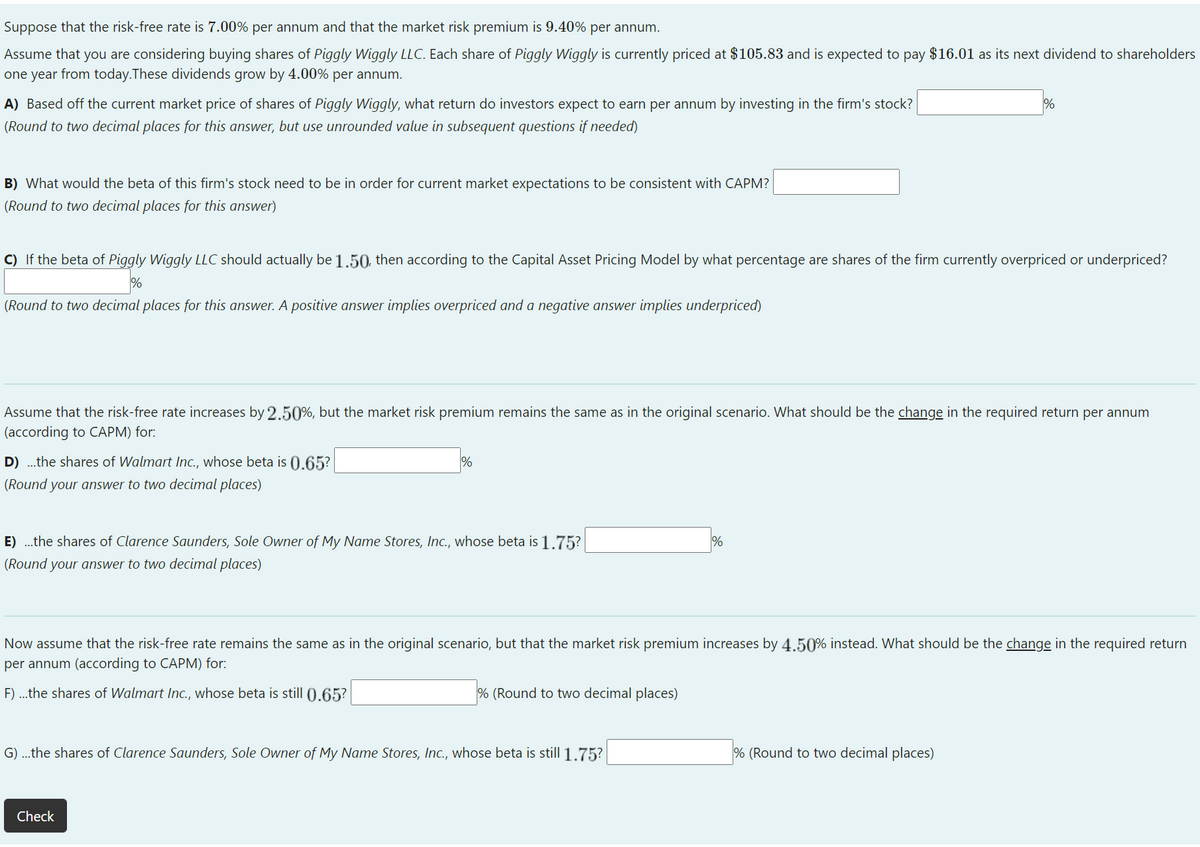

Suppose that the risk-free rate is 7.00% per annum and that the market risk premium is 9.40% per annum. Assume that you are considering buying shares of Piggly Wiggly LLC. Each share of Piggly Wiggly is currently priced at $105.83 and is expected to pay $16.01 as its next dividend to shareholders one year from today.These dividends grow by 4.00% per annum. A) Based off the current market price of shares of Piggly Wiggly, what return do investors expect to earn per annum by investing in the firm's stock? (Round to two decimal places for this answer, but use unrounded value in subsequent questions if needed) B) What would the beta of this firm's stock need to be in order for current market expectations to be consistent with CAPM? (Round to two decimal places for this answer) C) If the beta of Piggly Wiggly LLC should actually be1.50 then according to the Capital Asset Pricing Model by what percentage are shares of the firm currently overpriced or underpriced? (Round to two decimal places for this answer. A positive answer implies overpriced and a negative answer implies underpriced)

Suppose that the risk-free rate is 7.00% per annum and that the market risk premium is 9.40% per annum. Assume that you are considering buying shares of Piggly Wiggly LLC. Each share of Piggly Wiggly is currently priced at $105.83 and is expected to pay $16.01 as its next dividend to shareholders one year from today.These dividends grow by 4.00% per annum. A) Based off the current market price of shares of Piggly Wiggly, what return do investors expect to earn per annum by investing in the firm's stock? (Round to two decimal places for this answer, but use unrounded value in subsequent questions if needed) B) What would the beta of this firm's stock need to be in order for current market expectations to be consistent with CAPM? (Round to two decimal places for this answer) C) If the beta of Piggly Wiggly LLC should actually be1.50 then according to the Capital Asset Pricing Model by what percentage are shares of the firm currently overpriced or underpriced? (Round to two decimal places for this answer. A positive answer implies overpriced and a negative answer implies underpriced)

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 6P

Related questions

Question

Question is in the screen shot

Transcribed Image Text:Suppose that the risk-free rate is 7.00% per annum and that the market risk premium is 9.40% per annum.

Assume that you are considering buying shares of Piggly Wiggly LLC. Each share of Piggly Wiggly is currently priced at $105.83 and is expected to pay $16.01 as its next dividend to shareholders

one year from today.These dividends grow by 4.00% per annum.

A) Based off the current market price of shares of Piggly Wiggly, what return do investors expect to earn per annum by investing in the firm's stock?

%

(Round to two decimal places for this answer, but use unrounded value in subsequent questions if needed)

B) What would the beta of this firm's stock need to be in order for current market expectations to be consistent with CAPM?

(Round to two decimal places for this answer)

C) If the beta of Piggly Wiggly LLC should actually be 1.50, then according to the Capital Asset Pricing Model by what percentage are shares of the firm currently overpriced or underpriced?

%

(Round to two decimal places for this answer. A positive answer implies overpriced and a negative ans

implies under

ced)

Assume that the risk-free rate increases by 2.50%, but the market risk premium remains the same as in the original scenario. What should be the change in the required return per annum

(according to CAPM) for:

D) .the shares of Walmart Inc., whose beta is 0.65?

%

(Round your answer to two decimal places)

E) .the shares of Clarence Saunders, Sole Owner of My Name Stores, Inc., whose beta is 1.75?

%

(Round your answer to two decimal places)

Now assume that the risk-free rate remains the same as in the original scenario, but that the market risk premium increases by 4.50% instead. What should be the change in the required return

per annum (according to CAPM) for:

F) ...the shares of Walmart Inc., whose beta is still 0.65?

% (Round to two decimal places)

G) ...the shares of Clarence Saunders, Sole Owner of My Name Stores, Inc., whose beta is still 1.75?

% (Round to two decimal places)

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning