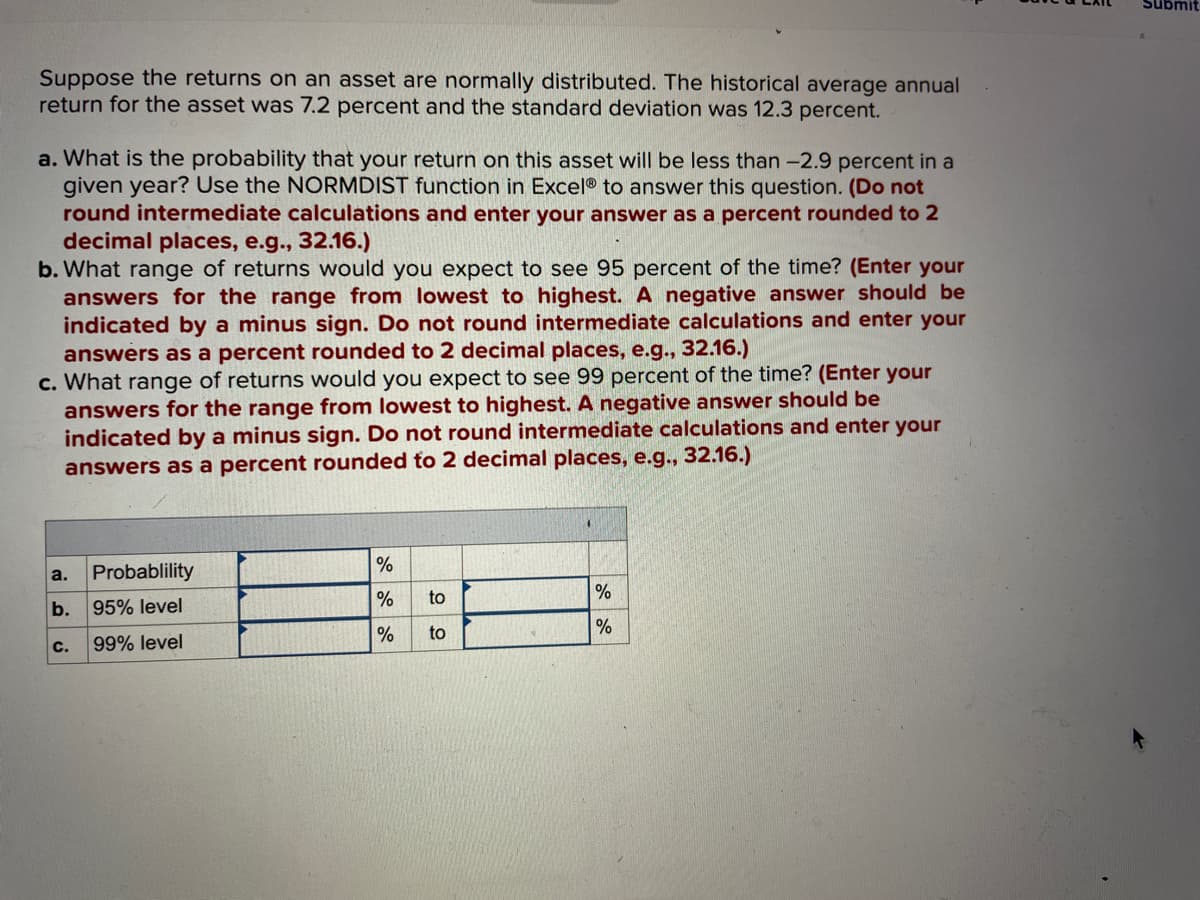

Suppose the returns on an asset are normally distributed. The historical average annual return for the asset was 7.2 percent and the standard deviation was 12.3 percent. a. What is the probability that your return on this asset will be less than -2.9 percent in a given year? Use the NORMDIST function in Excel® to answer this question. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What range of returns would you expect to see 95 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. What range of returns would you expect to see 99 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

Suppose the returns on an asset are normally distributed. The historical average annual return for the asset was 7.2 percent and the standard deviation was 12.3 percent. a. What is the probability that your return on this asset will be less than -2.9 percent in a given year? Use the NORMDIST function in Excel® to answer this question. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What range of returns would you expect to see 95 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. What range of returns would you expect to see 99 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 31PPS

Related questions

Question

Transcribed Image Text:Suppose the returns on an asset are normally distributed. The historical average annual

return for the asset was 7.2 percent and the standard deviation was 12.3 percent.

a. What is the probability that your return on this asset will be less than -2.9 percent in a

given year? Use the NORMDIST function in Excel® to answer this question. (Do not

round intermediate calculations and enter your answer as a percent rounded to 2

decimal places, e.g., 32.16.)

b. What range of returns would you expect to see 95 percent of the time? (Enter your

answers for the range from lowest to highest. A negative answer should be

indicated by a minus sign. Do not round intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

c. What range of returns would you expect to see 99 percent of the time? (Enter your

answers for the range from lowest to highest. A negative answer should be

indicated by a minus sign. Do not round intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a.

b.

C.

Probablility

95% level

99% level

%

%

to

% to

%

%

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill