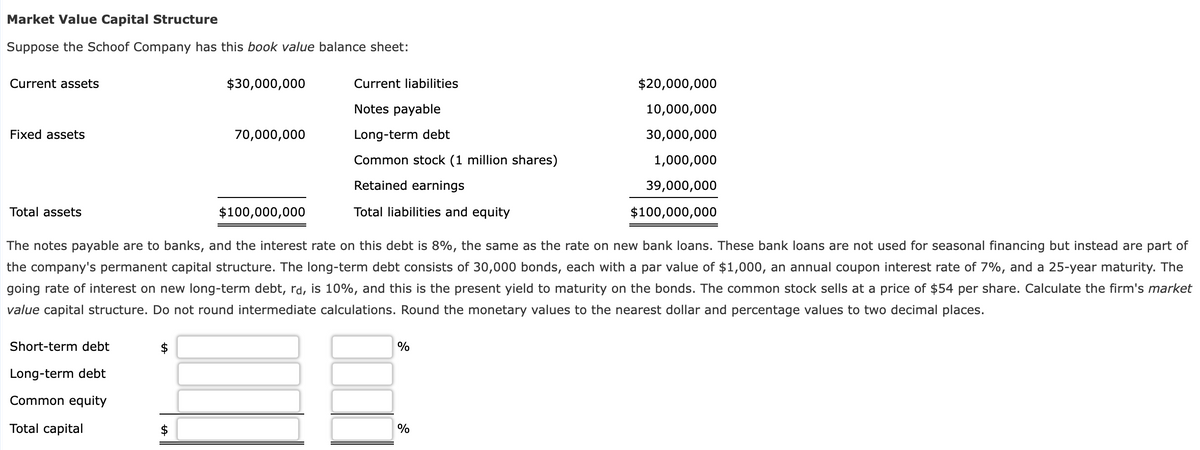

Suppose the Schoof Company has this book value balance sheet: Current assets $30,000,000 Current liabilities $20,000,000 Notes payable 10,000,000 Fixed assets 70,000,000 Long-term debt 30,000,000 Common stock (1 million shares) 1,000,000 Retained earnings 39,000,000 Total assets $100,000,000 Total liabilities and equity $100,000,000

Q: The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $40 per share…

A: A call option is a financial instrument that gives the holder the right, but not the duty, to…

Q: POD has a project with the following cash flows: Year 0 1 Cash Flows -$ 281,000 145,500 163,000 2 3…

A: Profitability Index (PI) is a financial ratio that measures the attractiveness of a project.It is…

Q: The following information will be used to answer questions 8, 9, and 10. Your company can invest in…

A: The objective of the question is to calculate the payback period for each project and then determine…

Q: Bhupatbhai

A: The objective of the question is to calculate the Net Asset Value (NAV) of the fund, the number of…

Q: IBM is planning to produce an expert system based on artificial intelligence and expects the…

A: YearCash Flow0-49000000110000000215000000320000000430000000Rate of return is 12%Project's…

Q: Sally deposits $13,036 in an account that earns 12% interest per annum. Calculate the interest…

A: Simple interest is the interest earned only on the principal amount (not taking into account the…

Q: Please show how to solve this in Excel using Excel formulas and please show the spreadsheet so I can…

A: A mortgage is the amount borrowed from lending institutions at a prevalent interest rate, it…

Q: Al-Awael Islamic Bank purchased warehouses for an amount of 150,000 dinars on 12-25-2018 in cash…

A: The question is asking about the financial responsibilities and implications of a lease agreement…

Q: Required information Section Break (8-11) [The following information applies to the questions…

A: In financial terms, the standard deviation aids in measuring the riskiness of investment for the…

Q: A 20 year/$10, 000 loan with interest i = 9% is to repaid with 12 payments of X at the end of each…

A: To solve this problem, we first need to find the value of X, the annual payment for the first 12…

Q: Chase starts an IRA (Individual Retirement Account) at the age of 30 to save for retirement. He…

A: Here,Monthly Deposit in IRA is $400Current Age is 30Retirement Age is 65Number of Years for deposits…

Q: P8-14 Portfolio analysis You have been given the expected return data shown in the first table on…

A: Portfolio analysis refers to examining the financial results of an investment, that is, the returns…

Q: price NPV. Miglietti Restaurants is looking at a project with the following forecasted sales:…

A: Net present value in capital budgeting refers to the present value of future cash inflows less…

Q: Use the Pl decision rule to decide if the project should be accepted or rejected? -38.88 percent,…

A: PI is the profitability index. It is used in capital budgeting to make project accept/reject…

Q: Bob Smith borrowed $800,000 on Jan 1, 2022. This amount, plus accrued interest at 12% compounded…

A: We have the amount borrowed ,rate of interest and term after whcih the same needs to be reapid. We…

Q: XYZ common just paid an annual dividend of $6.00. Dividends are expected to grow of return on the…

A: The Capital Asset pricing model is used for finding out the cost of equity as it will consider risk…

Q: At an output level of 76,000 units, you calculate that the degree of operating leverage is 3.3. The…

A: To calculate the percentage change in operating cash flow, we can use the formula: \[…

Q: Find the present value of 20 annual payments of $2,000 per annum where the first payment is made 14…

A: Present value refers to the current worth of a future sum of money or cash flow, given a specified…

Q: Suppose that you borrow $200,000 in the form of a 12-year loan with an annual interest rate of 6%…

A: Loan value: $200,000Time period: 12 years , which is 144 monthsInterest rate: 6% p.a, which is 0.5%…

Q: Duo Corporation is evaluating a project with the following cash flows: Year Cash Flow 0 -$ 15,600 1…

A: MIRR- This is a modification of IRR and it is based on the assumption that positive cash flows are…

Q: Halliford Corporation expects to have earnings this coming year of $2.64 per share. Halliford plans…

A: Stock price will be the sum of present value of all future dividends and present value of terminal…

Q: A couple is planning to finance its three-year-old son's university education. Money can be…

A: $166.22Explanation:Use the formula for the future value of a series of periodic deposits:FV = PMT ×…

Q: You are considering a new product launch. The project will cost $1,750,000, have a 4-year life, and…

A: NPV or net present value is an important capital budgeting metric. It is essentially the sum of…

Q: Consider the following table, which gives a security analyst's expected return on two stocks in two…

A: beta shows the % change in stock return with respect to the % change in market return.The higher the…

Q: Let's tackle each part of the question step by step:1. **Monopoly Market:** A) To find the…

A: The objective of the question is to analyze the market conditions under different scenarios:…

Q: Required information [The following information applies to the questions displayed below.] A pension…

A: The minimum variance portfolio refers to the mix of constituent stocks that provide the lowest risk…

Q: Expected Net Cash Flows Year Project X Project Y 0 – $10,000 – $10,000…

A: NPV is the most used and reliable method of capital budgeting based on the time value of money and…

Q: Company X just paid (year 0) a dividend of $1.20. If you expect Company X's dividends to grow at 7%…

A: As per the constant growth rate model, the price of the bond can be found by considering the…

Q: Rare Agri-Products Ltd. is considering a new project with a projectedlife of seven (7) years. The…

A: 1. Compute the Appropriate Rate for Discounting the Cash Flows of the Project (WACC) a. Cost of…

Q: Project CO C1 C2 IRR Alpha -400,000 241,000 293,000 21 21 Beta -200,000 131,000 172,000 31

A: To determine which project to choose between Alpha and Beta using the IRR (Internal Rate of Return)…

Q: You've collected the following information from your favorite financial website. 52-Week Price…

A: A stock is a financial instrument that provides the investor an ownership interest which entitles…

Q: Which of the following statements is correct? Credit spreads decrease with volatility Credit spreads…

A: The correct statement is: "Credit spreads increase with volatility.'' And the factor that is not…

Q: You look at your budget and decide that you can afford $260 per month for a car. What is the maximum…

A: Compound = monthly = 12Monthly Payment = p = $260Interest Rate = r = 5 / 12%Time = t = 7 * 12 = 84

Q: Assume Gillette Corporation will pay an annual dividend of $0.61 one year from now. Analysts expect…

A: The value of the stock today is the sum of the present value of its future cash flows such as…

Q: 10. Fred creates a loan agency. They will finance elite vehicles to UBER drivers. Fred explains his…

A: In a world where transportation needs are rapidly evolving, Fred saw an opportunity to bridge the…

Q: Compute the payback period and the Net Present Value at 10% discount rate, profit after tax for each…

A: Capital budgeting is similar to making long-term financial decisions. It all comes down to deciding…

Q: The NASDAQ stock market bubble peaked at 4,865 in 2000. Two and a half years later it had fallen to…

A: The Nasdaq is an electronic stock exchange based in New York City. It's the second-largest stock…

Q: Metallica Bearings, Incorporated, is a young start-up company. No dividends will be paid on the…

A: Expected Dividend 10 years from today (D10) = $12Constant growth rate after 10 years (g) = 6% or…

Q: Krell Industries has a share price of $22.35 today. If Krell is expected to pay a dividend of $0.84…

A: The equity cost of capital is the cost of acquiring a stake in a corporation. It is the return you…

Q: The Sisyphean Company has a bond outstanding with a face value of $1,000 that reaches maturity in 15…

A: A bond is a debt market security offering fixed periodic coupons with the promise to repay the…

Q: Other things equal, what is the highest price that you would pay for XYZ common if instead the stock…

A: $361.39Explanation:The beta of a stock measures its volatility compared to the market as a whole. A…

Q: The Dahlia Flower Company has earnings of $1.48 per share. a. If the benchmark PE for the company is…

A: PE ratio is also known as Price-Earnings ratio. It is the ratio of the stock price to the Earnings…

Q: A stock sells for a price of $60. Next year's dividend will be $3 per share. If the ROE ("project…

A: Current stock price (P0) = $60Next year expected dividend (D1) = $3Project Return (ROE) = 10% or…

Q: MaxiCare Corporation, a not-for-profit organization, specializes in health care for senior citizens.…

A: Given Data: YearCash Flows0 (1,80,00,00,000)1 - 2…

Q: are u sure about that in the nominal rate calculations we ignored inflation? it must be real rate ?

A: Interest rate there are two rate one' is nominal rate inflation included and without inflation is…

Q: An investor buys one share of stock for $100. At the end of year one she buys three more shares at…

A: TWR can be referred as the return on an average based on the time period in which they are being…

Q: You need a $140,000 loan. Option 1: a 30-year loan at an APR of 7.5%. Option 2: a 15-year loan at an…

A: APR(Annual percentage rate) refers to annual cost paid by the borrower for the loan taken which…

Q: You have an investment opportunity that promises to pay you $20,000 at a future date. You can earn…

A: Present value refers to the current value of an asset that will be present at some future date…

Q: The index model for stock A has been estimated with the following result: RA = 0.01 + 0.9RM + eA.…

A: Beta is a measure of market risk and standard deviation is a measure of volatility/standalone…

Q: United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make…

A: Net present value (NPV) is a technique that helps in assessing the future profitability of an…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Myers Company provides you with the following condensed balance sheet information. Assets 0000 Liabilities and Stockholders’ Equity Current assets $ 40,000 Current and long-term liabilities 00 $100,000 Equity investments 60,000 Stockholders’ equity 00 00 Equipment (net) 250,000 00Common stock ($5 par) $ 20,000 00 Intangibles $160,000 00Paid-in capital in excess of par 110,000 00 00Total assets $410,000 00Retained earnings 0180,000 $310,000 00 00 0000Total liabilities and stockholders’ equity 00 $410,000 Instructions For each of the following transactions, indicate the dollar impact (if any) on the following five items: (1) total assets, (2) common stock, (3) paid-in capital in excess of par, (4) retained earnings, and (5) stockholders’ equity. (Each situation is independent.) a. Myers declares and pays a $0.50 per share cash dividend. b. Myers declares and issues a 10% stock dividend when the market price of the stock is $14 per share. c.…The Statement of Financial Position (SFP) of Arthur Corporation on June 30, 202X is presented below:Current Assets P195,000Land 1,320,000Building 660,000Equipment 525,000Total Assets P2,700,000Liabilities P525,000Ordinary Shares, P5 par 900,00Share Premium 825,000Retained Earnings 450,000Total Equities P2,700,000All the assets and liabilities of Arthur were assumed to approximate their fair values except for land and building. It is estimated that the land has a fair value of P2,100,000, and the fair value of the building increased by P480,000. Ezekeil Corporation acquired 80% of Arthur’s outstanding shares for P3,000,000. The non-controlling interest is measured at fair value.Required:a. Determine the goodwill or gain on bargain purchase assuming the consideration paid includes control premium of P852,000. Determine the goodwill or gain on bargain purchase assuming the consideration paid excludes control premium of P138,000 and the fair value of the non-controlling interest is…

- a company has the following items: share capital-ordinaty: $920,000 treasury shares : $85,000 deferred taxes $100,000 retained earning : $ 363,000 which ammount should be report as total equity ? A- 1098000 B- 1198000 C- 1298000 D- 1398000Balance Sheet for Dex Company and Ed Company on December 31, 2023 are as follows: Dex Company Ed Company Cash P850,000 P75,000 Other Assets 2,200,000 425,000 Total Assets P3,050,000 P500,000 Liabilities P1,200,000 P100,000 Common Stock, P50 par 2,000,000 - Common Stock, P10 par - 250,000 Additional Paid-in Capital 500,000 - Retained Earnings (600,000) 150,000 Total Liabilities and Equity P3,050,000 P500,000 On this date, Dex Company acquired 80% of the stock of Ed Company. Instructions: Prepare a consolidated balance sheet and the eliminating entries as of December 31, 2023, under each set of conditions listed below. Subsidiary stock is acquired in exchange for cash of P200,000 and issuance of a note payable amounting to P250,000 payable by Dex Company. Inventories of Ed Company are to be increased by P75,000. The difference between the investment balance and the book value of the interest acquired…Balance Sheet for Dex Company and Ed Company on December 31, 2023 are as follows: Dex Company Ed Company Cash P850,000 P75,000 Other Assets 2,200,000 425,000 Total Assets P3,050,000 P500,000 Liabilities P1,200,000 P100,000 Common Stock, P50 par 2,000,000 - Common Stock, P10 par - 250,000 Additional Paid-in Capital 500,000 - Retained Earnings (600,000) 150,000 Total Liabilities and Equity P3,050,000 P500,000 On this date, Dex Company acquired 80% of the stock of Ed Company. Instructions: Prepare a consolidated balance sheet and the eliminating entries as of December 31, 2023, under each set of conditions listed below. Subsidiary stock is acquired in exchange for 5,000 shares of the parent company stock, and the investment accounts is recorded at P300,000, the current market value of the shares issued. The difference between the investment balance an the book value of the interest acquired is…

- Balance Sheet for Dex Company and Ed Company on December 31, 2023 are as follows: Dex Company Ed Company Cash P850,000 P75,000 Other Assets 2,200,000 425,000 Total Assets P3,050,000 P500,000 Liabilities P1,200,000 P100,000 Common Stock, P50 par 2,000,000 - Common Stock, P10 par - 250,000 Additional Paid-in Capital 500,000 - Retained Earnings (600,000) 150,000 Total Liabilities and Equity P3,050,000 P500,000 On this date, Dex Company acquired 80% of the stock of Ed Company. Instructions: Prepare a consolidated balance sheet and the eliminating entries as of December 31, 2023, under each set of conditions listed below. Subsidiary stock is acquired for cash of P350,000. The difference between the investment balance and the book value of the interest acquired is regarded as evidence of goodwill identified with the subsidiary company.Balance Sheet for Dex Company and Ed Company on December 31, 2023 are as follows: Dex Company Ed Company Cash P850,000 P75,000 Other Assets 2,200,000 425,000 Total Assets P3,050,000 P500,000 Liabilities P1,200,000 P100,000 Common Stock, P50 par 2,000,000 - Common Stock, P10 par - 250,000 Additional Paid-in Capital 500,000 - Retained Earnings (600,000) 150,000 Total Liabilities and Equity P3,050,000 P500,000 On this date, Dex Company acquired 80% of the stock of Ed Company. Instructions: Prepare a consolidated balance sheet and the eliminating entries as of December 31, 2023, under each set of conditions listed below. Subsidiary stock is acquired for cash of P350,000. The difference between the investment balance and the book value of the interest acquired is regarded as evidence of goodwill identified with the subsidiary company. Subsidiary stock is acquired in exchange for 5,000 shares of the…Balance Sheet for Dex Company and Ed Company on December 31, 2023 are as follows: Dex Company Ed Company Cash P850,000 P75,000 Other Assets 2,200,000 425,000 Total Assets P3,050,000 P500,000 Liabilities P1,200,000 P100,000 Common Stock, P50 par 2,000,000 - Common Stock, P10 par - 250,000 Additional Paid-in Capital 500,000 - Retained Earnings (600,000) 150,000 Total Liabilities and Equity P3,050,000 P500,000 On this date, Dex Company acquired 80% of the stock of Ed Company. Instructions: Prepare a consolidated balance sheet and the eliminating entries as of December 31, 2023, under each set of conditions listed below. Subsidiary stock is acquired by exchanging 5,000 shares of Dex Company stock. The investment is recorded at the par value of the stocks issued.

- Assume the capital structure of XYZ Company: Bonds payable, 10% . . . . . . . 500,000 Preferred stock, 8%, P100 par . . . . . . . . 100,000 Common stock, 100,000 shares. . . . . . . 400,000 Other data shows as follows: Sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . 800,000 Variable costs. . . . . . . . . . . . . . . . . . . . . . 362,500 Fixed Operating costs. . . . .. . . . . . . . . . . 187,500 Income tax rate . . . . . . . . . . . . . . . 30% Dividend growth rate . . . . . . . . . . . . . . . . 2% Required: Compute the following: Net Income available to Common DOL DFL DTLData pertaining to the current position of Lucroy Industries Inc. follow:Cash $ 800,000Marketable securities 550,000Accounts and notes receivable (net) 850,000Inventories 700,000Prepaid expenses 300,000Accounts payable 1,200,000Notes payable (short-term) 700,000Accrued expenses 100,000Instructions1. Compute (a) the working capital, (b) the current ratio, and (c) the quick ratio. Round ratios in parts b through j to one decimal place.2. List the following captions on a sheet of paper:Transaction Working Capital Current Ratio Quick RatioCompute the working capital, the current ratio, and the quick ratio after each of the…Presented below is the trial balance of Walter Corporation at December 31, 2020.Cash 197,000Sales 7,900,000Trading Securities (at cost, P145,000) 153,000Cost of goods sold 4,800,000Long-term investments in bonds 299,000Long-term investment in share capital - ordinary 277,000Short-term notes payable 90,000Accounts payable 455,000Selling expenses 2,000,000Investment revenue 63,000Land 260,000Buildings 1,040,000Dividends payable 136,000Accrued liabilities 96,000Accounts receivables 435,000Accumulated Depreciation – Building 352,000Allowance for doubtful accounts 25,000Administrative Expenses 900,000Interest Expense 211,000Inventories 597,000Provision for pension (long term) 80,000Long term notes payable 900,000Equipment 600,000Bonds Payable 1,000,000Accumulated Depreciation – Equipment 60,000Franchise 160,000Shares Capital – Ordinary 1,000,000Treasury Shares 191,000Patent 195,000Retained Earnings 78,000Other comprehensive income 80,000 Requirements:1. How much is the total assets?2. How…