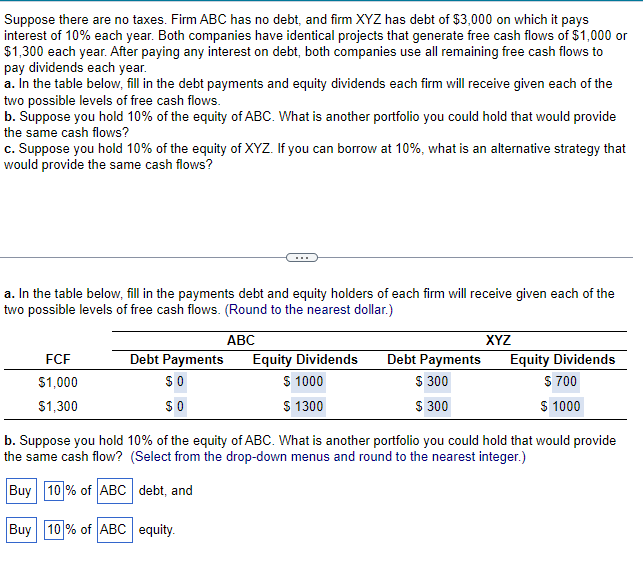

Suppose there are no taxes. Firm ABC has no debt, and firm XYZ has debt of $3,000 on which it pays interest of 10% each year. Both companies have identical projects that generate free cash flows of $1,000 or $1,300 each year. After paying any interest on debt, both companies use all remaining free cash flows to pay dividends each year. a. In the table below, fill in the debt payments and equity dividends each firm will receive given each of the two possible levels of free cash flows. b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide the same cash flows? c. Suppose you hold 10% of the equity of XYZ. If you can borrow at 10%, what is an alternative strategy that would provide the same cash flows? a. In the table below, fill in the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows. (Round to the nearest dollar.) ABC FCF $1,000 $1,300 Debt Payments $0 $0 Equity Dividends $ 1000 $ 1300 Debt Payments $ 300 $ 300 XYZ Equity Dividends $ 700 $ 1000 b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide the same cash flow? (Select from the drop-down menus and round to the nearest integer.) Buy 10% of ABC debt, and Buy 10% of ABC equity.

Suppose there are no taxes. Firm ABC has no debt, and firm XYZ has debt of $3,000 on which it pays interest of 10% each year. Both companies have identical projects that generate free cash flows of $1,000 or $1,300 each year. After paying any interest on debt, both companies use all remaining free cash flows to pay dividends each year. a. In the table below, fill in the debt payments and equity dividends each firm will receive given each of the two possible levels of free cash flows. b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide the same cash flows? c. Suppose you hold 10% of the equity of XYZ. If you can borrow at 10%, what is an alternative strategy that would provide the same cash flows? a. In the table below, fill in the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows. (Round to the nearest dollar.) ABC FCF $1,000 $1,300 Debt Payments $0 $0 Equity Dividends $ 1000 $ 1300 Debt Payments $ 300 $ 300 XYZ Equity Dividends $ 700 $ 1000 b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide the same cash flow? (Select from the drop-down menus and round to the nearest integer.) Buy 10% of ABC debt, and Buy 10% of ABC equity.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter17: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 3P

Related questions

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

Transcribed Image Text:Suppose there are no taxes. Firm ABC has no debt, and firm XYZ has debt of $3,000 on which it pays

interest of 10% each year. Both companies have identical projects that generate free cash flows of $1,000 or

$1,300 each year. After paying any interest on debt, both companies use all remaining free cash flows to

pay dividends each year.

a. In the table below, fill in the debt payments and equity dividends each firm will receive given each of the

two possible levels of free cash flows.

b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide

the same cash flows?

c. Suppose you hold 10% of the equity of XYZ. If you can borrow at 10%, what is an alternative strategy that

would provide the same cash flows?

a. In the table below, fill in the payments debt and equity holders of each firm will receive given each of the

two possible levels of free cash flows. (Round to the nearest dollar.)

ABC

FCF

$1,000

$1,300

Debt Payments

$0

$0

Equity Dividends

$ 1000

$ 1300

Buy 10% of ABC equity.

Debt Payments

$ 300

$ 300

XYZ

Equity Dividends

$ 700

$ 1000

b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide

the same cash flow? (Select from the drop-down menus and round to the nearest integer.)

Buy 10% of ABC

debt, and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning