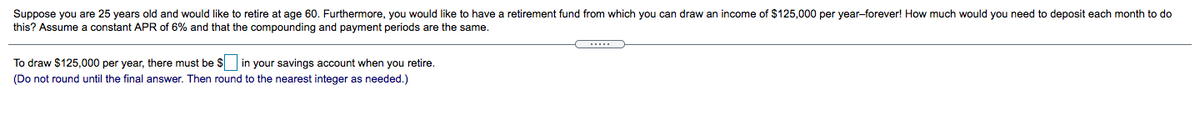

Suppose you are 25 years old and would like to retire at age 60. Furthermore, you would like to have a retirement fund from which you can draw an income of $125,000 per year-forever! How much would you need to deposit each month to do this? Assume a constant APR of 6% and that the compounding and payment periods are the same. To draw $125,000 per year, there must be S in your savings account when you retire. (Do not round until the final answer. Then round to the nearest integer as needed.)

Suppose you are 25 years old and would like to retire at age 60. Furthermore, you would like to have a retirement fund from which you can draw an income of $125,000 per year-forever! How much would you need to deposit each month to do this? Assume a constant APR of 6% and that the compounding and payment periods are the same. To draw $125,000 per year, there must be S in your savings account when you retire. (Do not round until the final answer. Then round to the nearest integer as needed.)

Intermediate Algebra

10th Edition

ISBN:9781285195728

Author:Jerome E. Kaufmann, Karen L. Schwitters

Publisher:Jerome E. Kaufmann, Karen L. Schwitters

Chapter11: Exponential And Logarithmic Functions

Section11.2: Applications Of Exponential Functions

Problem 27PS

Related questions

Question

Transcribed Image Text:Suppose you are 25 years old and would like to retire at age 60. Furthermore, you would like to have a retirement fund from which you can draw an income of $125,000 per year-forever! How much would you need to deposit each month to do

this? Assume a constant APR of 6% and that the compounding and payment periods are the same.

To draw $125,000 per year, there must be $ in your savings account when you retire.

(Do not round until the final answer. Then round to the nearest integer as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Algebra

Algebra

ISBN:

9781285195728

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Intermediate Algebra

Algebra

ISBN:

9781285195728

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning