Suppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below. A B C Probabilities return 0.05 0.50% -3.60% 3.60% 0.35 0.60% 2.75% 0.15% 0.45 3.66% 1.45% 0.45% 0.15 -4.80% -0.60% 6.30% Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.) Is there any reason to invest in Asset A given its low expected return and high standard deviation?

Suppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below. A B C Probabilities return 0.05 0.50% -3.60% 3.60% 0.35 0.60% 2.75% 0.15% 0.45 3.66% 1.45% 0.45% 0.15 -4.80% -0.60% 6.30% Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.) Is there any reason to invest in Asset A given its low expected return and high standard deviation?

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 5P

Related questions

Question

Suppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below.

| A | B | C | |

| Probabilities | return | ||

| 0.05 | 0.50% | -3.60% | 3.60% |

| 0.35 | 0.60% | 2.75% | 0.15% |

| 0.45 | 3.66% | 1.45% | 0.45% |

| 0.15 | -4.80% | -0.60% | 6.30% |

- Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.)

- Is there any reason to invest in Asset A given its low expected return and high standard deviation?

Expert Solution

Introduction

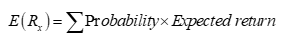

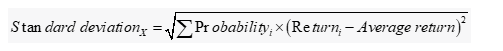

Expected return and standard deviation of a stock say "X" can be calculated as:

Here, i represents each state

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT