Suppose you desire to short-sell 150 shares of ABC stock, which has a bid price of $ 39.75 and an ask price of $ 40 25. You cover the short position 180 days later when the bid price is $ 27.55 and the ask price is $ 28 05 a) Taking into account only the bid and ask prices (ignoring commissions and interest), what profit did you make $ b) Suppose that there is a 0.3% commission to engage in the short-sale (this is the commission to sell the stock and a 0.3% commission to close the short-sale (this is the commission to buy the stock back). Considering these commissions, what profit did you make $ c) Suppose the 6-month interest rate is 3% and that you are paid no interest on the short-sale proceeds. Still assuming that there is a 0.3% commission to engage in the short-sale, how much interest do you lose during the 6 months in which you have the short position $ Note: You can eam partial credit on this problem

Suppose you desire to short-sell 150 shares of ABC stock, which has a bid price of $ 39.75 and an ask price of $ 40 25. You cover the short position 180 days later when the bid price is $ 27.55 and the ask price is $ 28 05 a) Taking into account only the bid and ask prices (ignoring commissions and interest), what profit did you make $ b) Suppose that there is a 0.3% commission to engage in the short-sale (this is the commission to sell the stock and a 0.3% commission to close the short-sale (this is the commission to buy the stock back). Considering these commissions, what profit did you make $ c) Suppose the 6-month interest rate is 3% and that you are paid no interest on the short-sale proceeds. Still assuming that there is a 0.3% commission to engage in the short-sale, how much interest do you lose during the 6 months in which you have the short position $ Note: You can eam partial credit on this problem

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 4P

Related questions

Question

Pls help me with this homework, I will upvote you…Pls answer in 7-8 sentence only…in simple words

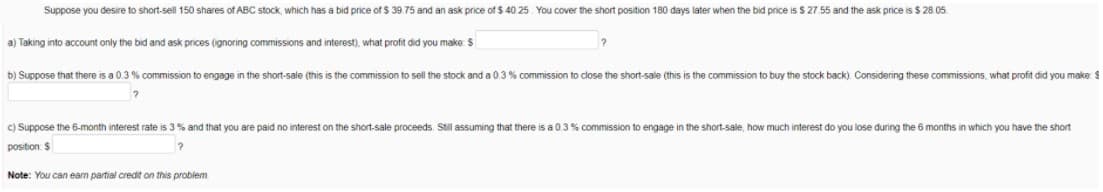

Transcribed Image Text:Suppose you desire to short-sell 150 shares of ABC stock, which has a bid price of $ 39.75 and an ask price of $ 40 25. You cover the short position 180 days later when the bid price is $ 27.55 and the ask price is $ 28.05.

a) Taking into account only the bid and ask prices (ignoring commissions and interest), what profit did you make S

b) Suppose that there is a 0.3 % commission to engage in the short-sale (this is the commission to sell the stock and a 0.3 % commission to close the short-sale (this is the commission to buy the stock back). Considering these commissions, what profit did you make: $

c) Suppose the 6-month interest rate is 3 % and that you are paid no interest on the short-sale proceeds. Still assuming that there is a 0.3% commission to engage in the short-sale, how much interest do you lose during the 6 months in which you have the short

position $

Note: You can eam partial credit on this problem

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning