Suppose you hold all of the $9.99 million in convertible notes in a start-up (this includes accrued interest). Your note has a $18 million cap and a 20% discount. There are 3 million founders' shares and the option pool contains an additional 3 million shares. A VC is making an A-round investment and requires 25% of the exit value of the firm. (There are no future financing rounds). The VC is investing $11 million and requires a 50% return (annually). The firm will exit in 3 years. a. How many shares do you (the note holder) receive if you convert using the cap? (if your answer is 1 million, record 1,00,000. Round to the nearest share.)

Suppose you hold all of the $9.99 million in convertible notes in a start-up (this includes accrued interest). Your note has a $18 million cap and a 20% discount. There are 3 million founders' shares and the option pool contains an additional 3 million shares. A VC is making an A-round investment and requires 25% of the exit value of the firm. (There are no future financing rounds). The VC is investing $11 million and requires a 50% return (annually). The firm will exit in 3 years. a. How many shares do you (the note holder) receive if you convert using the cap? (if your answer is 1 million, record 1,00,000. Round to the nearest share.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter18: Initial Public Offerings, Investment Banking, And Capital Formation

Section: Chapter Questions

Problem 9MC

Related questions

Question

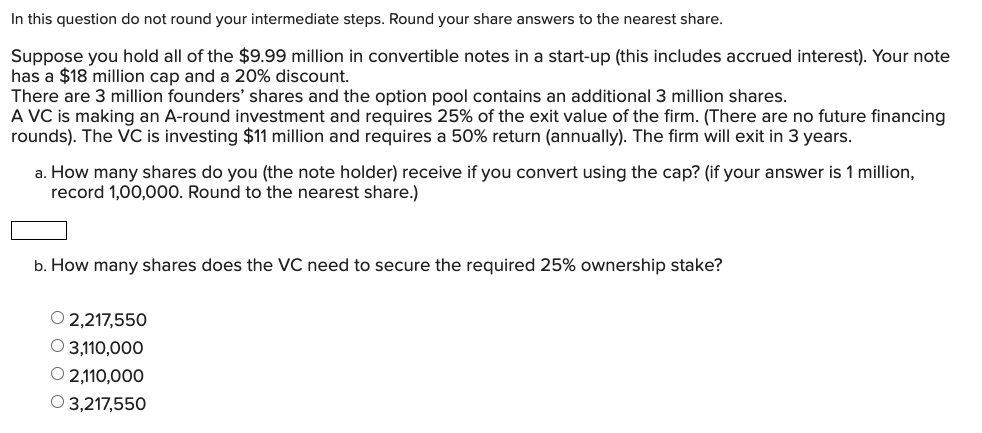

Transcribed Image Text:In this question do not round your intermediate steps. Round your share answers to the nearest share.

Suppose you hold all of the $9.99 million in convertible notes in a start-up (this includes accrued interest). Your note

has a $18 million cap and a 20% discount.

There are 3 million founders' shares and the option pool contains an additional 3 million shares.

A VC is making an A-round investment and requires 25% of the exit value of the firm. (There are no future financing

rounds). The VC is investing $11 million and requires a 50% return (annually). The firm will exit in 3 years.

a. How many shares do you (the note holder) receive if you convert using the cap? (if your answer is 1 million,

record 1,00,000. Round to the nearest share.)

b. How many shares does the VC need to secure the required 25% ownership stake?

O 2,217,550

О 3110,000

O 2,110,000

O 3,217,550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT