Suppose you receive $100 at the end of each year for the next three years. a. If the interest rate is 8%, what is the present value of these cash flows? b. What is the future value in three years of the present value you computed in (a)? c. Suppose you deposit the cash flows in a bank account that pays 8% interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)? How does the final bank balance compare with your answer in (b)? a. If the interest rate is 8%, what is the present value these cash flows? The present value of these cash flows is $. (Round to the nearest cent.) b. What is the future value in three years of the present value you computed in (a)? The future value in three years is $. (Round to the nearest cent.) c. Suppose you deposit the cash flows in a bank account that pays 8% interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)? The balance in the account at the end of year one is $. (Round to the nearest cent.) The balance in the account at the end of year two is $. (Round to the nearest cent.) The balance in the account at the end of year three is $. (Round to the nearest cent.) How does the final bank balance compare with your answer in (b)? (Select from the drop-down menu and ignore small differences due to rounding.) The final bank balance in (c) is v the bank balance from part (b).

Suppose you receive $100 at the end of each year for the next three years. a. If the interest rate is 8%, what is the present value of these cash flows? b. What is the future value in three years of the present value you computed in (a)? c. Suppose you deposit the cash flows in a bank account that pays 8% interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)? How does the final bank balance compare with your answer in (b)? a. If the interest rate is 8%, what is the present value these cash flows? The present value of these cash flows is $. (Round to the nearest cent.) b. What is the future value in three years of the present value you computed in (a)? The future value in three years is $. (Round to the nearest cent.) c. Suppose you deposit the cash flows in a bank account that pays 8% interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)? The balance in the account at the end of year one is $. (Round to the nearest cent.) The balance in the account at the end of year two is $. (Round to the nearest cent.) The balance in the account at the end of year three is $. (Round to the nearest cent.) How does the final bank balance compare with your answer in (b)? (Select from the drop-down menu and ignore small differences due to rounding.) The final bank balance in (c) is v the bank balance from part (b).

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter4: Managing Your Cash And Savings

Section: Chapter Questions

Problem 7FPE: Calculating interest earned and future value of savings account. If you put 6,000 in a savings...

Related questions

Question

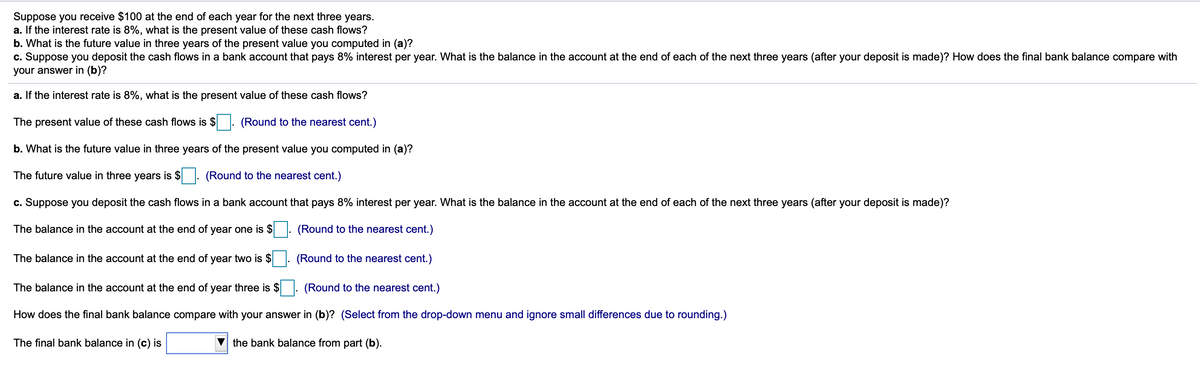

Transcribed Image Text:Suppose you receive $100 at the end of each year for the next three years.

a. If the interest rate is 8%, what is the present value of these cash flows?

b. What is the future value in three years of the present value you computed in (a)?

c. Suppose you deposit the cash flows in a bank account that pays 8% interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)? How does the final bank balance compare with

your answer in (b)?

a. If the interest rate is 8%, what is the present value of these cash flows?

The present value of these cash flows is $ |. (Round to the nearest cent.)

b. What is the future value in three years of the present value you computed in (a)?

The future value in three years is $

(Round to the nearest cent.)

c. Suppose you deposit the cash flows in a bank account that pays 8% interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)?

The balance in the account at the end of year one is $

(Round to the nearest cent.)

The balance in the account at the end of year two is $

(Round to the nearest cent.)

The balance in the account at the end of year three is $

(Round to the nearest cent.)

How does the final bank balance compare with your answer in (b)? (Select from the drop-down menu and ignore small differences due to rounding.)

The final bank balance in (c) is

the bank balance from part (b).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning