Suppose you want to have $300,000 for retirement in 25 years. Your account earns 9% interest. a) How much would you need to deposit in the account each month? b) How much interest will you earn?

Suppose you want to have $300,000 for retirement in 25 years. Your account earns 9% interest. a) How much would you need to deposit in the account each month? b) How much interest will you earn?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 11E

Related questions

Question

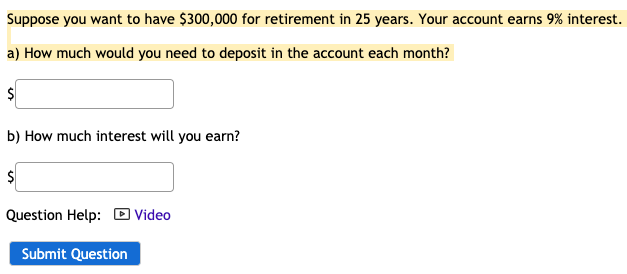

Suppose you want to have $300,000 for retirement in 25 years. Your account earns 9% interest.

a) How much would you need to deposit in the account each month?

b) How much interest will you earn?

Transcribed Image Text:Suppose you want to have $300,000 for retirement in 25 years. Your account earns 9% interest.

a) How much would you need to deposit in the account each month?

b) How much interest will you earn?

Question Help: D Video

Submit Question

Expert Solution

Introduction

According to the time value concept, a sum of money today has more purchasing power than the same amount of money at some point in the future. This is because the present value of money has interest earnings capacity.

The future value of a current amount of money is the value expected to be received or paid at a future date based on a predetermined growth rate.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning