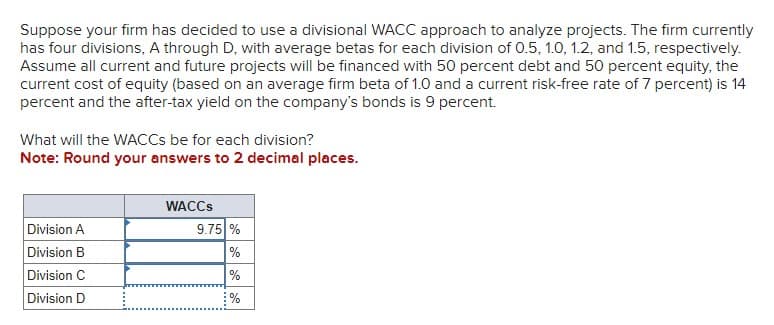

Suppose your firm has decided to use a divisional WACC approach to analyze projects. The firm currently has four divisions, A through D, with average betas for each division of 0.5, 1.0, 1.2, and 1.5, respectively. Assume all current and future projects will be financed with 50 percent debt and 50 percent equity, the current cost of equity (based on an average firm beta of 1.0 and a current risk-free rate of 7 percent) is 14 percent and the after-tax yield on the company's bonds is 9 percent. What will the WACCs be for each division? Note: Round your answers to 2 decimal places. WACCs Division A 9.75 % Division B % Division C % Division D %

Suppose your firm has decided to use a divisional WACC approach to analyze projects. The firm currently has four divisions, A through D, with average betas for each division of 0.5, 1.0, 1.2, and 1.5, respectively. Assume all current and future projects will be financed with 50 percent debt and 50 percent equity, the current cost of equity (based on an average firm beta of 1.0 and a current risk-free rate of 7 percent) is 14 percent and the after-tax yield on the company's bonds is 9 percent. What will the WACCs be for each division? Note: Round your answers to 2 decimal places. WACCs Division A 9.75 % Division B % Division C % Division D %

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 18P

Related questions

Question

Transcribed Image Text:Suppose your firm has decided to use a divisional WACC approach to analyze projects. The firm currently

has four divisions, A through D, with average betas for each division of 0.5, 1.0, 1.2, and 1.5, respectively.

Assume all current and future projects will be financed with 50 percent debt and 50 percent equity, the

current cost of equity (based on an average firm beta of 1.0 and a current risk-free rate of 7 percent) is 14

percent and the after-tax yield on the company's bonds is 9 percent.

What will the WACCs be for each division?

Note: Round your answers to 2 decimal places.

WACCs

Division A

9.75 %

Division B

%

Division C

%

Division D

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning