Supposing the return from an investment has the following probability distribution Return Probability R (%) 8 0.2 10 0.2 12 0.5 14 0.1 Required: What is the expected return of the investment? What is the risk as measured by the standard deviation of expected returns?

Supposing the return from an investment has the following probability distribution Return Probability R (%) 8 0.2 10 0.2 12 0.5 14 0.1 Required: What is the expected return of the investment? What is the risk as measured by the standard deviation of expected returns?

Chapter8: Standard Costs And Variances

Section: Chapter Questions

Problem 4MC: This variance is the difference involving spending more or using more than the standard amount. A....

Related questions

Question

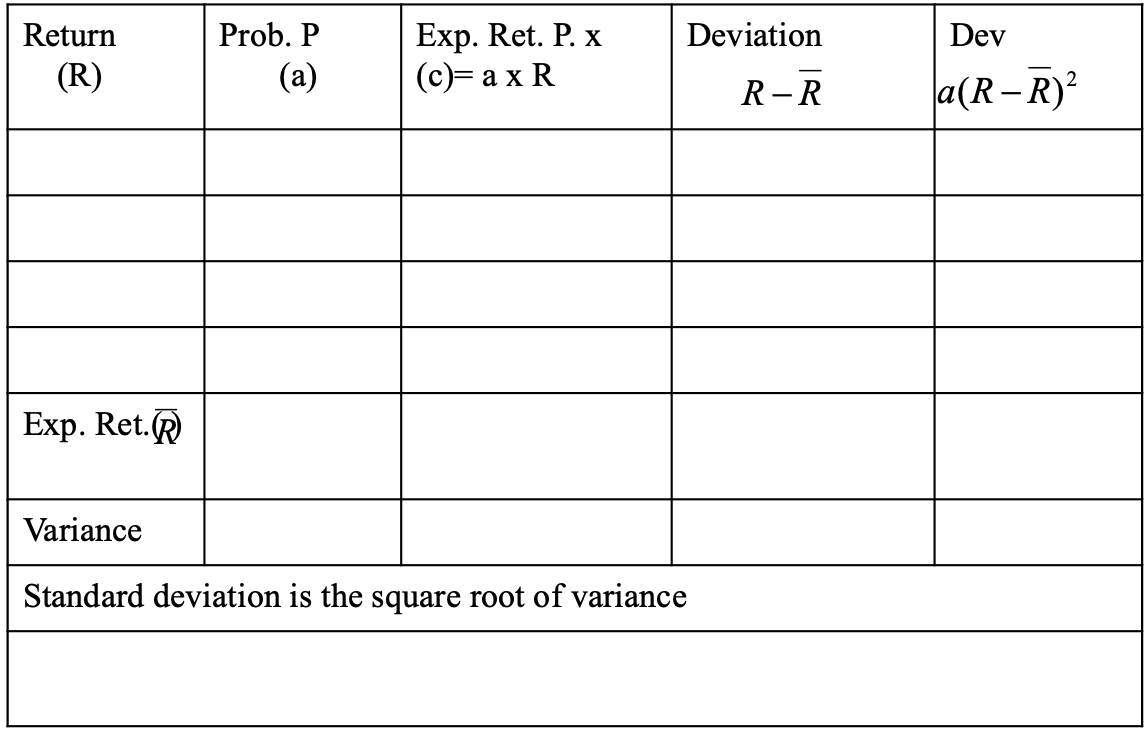

Supposing the return from an investment has the following probability distribution

Return Probability

R (%)

8 0.2

10 0.2

12 0.5

14 0.1

Required:

What is the expected return of the investment?

What is the risk as measured by the standard deviation of expected returns?

Transcribed Image Text:Return

(R)

Exp. Ret.

Prob. P

(a)

Exp. Ret. P. x

(c)= a x R

Deviation

R-R

Variance

Standard deviation is the square root of variance

Dev

a(R-R)²

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning