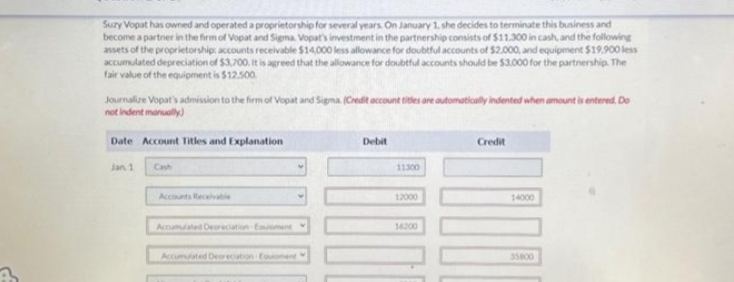

Suzy Vopat has owned and operated a proprietorship for several years. On January 1, she decides to terminate this business and become a partner in the firm of Vopat and Sigma. Vopat's investment in the partnership consists of $11.300 in cash, and the following assets of the proprietorship: accounts receivable $14,000 less allowance for doubtful accounts of $2.000, and equipment $19.900 less accumulated depreciation of $3,700. It is agreed that the allowance for doubtful accounts should be $3.000 for the partnership. The fair value of the equipment is $12.500 Journalize Vopat's admission to the firm of Vopat and Sigma (Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Jan 1 Cash Accounts Receivable Accumulated Deoreciation Fouoment Accumulated Deoreciation Equipment Debit 11300 12000 14200 Credit 000 14000 35800

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Vj

Sub: accounting

Trending now

This is a popular solution!

Step by step

Solved in 3 steps