Swifty Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below. Employee Hours Worked Hourly Rate Federal Income Tax Withholdings United Fund Ben Abel 40 $14.00 $59.00 $5.00 Rita Hager 41 16.00 64.00 5.00 Jack Never 44 13.00 60.00 8.00 Sue Perez 46 13.00 62.00 5.00 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.6%. 1. Prepare a payroll register for the weekly payroll. No employee has reached the Social Security limit of $132,900 or the FUTA/SUTA limit of $7,000 2. Journalize the payroll on March 15, 2022, and the accrual of employer payroll taxes. 3. Journalize the payment of the payroll on March 16, 2022.

Swifty Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below.

|

Employee

|

Hours Worked

|

Hourly Rate

|

Federal Income Tax Withholdings

|

United Fund

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Ben Abel | 40 | $14.00 | $59.00 | $5.00 | ||||||

| Rita Hager | 41 | 16.00 | 64.00 | 5.00 | ||||||

| Jack Never | 44 | 13.00 | 60.00 | 8.00 | ||||||

| Sue Perez | 46 | 13.00 | 62.00 | 5.00 |

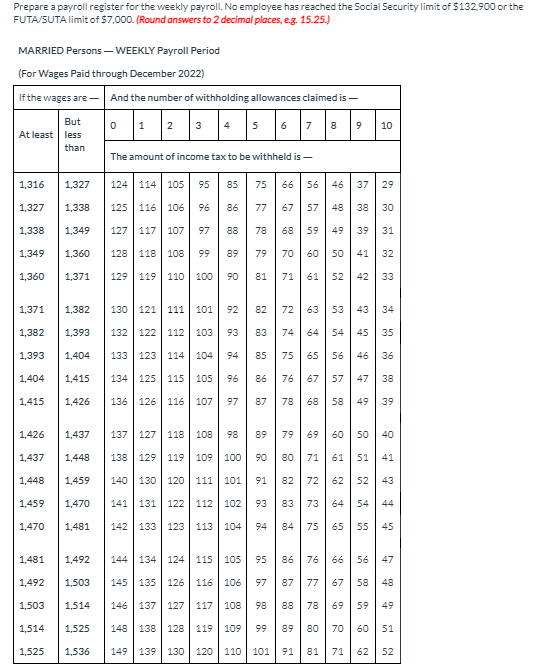

Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state

1. Prepare a payroll register for the weekly payroll. No employee has reached the Social Security limit of $132,900 or the FUTA/SUTA limit of $7,000

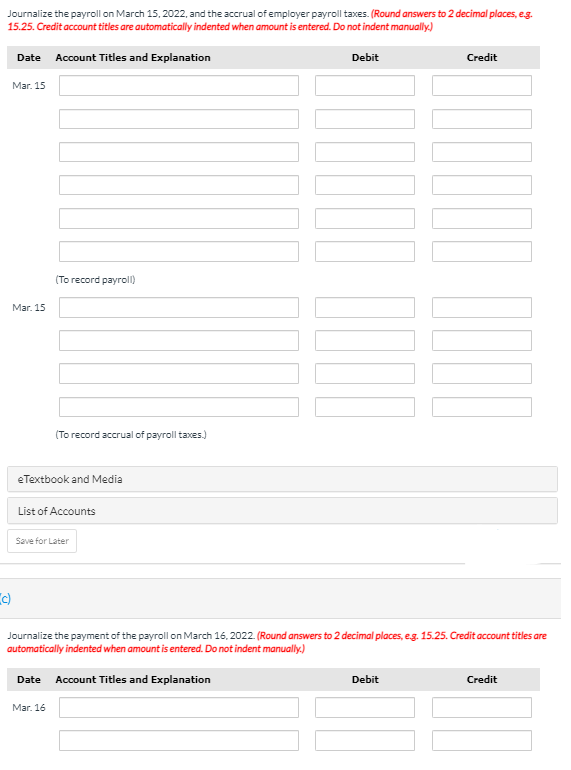

2. Journalize the payroll on March 15, 2022, and the accrual of employer payroll taxes.

3. Journalize the payment of the payroll on March 16, 2022.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images