Sybil is a self-employed artist who uses 10% of her residence as a studio. The shudio portion of her home is used excusively for busires and is treuerted by Customens on a regular basis. Sybil also uses her den as an office (10% of the total foor space of her home) to prepare bills and keep records. However, te den is used by her ghildren as a TV room. Sybi's net income from the sale of the artwork (other than her home office expenses) is 40,000 in the oument year. She incurs $1,400 of exienses directly related to the shudio (painting of the studio, window blinds, ete.) Sybil incurs the folowing expenses in the curent year eled to residence: Real estate taxes Mortgage interest Insurance Depreciation Repairs and utilities Total $2,000 5,000 500 3,500 1.000 12.000 How much of the above can Sybil deduct as home office expense?

Sybil is a self-employed artist who uses 10% of her residence as a studio. The shudio portion of her home is used excusively for busires and is treuerted by Customens on a regular basis. Sybil also uses her den as an office (10% of the total foor space of her home) to prepare bills and keep records. However, te den is used by her ghildren as a TV room. Sybi's net income from the sale of the artwork (other than her home office expenses) is 40,000 in the oument year. She incurs $1,400 of exienses directly related to the shudio (painting of the studio, window blinds, ete.) Sybil incurs the folowing expenses in the curent year eled to residence: Real estate taxes Mortgage interest Insurance Depreciation Repairs and utilities Total $2,000 5,000 500 3,500 1.000 12.000 How much of the above can Sybil deduct as home office expense?

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 21P: Cindy operates a computerized engineering drawing business from her home. Cindy maintains a home...

Related questions

Question

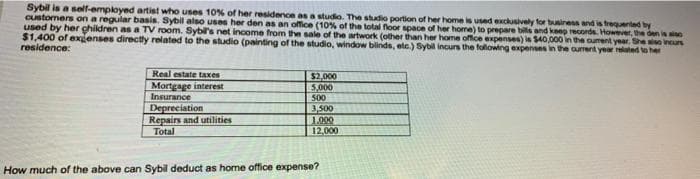

Transcribed Image Text:Sybil is a self-employed artist who uses 10% of her residence as a studio. The studio portion of her home is used exclusively for business and is trequerted by

Customens on a regular basis. Sybil also uses her den as an office (10% of the total floor space of her home) to prepare bils and keep records. However, the den ise

used by her ghildren as a TV room. Sybi's net income from the sale of the artwork (other than her home office expenses) is $40,000 in the cument year. She incurs

$1,400 of exenses directly related to the studio (painting of the studio, window blinds, etc.) Sybil incurs the folloaing expenses in the ourrent year relatled to her

residence:

Real estate taxes

Mortgage interest

Insurance

Depreciation

Repairs and utilities

Total

$2,000

5,000

500

3,500

1,000

12,000

How much of the above can Sybil deduct as home office expense?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT