t Assets and Non-

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

Please Compute for the Current Assets and Non-current Assets.

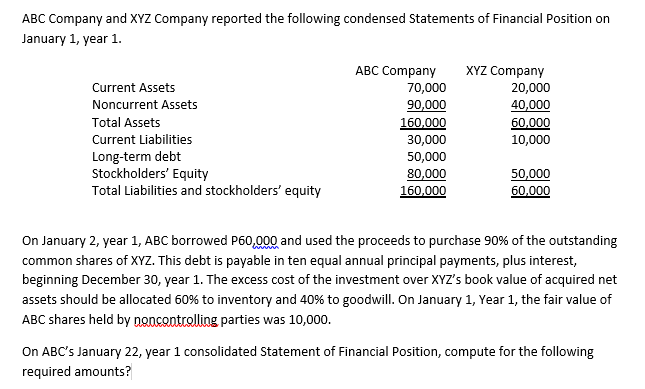

Transcribed Image Text:ABC Company and XYZ Company reported the following condensed Statements of Financial Position on

January 1, year 1.

АВС Company

XYZ Company

20,000

40,000

60,000

10,000

Current Assets

70,000

Noncurrent Assets

90,000

160.000

30,000

Total Assets

Current Liabilities

Long-term debt

Stockholders' Equity

Total Liabilities and stockholders' equity

50,000

80,000

160,000

50,000

60,000

On January 2, year 1, ABC borrowed P60,000 and used the proceeds to purchase 90% of the outstanding

common shares of XYZ. This debt is payable in ten equal annual principal payments, plus interest,

beginning December 30, year 1. The excess cost of the investment over XYZ's book value of acquired net

assets should be allocated 60% to inventory and 40% to goodwill. On January 1, Year 1, the fair value of

ABC shares held by noncantrolling parties was 10,000.

On ABC's January 22, year 1 consolidated Statement of Financial Position, compute for the following

required amounts?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning