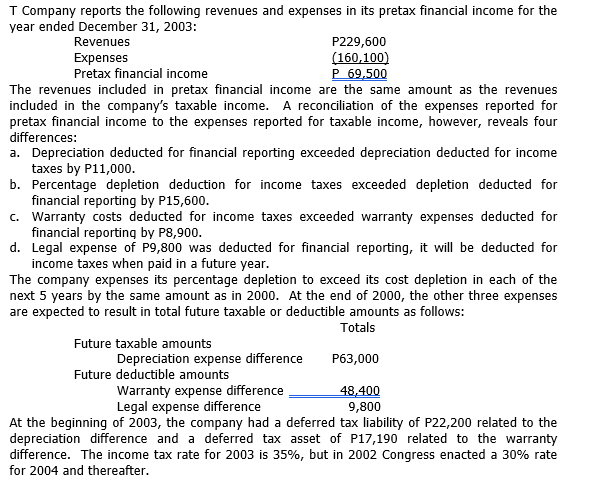

T Company reports the following revenues and expenses in its pretax financial income for the year ended December 31, 2003: Revenues Expenses Pretax financial income P229,600 (160,100) P 69,500 The revenues included in pretax financial income are the same amount as the revenues included in the company's taxable income. A reconciliation of the expenses reported for pretax financial income to the expenses reported for taxable income, however, reveals four differences: a. Depreciation deducted for financial reporting exceeded depreciation deducted for income taxes by P11,000. b. Percentage depletion deduction for income taxes exceeded depletion deducted for financial reporting by P15,600. c. Warranty costs deducted for income taxes exceeded warranty expenses deducted for financial reporting by P8,900. d. Legal expense of P9,800 was deducted for financial reporting, it will be deducted for income taxes when paid in a future year. The company expenses its percentage depletion to exceed its cost depletion in each of the next 5 years by the same amount as in 2000. At the end of 2000, the other three expenses are expected to result in total future taxable or deductible amounts as follows: Totals Future taxable amounts Depreciation expense difference Future deductible amounts Warranty expense difference Legal expense difference P63,000 48,400 9,800 At the beginning of 2003, the company had a deferred tax liability of P22,200 related to the depreciation difference and a deferred tax asset of P17,190 related to the warranty difference. The income tax rate for 2003 is 35%, but in 2002 Congress enacted a 30% rate for 2004 and thereafter.

T Company reports the following revenues and expenses in its pretax financial income for the year ended December 31, 2003: Revenues Expenses Pretax financial income P229,600 (160,100) P 69,500 The revenues included in pretax financial income are the same amount as the revenues included in the company's taxable income. A reconciliation of the expenses reported for pretax financial income to the expenses reported for taxable income, however, reveals four differences: a. Depreciation deducted for financial reporting exceeded depreciation deducted for income taxes by P11,000. b. Percentage depletion deduction for income taxes exceeded depletion deducted for financial reporting by P15,600. c. Warranty costs deducted for income taxes exceeded warranty expenses deducted for financial reporting by P8,900. d. Legal expense of P9,800 was deducted for financial reporting, it will be deducted for income taxes when paid in a future year. The company expenses its percentage depletion to exceed its cost depletion in each of the next 5 years by the same amount as in 2000. At the end of 2000, the other three expenses are expected to result in total future taxable or deductible amounts as follows: Totals Future taxable amounts Depreciation expense difference Future deductible amounts Warranty expense difference Legal expense difference P63,000 48,400 9,800 At the beginning of 2003, the company had a deferred tax liability of P22,200 related to the depreciation difference and a deferred tax asset of P17,190 related to the warranty difference. The income tax rate for 2003 is 35%, but in 2002 Congress enacted a 30% rate for 2004 and thereafter.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 15DQ

Related questions

Question

A. How much is the

B. How much is the

C. How much is the net income after income tax provision at December 31, 2003?

Transcribed Image Text:T Company reports the following revenues and expenses in its pretax financial income for the

year ended December 31, 2003:

Revenues

Expenses

Pretax financial income

P229,600

(160,100)

P 69,500

The revenues included in pretax financial income are the same amount as the revenues

included in the company's taxable income. A reconciliation of the expenses reported for

pretax financial income to the expenses reported for taxable income, however, reveals four

differences:

a. Depreciation deducted for financial reporting exceeded depreciation deducted for income

taxes by P11,000.

b. Percentage depletion deduction for income taxes exceeded depletion deducted for

financial reporting by P15,600.

c. Warranty costs deducted for income taxes exceeded warranty expenses deducted for

financial reporting by P8,900.

d. Legal expense of P9,800 was deducted for financial reporting, it will be deducted for

income taxes when paid in a future year.

The company expenses its percentage depletion to exceed its cost depletion in each of the

next 5 years by the same amount as in 2000. At the end of 2000, the other three expenses

are expected to result in total future taxable or deductible amounts as follows:

Totals

Future taxable amounts

Depreciation expense difference

P63,000

Future deductible amounts

Warranty expense difference

Legal expense difference

48,400

9,800

At the beginning of 2003, the company had a deferred tax liability of P22,200 related to the

depreciation difference and a deferred tax asset of P17,190 related to the warranty

difference. The income tax rate for 2003 is 35%, but in 2002 Congress enacted a 30% rate

for 2004 and thereafter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you