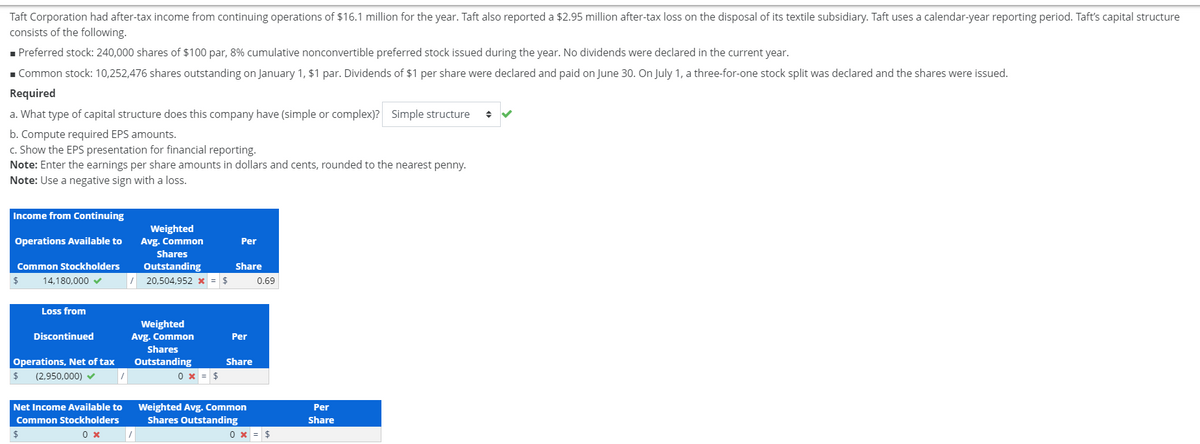

Taft Corporation had after-tax income from continuing operations of $16.1 million for the year. Taft also reported a $2.95 million after-tax loss on the disposal of its textile subsidiary. Taft uses a calendar-year reporting period. Taft's capital structure consists of the following. Preferred stock: 240,000 shares of $100 par, 8% cumulative nonconvertible preferred stock issued during the year. No dividends were declared in the current year. ■Common stock: 10,252,476 shares outstanding on January 1, $1 par. Dividends of $1 per share were declared and paid on June 30. On July 1, a three-for-one stock split was declared and the shares were issued. Required a. What type of capital structure does this company have (simple or complex)? Simple structure b. Compute required EPS amounts. c. Show the EPS presentation for financial reporting. Note: Enter the earnings per share amounts in dollars and cents, rounded to the nearest penny. Note: Use a negative sign with a loss. Income from Continuing Weighted Operations Available to Avg. Common Common Stockholders 14,180,000 Loss from Per Shares Outstanding Share 20,504,952 x 0.69 Discontinued Operations, Net of tax $ (2,950,000) Net Income Available to Common Stockholders 0x / Weighted Avg. Common Per Shares Outstanding Share Weighted Avg. Common Shares Outstanding Per Share 0x - $

Taft Corporation had after-tax income from continuing operations of $16.1 million for the year. Taft also reported a $2.95 million after-tax loss on the disposal of its textile subsidiary. Taft uses a calendar-year reporting period. Taft's capital structure consists of the following. Preferred stock: 240,000 shares of $100 par, 8% cumulative nonconvertible preferred stock issued during the year. No dividends were declared in the current year. ■Common stock: 10,252,476 shares outstanding on January 1, $1 par. Dividends of $1 per share were declared and paid on June 30. On July 1, a three-for-one stock split was declared and the shares were issued. Required a. What type of capital structure does this company have (simple or complex)? Simple structure b. Compute required EPS amounts. c. Show the EPS presentation for financial reporting. Note: Enter the earnings per share amounts in dollars and cents, rounded to the nearest penny. Note: Use a negative sign with a loss. Income from Continuing Weighted Operations Available to Avg. Common Common Stockholders 14,180,000 Loss from Per Shares Outstanding Share 20,504,952 x 0.69 Discontinued Operations, Net of tax $ (2,950,000) Net Income Available to Common Stockholders 0x / Weighted Avg. Common Per Shares Outstanding Share Weighted Avg. Common Shares Outstanding Per Share 0x - $

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter13: Earnings Per Share (eps)

Section: Chapter Questions

Problem 1R: Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8%...

Related questions

Question

Transcribed Image Text:Taft Corporation had after-tax income from continuing operations of $16.1 million for the year. Taft also reported a $2.95 million after-tax loss on the disposal of its textile subsidiary. Taft uses a calendar-year reporting period. Taft's capital structure

consists of the following.

■ Preferred stock: 240,000 shares of $100 par, 8% cumulative nonconvertible preferred stock issued during the year. No dividends were declared in the current year.

■Common stock: 10,252,476 shares outstanding on January 1, $1 par. Dividends of $1 per share were declared and paid on June 30. On July 1, a three-for-one stock split was declared and the shares were issued.

Required

a. What type of capital structure does this company have (simple or complex)? Simple structure

b. Compute required EPS amounts.

c. Show the EPS presentation for financial reporting.

Note: Enter the earnings per share amounts in dollars and cents, rounded to the nearest penny.

Note: Use a negative sign with a loss.

Income from Continuing

Weighted

Operations Available to

Avg. Common

Shares

Per

Common Stockholders

Outstanding

Share

$

20,504,952 x = $

0.69

14,180,000

Loss from

Discontinued

Operations, Net of tax

$

(2,950,000) ✔

Net Income Available to

Common Stockholders

$

0 x

Weighted

Avg. Common

Per

Shares

Outstanding

0x = $

Share

Weighted Avg. Common

Shares Outstanding

Per

Share

0 x = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning