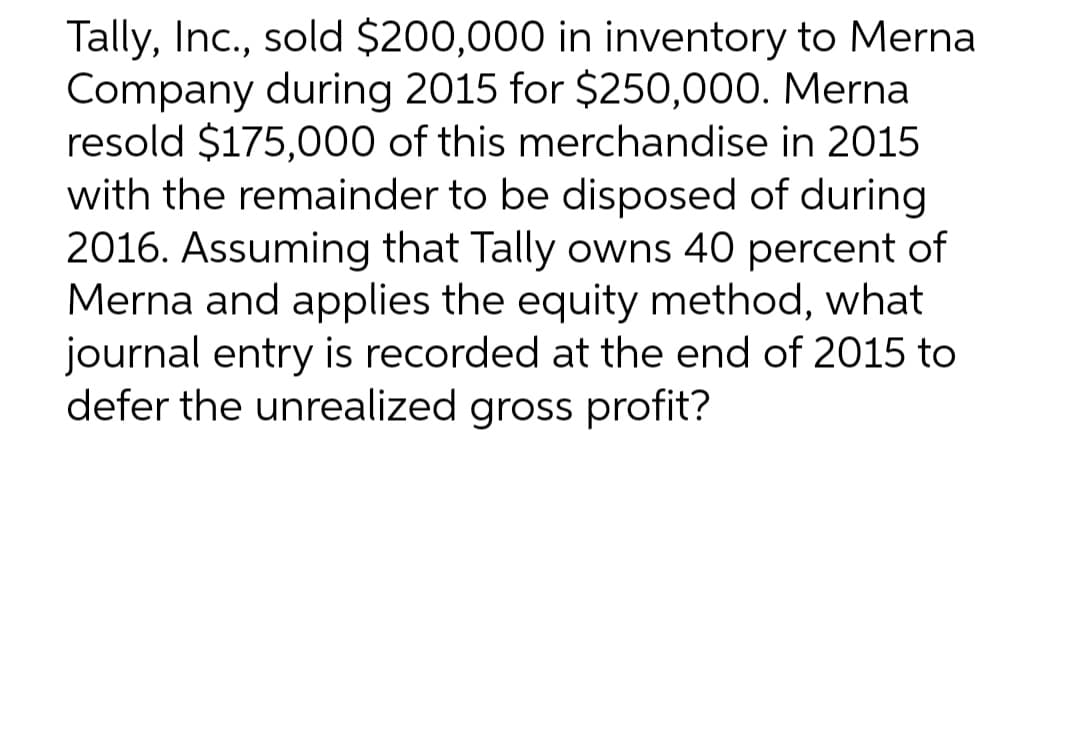

Tally, Inc., sold $200,000 in inventory to Merna Company during 2015 for $250,000. Merna resold $175,000 of this merchandise in 2015 with the remainder to be disposed of during 2016. Assuming that Tally owns 40 percent of Merna and applies the equity method, what journal entry is recorded at the end of 2015 to defer the unrealized gross profit?

Q: In 2021, a 12 years old, receives non-eligible dividends of $13,850 from a private corporation…

A: The dividends are grossed up by "15%" for non-eligible dividends in the year 2021. To calculate the…

Q: An insurance company is offering a new policy to its customers. Typically, the policy is bought by a…

A: Introduction: A value policy is one in which the amount payable for a dispute is determined upon at…

Q: ABC Corp acquired a lot by paying down payment of P400,000 and issued a non-interest bearing note of…

A: Cost of fixed assets shall include it's Purchase cost and all cost incurred to bring the asset to…

Q: Corny and Sweet grows and sells sweet corn at its roadside produce stand. The selling price per…

A: Contribution margin per dozen = Selling price per dozen - Variable cost per dozen = $4.00 - $1.25 =…

Q: Different FIFO inventory assumptions: Beginning inventory of 10 units @ $5 = $50 Purchases month…

A: Introduction: Under FIFO inventory method, goods which have come first will be available for sell…

Q: State the standard method of determining the cost of goods sold by a retailing or a wholesaling…

A: The cost of goods sold includes the total cost of goods sold include the cost of goods that are sold…

Q: A plant operating at 100% capacity (1000 kg product per year) has an annual net profit of $40,000…

A: Break even point(BEP)= Fixed cost/Contribution per unit Variable cost ratio + Contribution Ratio=…

Q: The budgeted sales of Kelley, SA for the given months are as follows: Cash Sales Credit Sales…

A: Accounts receivable is the amount that has been earned by the company but the amount has not been…

Q: Match the two lists, below, by placing the capital letter from List 1 in each of the cells preceding…

A: Control Environment A control environment is made up of the standards, policies, procedures, and…

Q: The Income Statement for the year 2021 of Mira Co. contains the following information: Revenue…

A: Stockholder equity statement is the one where net income and additional capital introduced are added…

Q: depreciation in year 3

A: units of production depreciation method : it is the one of the method for calculation of…

Q: Riviera Interior Design had the following transactions for the year ended 30 June 2020: This…

A: Journal entries are used by the companies, firms, NPO, etc. to keep a record of the transactions…

Q: The following account balances were provided by Kate's Consulting Company as of December 31, 2022.…

A: Formula used: Ending capital = Beginning capital + Net profit - Drawings made

Q: Choose which option (Option 1- Option 3) was used to calculate the contract cost for any number of…

A: Contract costing is a part of job costing. It refers to the determination of costs related to a…

Q: Asset value on Jan 01 is $ 500000, Salvage value after 10 years is 25000. Compute accumulated…

A: Business organizations are required to charge the depreciation expense on their assets so that the…

Q: Ernst Company's balance sheet shows total liabilities of $32,500,000, total stockholders' equity of…

A: Debt ratio= total debt/Total asset*100 =32500000/40625000 *100 = 80%

Q: Problem 27-3 (IAA) At the beginning of current year, Definite Company acquired the following assets:…

A: Note: Hi! Thank you for the question As per the honor code, We’ll answer the first question since…

Q: is there a $100 need to be deducted as p

A: Adjusted Gross income refers to the total sum value of income gained by an entity after deducting…

Q: A water-based paint containing 25.0 wt% pigment and the rest is water sells for PhP 900/kg. Another…

A:

Q: Dollar Dress Shop’s inventory at cost on January 1 was $82,800. Its retail value was $87,500. During…

A:

Q: What company is better in short term investment?

A: Answer:- Investment meaning:- An asset or object purchased with the intention of generating income…

Q: A company anticipates a taxable cash expense of $80,000 in year 2 of a project. The company's tax…

A: Cash expense $80,000 Less: Tax benefit ($80,000 x 30%) $24,000 Net cash expense $56,000

Q: Accounting Act §5-3.2. paragraph regulates depreciation of property, plant and equipment. What…

A: Depreciation refers to writing off the cost of a asset over its useful life in the ratio of economic…

Q: equipment acquired on January 1, 2018 at a cost of P2,200,000 with 20 years estimated useful life.…

A: The tangible assets are the assets that help the company to generate revenue and earn income and It…

Q: If a new partner was admitted into the partnership by purchasing the interest of an existing partner…

A: A partnership is an agreement between two or more partners. The partners work together for a common…

Q: ABC Corp purchased land and building at a lump price of P6M. ABC demolished the building and…

A: The lump sum cost is allocated to assets on the basis of their fair value.

Q: Which is not part of the description of PPE?

A: PPE refers to property, plant and equipment which are considered as fixed assets. These are used in…

Q: The accounting treatment for the sale of the interest of the retiring partner to an outsider or…

A: The retirement of the partner means the partner that is leaving the partnership. The partner can…

Q: Calculate the debt-to-equity ratio. Ernst Company's balance sheet shows total liabilities of…

A: Formula: Debt to equity = Total liabilities / Total stock holders equity

Q: Here are the comparative condensed income statements of Pina Colada Corporation. PINA COLADA…

A: Horizontal analysis is that analysis which shows increase or decrease in items from previous year to…

Q: ) Glen, Maria's friend, sees a pair of running shoes on sale in the same store in Duluth for…

A: Glen Should buy pair of shoes for $109.99 as he thinks its value is reduced by $9.01. as the Glen is…

Q: Signature Scents has two divisions: the Cologne Division and the Bottle Division. The Bottle…

A: Given: The Bottle Division has sufficient capacity to meet all external market demands in addition…

Q: On June 1, 20Y2, He

A:

Q: Cash on hand and in banks- Accounts receivable -- Merchandise inventory - - 50,000 - 350,000…

A: Introduction: Current Assets : Assets which can be easily converted in to cash with in one year…

Q: for court costs. salary payments are equal amounts paid at rate you choose is an EAR of 11 percent,…

A: Explanation of Concept Concept of discount cash flow for calculating the present value of initial…

Q: Window World extended credit to customer Nile Jenkins in the amount of $134,900 for his purchase of…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: The information below pertains to xyz limited. 40000 units per month is the normal capability. @ 10…

A: Absorption Costing: absorption costing is also called "Full costing", it is a technique of…

Q: Harvest Inc. produces and sells a single product. The selling price of the product is $200.00 per…

A: The contribution margin is a metric that shows how much a company's net sales contribute to fixed…

Q: Total assets of JBA Engineering and Design Firm is $1,000,000. 20% represents the claim of the…

A: Total Liability = Total Assets - Owners' Equity

Q: Asset value on Jan 01 is $ 500000, Salvage value after 10 years is 25000. Compute accumulated…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: May and Jun are partners with profit and loss ratio of 75:25 and capital balances of P480,000 and…

A: When there is partnership among the partners there is agreement to share this as well as the reward…

Q: The joint process from which Ple'egrea, Inc. obtains both Nuts and Bolts has a total cost of $74,000…

A: Allocation of Joint Cost: To calculate the cost per unit of output using this approach, just divide…

Q: Which of the following choices correctly denotes factors that can influence a company's pricing…

A: Pricing a product or service is an important task for every organisation. It is the basis for the…

Q: The demolition costs of an old building to clear the land for a possible future sale but DID NOT…

A: Cost of land shall include all the costs incurred that are attributable to bring the land for sale…

Q: Jessica spent $5,000 on a new energy-efficient tankless water heater in 2021. She claimed a $400…

A: Tax Credit Rule - The federal tax credit only applies to equipment installed in existing homes, not…

Q: What is meant by Owners’ equity?

A: The balance sheet is the financial statement of the business which represents the financial position…

Q: Concord Corporation purchased for $285,000 a 25% interest in Murphy, Inc. This investment enables…

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: • Price per unit: $10 . Variable cost per unit: $7 . Fixed costs: $1,500 Given these data, compute…

A: Under Marginal costing (variable costing) contribution percentage or contribution per unit of…

Q: the balance sheet shows that equity has increased significantly in 2021. Your task is to explain…

A: A balance sheet of an entity refers to the financial statement that reports an entity's assets,…

Q: Corny and Sweet grows and sells sweet corn at its roadside produce stand. The selling price per…

A: The break even sales units are calculated as fixed cost divided by contribution margin per unit.

Step by step

Solved in 2 steps

- Bloom Company had beginning unadjusted retained earnings of 400,000 in the current year. At the beginning of the current year, Bloom changed its inventory method from LIFO to FIFO, and the cumulative effect (net of taxes) of this change was 28,000. In addition, Bloom earned net income of 150,000 and paid dividends of 30,000 in the current year. Prepare Blooms retained earnings statement for the current year.Camille, Incorporated, sold $147,000 in inventory to Eckerle Company during 2023 for $245,000. Eckerle resold $109,000 of this merchandise in 2023 with the remainder to be disposed of during 2024. Required: Assuming that Camille owns 34 percent of Eckerle and applies the equity method, what journal entry is recorded at the end of 2023 to defer the intra-entity gross profit? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. 1.Record the entry at the end of 2023 to defer unrealized gross profit.Camille, Inc., sold $147,000 in inventory to Eckerle Company during 2020 for $245,000. Eckerle resold $109,000 of this merchandise in 2020 with the remainder to be disposed of during 2021. Assuming that Camille owns 34 percent of Eckerle and applies the equity method, what journal entry is recorded at the end of 2020 to defer the intra-entity gross profit?

- Camille, Inc., sold $130,000 in inventory to Eckerle Company during 2020 for $250,000. Eckerle resold $89,000 of this merchandise in 2020 with the remainder to be disposed of during 2021. Assuming that Camille owns 20 percent of Eckerle and applies the equity method, what journal entry is recorded at the end of 2020 to defer the intra-entity gross profit? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.)On January 1, 2015, P Company acquired a 90% interest in S Company. During 2016, S Company sold merchandise to P Company at 25% above cost in the amount (selling price) of $203,700. At the end of the year, P Company had in its inventory one-third of the amount of goods purchased from S Company.On January 1, 2016, P Company sold equipment that had a book value of $83,600 to S Company for $118,100. The equipment had an estimated remaining life of four years.S Company reported net income of $116,100, and P Company reported net income of $293,000 from their independent operations (including sales to affiliates) for the year ended December 31, 2016.Calculate controlling interest in consolidated net income for the year ended December 31, 2016.Refer to the preceding facts for Panther’s acquisition of Sandin common stock. On January 1, 2016, Sandin held merchandise sold to it from Panther for $20,000. During 2016, Panther sold merchandise to Sandin for $100,000. On December 31, 2016, Sandin held $25,000 of this merchandise in its inventory. Panther has a gross profit of 30%. Sandin owed Panther $15,000 on December 31 as a result of this intercompany sale. On January 1, 2015, Sandin sold equipment to Panther at a profit of $24,000. Panther also sold some fixed assets to nonaffiliates. Depreciation is computed over a 6-year life, using the straight-line method. 1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Sandin. 2. Complete a consolidated worksheet for Panther Company and its subsidiary Sandin Company as of December 31, 2016. Prepare supporting amortization and income distribution schedules.

- Refer to the preceding facts for Panther’s acquisition of Sandin common stock. On January 1, 2016, Panther held merchandise sold to it from Sandin for $12,000. This beginning inventory had an applicable gross profit of 25%. During 2016, Sandin sold merchandise to Panther for $75,000. On December 31, 2016, Panther held $18,000 of this merchandise in its inventory. This ending inventory had an applicable gross profit of 30%. Panther owed Sandin $20,000 on December 31 as a result of this intercompany sale. On January 1, 2016, Panther sold equipment with a book value of $35,000 to Sandin for $50,000. Panther also sold some fixed assets to nonaffiliates. During 2016, the equipment was used by Sandin. Depreciation is computed over a 5-year life, using the straight-line method. 1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Sandin. 2. Complete a consolidated worksheet for Panther Company and its subsidiary Sandin Company as of…Phast Corporation owns a 80% interest in Stechno Company, acquired several years ago at a cost equal to book value and fair value. Stechno sells merchandise to Phast for the first time in 2014, and some is unsold at December 31, 2014. In computing income from the investee for 2014 under the equity method, Phast uses which equation? A. 80% of Stechno's income plus 100% of the unrealized profit in Phast's ending inventory B. 80% of Stechno's income less 80% of the unrealized profit in Phast's ending inventory C. 80% of Stechno's income plus 80% of the unrealized profit in Phast's ending inventory D. 80% of Stechno's income less 100% of the unrealized profit in Phast's ending inventoryOn January 1, 2018, Spark Corp. acquired a 40% interest in Cranston Inc. for $250,000. On that date, Cranston’s balance sheet disclosed net assets of $430,000. During 2018, Cranston reported net income of $100,000 and paid cash dividends of $30,000. Spark sold inventory costing $40,000 to Cranston during 2018 for $50,000. Cranston used all of this merchandise in its operations during 2018. Any excess cost over fair value is attributable to an unamortized trademark with a 20-year remaining life. Prepare all of spark's journal entries for 2018 to apply the equity method to this investment. This is what I have so Far: To record initial investment: Dr Equity Investment 250,000 Cr Cash 250,000 To record investee income: Dr Equity Investment 40, 000 Cr Equty Income To record Dividends Dr Cash 12, 000 Cr Equity Investment 12,000 How do I show the inventory when it is sold?

- Company S is 80% owned by Company P. Near the end of 2015, Company S sold merchandise with a cost of $6,000 to Company P for $7,000. Company P sold the merchandise to a nonaffiliated firm in 2016 for $10,000. How much total profit should be recorded on the consolidated income statements in 2015 and 2016? How much profit should be awarded to the controlling and noncontrolling interests in 2015 and 2016?If P acquired 90% of the outstanding common stock of S company. During 2015, P Company sells merchandise amounted 1800000 to S Company at 20% above cost. S Company had in its inventory half of the amount of goods purchased from P during 2015. If P company uses cost method, what eliminating entry will be recorded by P in 2016 to eliminate the Unrealized Profit in Inventory related to 2015? Select one: a. DR. Cost of goods sold 150000 CR. Inventory (ending) 150000 b. DR. Retained earnings 1/1 900000 CR. Inventory (ending) 900000 c. DR. Retained earnings 1/1 135000, NCI 15000 CR. Cost of goods sold 150000 d. DR. Retained earnings 1/1 150000 CR. Cost of goods sold 150000 e. DR. Retained earnings 1/1 810000, NCI 90000 CR. Cost of goods sold 900000Refer to the preceding facts for Packard’s acquisition of Stude common stock. On January 1, 2016, Packard held merchandise acquired from Stude for $10,000. This beginning inventory had an applicable gross profit of 25%. During 2016, Stude sold $40,000 worth of merchandise to Packard. Packard held $6,000 of this merchandise at December 31, 2016. This ending inventory had an applicable gross profit of 30%. Packard owed Stude $11,000 on December 31 as a result of these intercompany sales. 1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Stude. 2. Complete a consolidated worksheet for Packard Corporation and its subsidiary Stude Corporation as of December 31, 2016. Prepare supporting amortization and income distribution schedules.