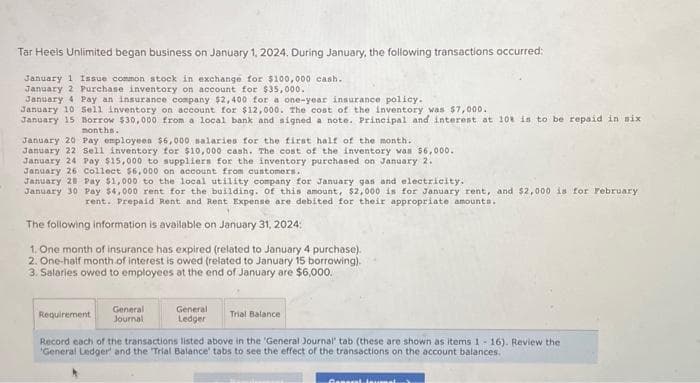

Tar Heels Unlimited began business on January 1, 2024. During January, the following transactions occurred: January 1 Issue common stock in exchange for $100,000 cash. January 2 Purchase inventory on account for $35,000. January 4 Pay an insurance company $2,400 for a one-year insurance policy. January 10 Sell inventory on account for $12,000. The cost of the inventory was $7,000. January 15 Borrow $30,000 from a local bank and signed a note. Principal and interest at 10% is to be repaid in six months. January 20 Pay employees $6,000 salaries for the first half of the month.. January 22 Sell inventory for $10,000 cash. The cost of the inventory was $6,000. January 24 Pay $15,000 to suppliers for the inventory purchased on January 2. January 26 Collect $6,000 on account from customers. January 28 Pay $1,000 to the local utility company for January gas and electricity. January 30 Pay $4,000 rent for the building. Of this amount, $2,000 is for January rent, and $2,000 is for February rent. Prepaid Rent and Rent Expense are debited for their appropriate amounts. The following information is available on January 31, 2024: 1. One month of insurance has expired (related to January 4 purchase). 2. One-half month of interest is owed (related to January 15 borrowing). 3. Salaries owed to employees at the end of January are $6,000. Requirement General Journal General Ledger Trial Balance Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1-16). Review the 'General Ledger and the Trial Balance' tabs to see the effect of the transactions on the account balances.

Tar Heels Unlimited began business on January 1, 2024. During January, the following transactions occurred: January 1 Issue common stock in exchange for $100,000 cash. January 2 Purchase inventory on account for $35,000. January 4 Pay an insurance company $2,400 for a one-year insurance policy. January 10 Sell inventory on account for $12,000. The cost of the inventory was $7,000. January 15 Borrow $30,000 from a local bank and signed a note. Principal and interest at 10% is to be repaid in six months. January 20 Pay employees $6,000 salaries for the first half of the month.. January 22 Sell inventory for $10,000 cash. The cost of the inventory was $6,000. January 24 Pay $15,000 to suppliers for the inventory purchased on January 2. January 26 Collect $6,000 on account from customers. January 28 Pay $1,000 to the local utility company for January gas and electricity. January 30 Pay $4,000 rent for the building. Of this amount, $2,000 is for January rent, and $2,000 is for February rent. Prepaid Rent and Rent Expense are debited for their appropriate amounts. The following information is available on January 31, 2024: 1. One month of insurance has expired (related to January 4 purchase). 2. One-half month of interest is owed (related to January 15 borrowing). 3. Salaries owed to employees at the end of January are $6,000. Requirement General Journal General Ledger Trial Balance Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1-16). Review the 'General Ledger and the Trial Balance' tabs to see the effect of the transactions on the account balances.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 20PC: Analyzing Transactions. Using the analytical framework, indicate the effect of the following related...

Related questions

Topic Video

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

Transcribed Image Text:Tar Heels Unlimited began business on January 1, 2024. During January, the following transactions occurred:

January 1 Issue common stock in exchange for $100,000 cash.

January 2 Purchase inventory on account for $35,000.

January 4 Pay an insurance company $2,400 for a one-year insurance policy.

January 10 Sell inventory on account for $12,000. The cost of the inventory was $7,000.

January 15 Borrow $30,000 from a local bank and signed a note. Principal and interest at 10% is to be repaid in six

months.

January 20 Pay employees $6,000 salaries for the first half of the month.

January 22 Sell inventory for $10,000 cash. The cost of the inventory was $6,000.

January 24 Pay $15,000 to suppliers for the inventory purchased on January 2.

January 26 Collect $6,000 on account from customers.

January 28 Pay $1,000 to the local utility company for January gas and electricity.

January 30 Pay $4,000 rent for the building. Of this amount, $2,000 is for January rent, and $2,000 is for February

rent. Prepaid Rent and Rent Expense are debited for their appropriate amounts.

The following information is available on January 31, 2024:

1. One month of insurance has expired (related to January 4 purchase).

2. One-half month of interest is owed (related to January 15 borrowing).

3. Salaries owed to employees at the end of January are $6,000.

General

Journal

Requirement

General

Ledger

Trial Balance

Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1-16). Review the

'General Ledger and the Trial Balance' tabs to see the effect of the transactions on the account balances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning