Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended February 1, 2020, Does the company separately report current assets and long-term assets, as well as current liabilities and long-term liabilities? Are any investments shown as a current asset? Why? In which liability account would the company report the balance of its gift card liability? What method does the company use to depreciate its property and equipment?

Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended February 1, 2020, Does the company separately report current assets and long-term assets, as well as current liabilities and long-term liabilities? Are any investments shown as a current asset? Why? In which liability account would the company report the balance of its gift card liability? What method does the company use to depreciate its property and equipment?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

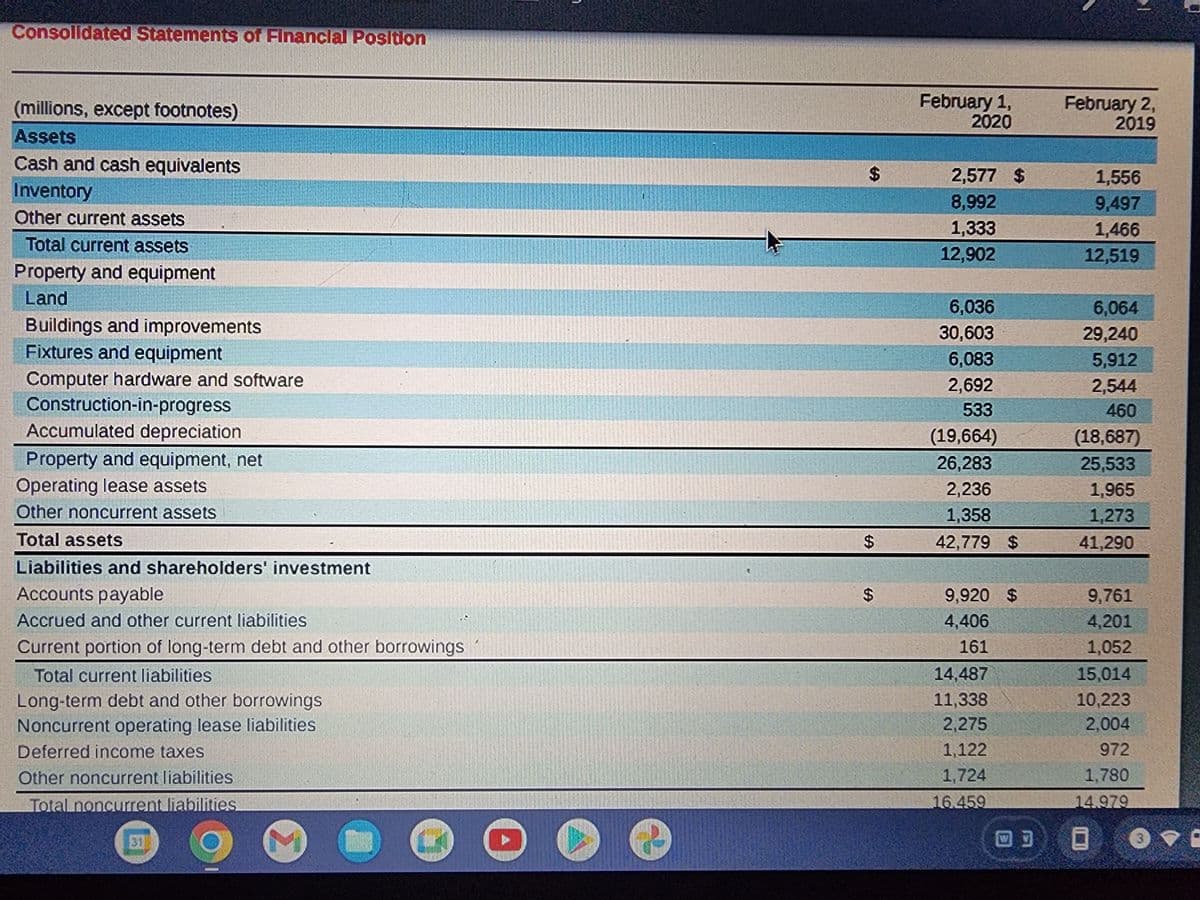

Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended February 1, 2020,

Does the company separately report current assets and long-term assets, as well as current liabilities and long-term liabilities?

Are any investments shown as a current asset? Why?

In which liability account would the company report the balance of its gift card liability?

What method does the company use to

Transcribed Image Text:Consolidated Statements of Financial Position

(millions, except footnotes)

Assets

Cash and cash equivalents

Inventory

Other current assets

Total current assets

Property and equipment

Land

Buildings and improvements

Fixtures and equipment

Computer hardware and software

Construction-in-progress

Accumulated depreciation

Property and equipment, net

Operating lease assets.

Other noncurrent assets

POL FORE SANT

Total assets

Liabilities and shareholders' investment

Accounts payable

Accrued and other current liabilities

Current portion of long-term debt and other borrowings

Total current liabilities

Long-term debt and other borrowings

Noncurrent operating lease liabilities

Deferred income taxes

Other noncurrent liabilities

Total noncurrent liabilities

31

1 C C

69

$

February 1,

2020

2,577 $

8,992

1,333

12,902

6,036

30,603

6,083

2,692

533

(19,664)

26,283

2,236

1,358

42,779 $

9,920 $

4,406

161

14,487

11,338

2,275

1,122

1,724

16.459

February 2,

2019

1,556

9,497

1,466

12,519

6,064

29,240

5,912

2,544

460

(18,687)

25,533

1,965

1,273

41,290

9,761

4,201

1,052

15,014

10,223

2,004

972

1,780

14.979

0

3

![Deferred income taxes

Other noncurrent liabilities

Total noncurrent liabilities

Shareholders' investment

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive loss

Total shareholders' investment

Total liabilities and shareholders' investment

M 3

$

Op

1,122

1,724

16,459

42

6,226

6,433

(868)

11,833

42,779 $

972

1,780

14,979

Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 504,198,962 shares issued and outstanding as of February 1, 2020;

517,761,600 shares issued and outstanding as of February 2, 2019.

Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding during any period presented.

See accompanying Notes to Consolidated Financial Statements.

43

6,042

6,017

(805)

11,297

41,290

W] 8

3](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F47f5a366-bdbc-483a-b97a-c5d86d8e18d4%2Ffe33dbe1-7cee-4812-8f42-451d391ea68f%2Fjb2m62e_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Deferred income taxes

Other noncurrent liabilities

Total noncurrent liabilities

Shareholders' investment

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive loss

Total shareholders' investment

Total liabilities and shareholders' investment

M 3

$

Op

1,122

1,724

16,459

42

6,226

6,433

(868)

11,833

42,779 $

972

1,780

14,979

Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 504,198,962 shares issued and outstanding as of February 1, 2020;

517,761,600 shares issued and outstanding as of February 2, 2019.

Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding during any period presented.

See accompanying Notes to Consolidated Financial Statements.

43

6,042

6,017

(805)

11,297

41,290

W] 8

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub