tate the reasons for the significant deterioration of the cash balance in the cash budget Photo given the operating profits recorded in the budgeted income statement

tate the reasons for the significant deterioration of the cash balance in the cash budget Photo given the operating profits recorded in the budgeted income statement

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter21: Budgeting

Section: Chapter Questions

Problem 9DQ: A. Discuss the purpose of the cash budget. B. If the cash for the first quarter of the fiscal year...

Related questions

Question

100%

State the reasons for the significant deterioration of the cash balance in the

Transcribed Image Text:19:01 7

Done be9c5e466e5e0b46ec5b7f561fd..

Document 3- Cash budget

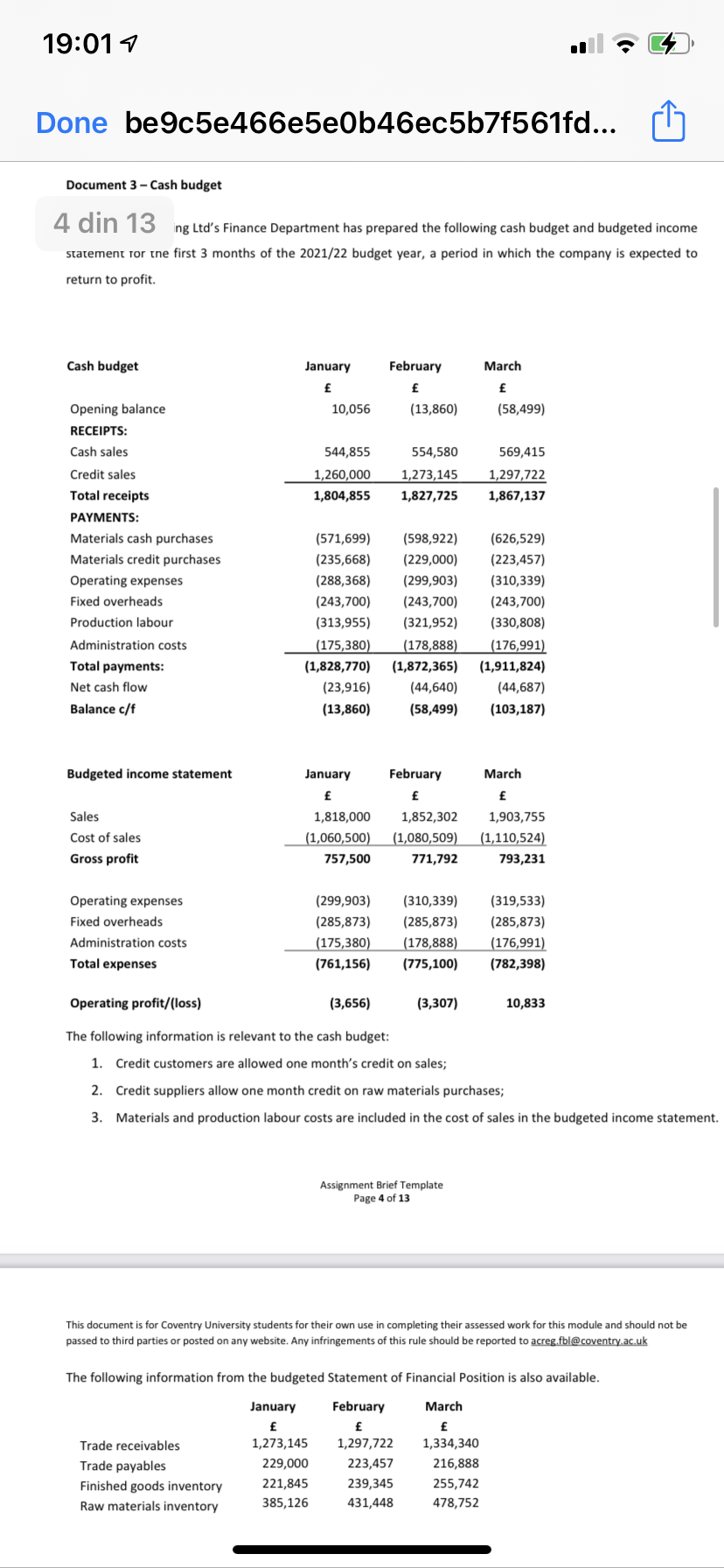

4 din 13 ng Ltd's Finance Department has prepared the following cash budget and budgeted income

statement ror tne first 3 months of the 2021/22 budget year, a period in which the company is expected to

return to profit.

Cash budget

January

February

March

£

£

Opening balance

10,056

(13,860)

(58,499)

RECEIPTS:

Cash sales

544,855

554,580

569,415

Credit sales

1,260,000

1,273,145

1,297,722

Total receipts

1,804,855

1,827,725

1,867,137

PAYMENTS:

Materials cash purchases

(571,699)

(598,922)

(626,529)

Materials credit purchases

(235,668)

(229,000)

(223,457)

Operating expenses

(288,368)

(299,903)

(310,339)

Fixed overheads

(243,700)

(243,700)

(243,700)

Production labour

(313,955)

(321,952)

(330,808)

Administration costs

|(175,380)

(178,888)

(176,991)

Total payments:

(1,828,770)

(1,872,365)

(1,911,824)

Net cash flow

(23,916)

(44,640)

(44,687)

Balance c/f

(13,860)

(58,499)

(103,187)

Budgeted income statement

January

February

March

£

Sales

1,818,000

1,852,302

1,903,755

Cost of sales

(1,060,500)

(1,080,509)

|(1,110,524)

Gross profit

757,500

771,792

793,231

Operating expenses

(299,903)

(310,339)

(319,533)

Fixed overheads

(285,873)

(285,873)

(285,873)

(175,380)

(761,156)

(178,888)

(775,100)

Administration costs

(176,991)

Total expenses

(782,398)

Operating profit/(loss)

(3,656)

(3,307)

10,833

The following information is relevant to the cash budget:

1.

Credit customers are allowed one month's credit on sales;

2. Credit suppliers allow one month credit on raw materials purchases;

3. Materials and production labour costs are included in the cost of sales in the budgeted income statement.

Assignment Brief Template

Page 4 of 13

This document is for Coventry University students for their own use in completing their assessed work for this module and should not be

passed to third parties or posted on any website. Any infringements of this rule should be reported to acreg.fbl@coventry.ac.uk

The following information from the budgeted Statement of Financial Position is also available.

January

February

March

£

£

£

Trade receivables

1,273,145

1,297,722

1,334,340

Trade payables

229,000

223,457

216,888

Fini

goods inventory

221,845

239,345

255,742

Raw materials inventory

385,126

431,448

478,752

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning