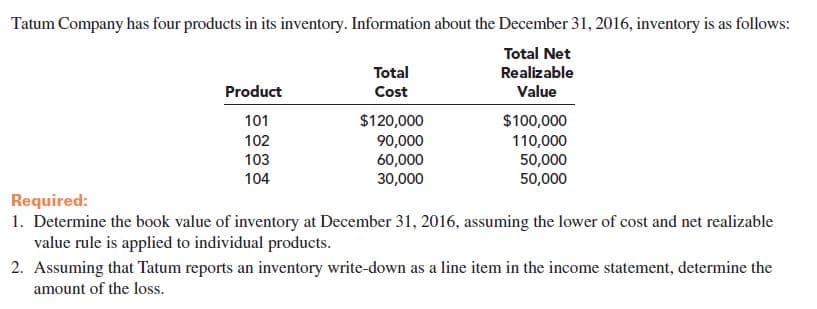

Tatum Company has four products in its inventory. Information about the December 31, 2016, inventory is as follows: Total Net Total Cost Realizable Product Value $120,000 $100,000 101 102 90,000 60,000 30,000 110,000 50,000 50,000 103 104 Required: 1. Determine the book value of inventory at December 31, 2016, assuming the lower of cost and net realizable value rule is applicd to individual products. 2. Assuming that Tatum reports an inventory write-down as a line item in the income statement, determine the amount of the loss.

Tatum Company has four products in its inventory. Information about the December 31, 2016, inventory is as follows: Total Net Total Cost Realizable Product Value $120,000 $100,000 101 102 90,000 60,000 30,000 110,000 50,000 50,000 103 104 Required: 1. Determine the book value of inventory at December 31, 2016, assuming the lower of cost and net realizable value rule is applicd to individual products. 2. Assuming that Tatum reports an inventory write-down as a line item in the income statement, determine the amount of the loss.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Question

Transcribed Image Text:Tatum Company has four products in its inventory. Information about the December 31, 2016, inventory is as follows:

Total Net

Total

Cost

Realizable

Product

Value

$120,000

$100,000

101

102

90,000

60,000

30,000

110,000

50,000

50,000

103

104

Required:

1. Determine the book value of inventory at December 31, 2016, assuming the lower of cost and net realizable

value rule is applicd to individual products.

2. Assuming that Tatum reports an inventory write-down as a line item in the income statement, determine the

amount of the loss.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning