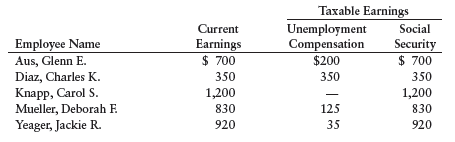

Taxable Earnings Unemployment Compensation $200 Current Social Employee Name Earnings $ 700 Security $ 700 Aus, Glenn E. Diaz, Charles K. 350 350 350 Knapp, Carol S. Mueller, Deborah F. Yeager, Jackie R. 1,200 1,200 830 125 830 920 35 920

Taxable Earnings Unemployment Compensation $200 Current Social Employee Name Earnings $ 700 Security $ 700 Aus, Glenn E. Diaz, Charles K. 350 350 350 Knapp, Carol S. Mueller, Deborah F. Yeager, Jackie R. 1,200 1,200 830 125 830 920 35 920

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 26P

Related questions

Question

CALCULATION AND

Calculate the employer’s payroll taxes expense and prepare the journal entry as of March 12, 20--, assuming that FUTA tax is 0.6%, SUTA tax is 5.4%, Social Security tax is 6.2%, and Medicare tax is 1.45%.

Transcribed Image Text:Taxable Earnings

Unemployment

Compensation

$200

Current

Social

Employee Name

Earnings

$ 700

Security

$ 700

Aus, Glenn E.

Diaz, Charles K.

350

350

350

Knapp, Carol S.

Mueller, Deborah F.

Yeager, Jackie R.

1,200

1,200

830

125

830

920

35

920

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you