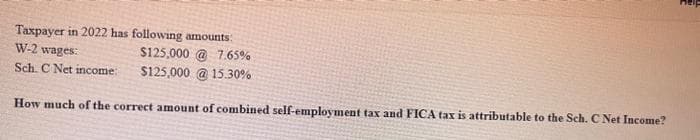

Taxpayer in 2022 has following amounts: W-2 wages: $125,000 @ 7.65% Sch. C Net income: $125,000 @ 15.30% How much of the correct amount of combined self-employment tax and FICA tax is attributable to the Sch. C Net Income?

Q: The following are three situations, all involving private companies, in which the auditor is…

A: Auditing is a systematic examination of an organization's financial records, transactions, and…

Q: A scientist claims that pneumonia causes weight loss in mice. The table shows the weights (in grams)…

A: b. t>2.015.c. đ= 0.933, sd= 0.309d. t= 7.40Explanation:b. critical values:n = 6α = 0.5df=n-1df=…

Q: Suppose that Congress sets the top personal tax rate on interest and dividends at 35% and the top…

A: Personal tax rate on income = 35%Corporate tax = 21%Capital gain are 50% of equity income.

Q: vvv Limited purchased a machine for $300,000 cash on 1 July 2005. The useful life of the machine is…

A: The objective of the question is to provide the journal entries related to the machine purchased by…

Q: used as a reference for this problem.) Calculate the purchase price of the bond using A-2 and A-4…

A: A bond is an instrument that is a type of loan given by an investor to a borrower. It gives a fixed…

Q: Factory overhead cost variances The following data relate to factory overhead cost for the…

A: Variance AmountFavorable/UnfavorableControllable variance $-9,600FavorableVolume…

Q: Return on investment is often expressed as follows: Controllable margin Average operating assets…

A: Ratios are very helpful in decision making process in the business. It makes use of financial…

Q: Required information [The following information applies to the questions displayed below.) Fausett…

A: Companies can spread out the expense of long-term assets over the course of their useful lives by…

Q: Paul, Inc. owns 75% of the voting stock of Booker Corp., and the two companies are consolidated in…

A: Under the consolidation method, a parent company combines its own revenue with 100% of the revenue…

Q: Problem 8-71 (LO 8-4) (Algo) [The following information applies to the questions displayed below.]…

A: Child and dependent care credit:The child and dependent care credit is a credit that helps the…

Q: Copr Goedl 2022 Sheba Industries reported the following budgeted sales in units for the first…

A: The objective of the question is to calculate the total number of units to be produced in July for…

Q: Required information [The following information applies to the questions displayed below] The…

A: FIFO method is one of the methods of inventory valuation in which it is assumed that old purchases…

Q: Orion Iron Corporation tracks the number of units purchased and sold throughout each year but…

A: The inventory can be valued using various methods as LIFO, FIFO and weighted average method.Under…

Q: When a company retires its own common shares, the company must a. decrease the common share…

A: The objective of the question is to understand the accounting treatment when a company retires its…

Q: Variable and Absorption CostingChandler Company sells its product for $108 per unit. Variable…

A: Part 1: Answer:Using variable costing, Chandler Company's net income would be…

Q: Marquis Company uses a weighted-average perpetual inventory system and has the following purchases…

A: Pertptual inventory system: A perpetual inventory system is simply a system that is used to track…

Q: The partners agreed to dispose of an old pick-up truck with a net book value of $350,000 for…

A: Income tax:The income tax refers to the amount that is paid by the taxpayer to the tax authority of…

Q: A company incurred the following costs: Purchase price of land $290,000 Survey fees 7,000 Payment…

A: The cost of land includes all the expenses that are incurred to take the ownership transfer. It…

Q: Kelvin owns and lives in a duplex. He rents the other unit for $680 per month. He incurs the…

A: For tax purposes, Schedule A records the expenses related to mortgage or home loan interest, state…

Q: i need the answer quickly

A: Inventory can be valued using various methods -First-in First-Out Method - Under the First-in…

Q: On the 12/31 Consolidated Financial Statements, what amounts will be reported for: 1. Revenues: 2.…

A: To determine the amounts reported in the consolidated financial statements for the given items, we…

Q: Caldwell Supply, a wholesaler, has determined that its operations have three primary activities:…

A: Target cost is the cost the company can incur for the respective expenses to earn the target…

Q: >Decision Case F:3-1 One year ago, Tyler Stasney founded Swift Classified Ads. Stasney remembers…

A: Income statement forms part of the financial statement of the company as it represents the financial…

Q: Orange Corporation has two divisions: Fruit and Flower. The following information for the past year…

A: Return on investment helps in measuring the performance by evaluating the profit and efficiency of…

Q: i need the answer quickly

A: Cost of goods sold budget shows the expenses incurred for producing a product. Cost of goods sold is…

Q: Question Starshine Coffee Equipment sells European style coffee makers and uses a perpetual…

A: The objective of the question is to calculate the ending inventory as at June 30 and the cost of…

Q: Gurland Valves Company manufactures brass valves that meet precise specification standards. All…

A: Activity-Based Costing (ABC) is a costing methodology that assigns overhead costs to specific…

Q: a. Prepare a differential analysis report for the lease or sell decision. INMAN INDUSTRIES Proposal…

A: Differential analysis involves comparing the costs and benefits of alternative courses of action to…

Q: 3,800 units, 60% completed Direct materials, 32,000 units Direct labor Factory overhead $ 60,400…

A: "Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: ! Required information [The following information applies to the questions displayed below.] Stark…

A: Trial balance :— It is the statement that shows list of final ending balances of all ledger accounts…

Q: The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a…

A: The objective of the question is to determine whether the production and sale of racing bikes should…

Q: Colby Corporation has provided the following information: • Operating revenues from customers were…

A: Operating expenses are the expenses that are incurred for the operation of the business during the…

Q: A share of common stock just paid a dividend (DO) of $3.00. If the expected long-run growth rate for…

A: The objective of this question is to calculate the current stock price (P0) using the Gordon Growth…

Q: Harold and Maude were married and lived in a common-law state. Maude died in 2018 with a taxable…

A: A tax levied on the transfer of a deceased person's taxable estate is known as an estate tax. Prior…

Q: Answer the following question, giving detailed examples to justify your answer;- Based on the book…

A: The convergence of international accounting standards represents a pivotal movement in the global…

Q: Young and Old Corporation (YOC) uses two aging categories to estimate uncollectible accounts.…

A: The allowance for doubtful accounts is recorded under the balance sheet method for recording bad…

Q: SOLVE ALL QUESTIONS OTHERWISE LEAVE

A: Activity-based costingThe measure of cost determines the cost of the products and services based on…

Q: On March 1, a dressmaker starts work on three different custom-designed wedding dresses. The company…

A: Predetermined Overhead Rate :— It is the rate used to allocate manufacturing overhead cost to cost…

Q: Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current…

A: Deductions:Deduction refers to the tax benefit amount that is given to the taxpayer by the tax…

Q: Blue Corporation purchases equity securities costing $158,200 and classifies them as…

A: Available-for-sale (AFS) securities are financial assets that are not classified as either…

Q: a. Prepare a differential analysis report for the proposal to replace the machine. Include in the…

A: Differential method of comparing 2 alternative proposals:The differential cost technique is used in…

Q: On January 1, 2022, Chiquita Corporation issued 4,000 shares of $2 par value restricted common stock…

A: Share-based compensationThe compensation or commission provided to the employees in the form of…

Q: Mrs. Shine was registered in Jamaica as a sole trader in 2015. To grow her practice Mrs. Shine…

A: The objective of the question is to calculate the adjusted profit or loss for the partnership of…

Q: Quality Motor Company is an auto repair shop that uses standards to control its labor time and labor…

A: Variance analysis is a method to identify the difference between estimated budgets and actual…

Q: Required information Use the following information for Exercises 25-27 below. (Algo) [The following…

A: An income statement is one of the financial statements that is prepared to show the net income /…

Q: Required: On January 3, 2024, Matteson Corporation acquired 40 percent of the outstanding common…

A: Under the equity method of accounting for investments, the investor (Matteson Corporation, in this…

Q: Master Budget with Supporting SchedulesYou have just been hired as a management trainee by Cravat…

A: The objective of the question is to prepare a master budget for the three-month period ending June…

Q: Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources),…

A: Cost allocation to support departmentsWhen the company has more departments, there will be a…

Q: The company accrued income taxes at the end of January of $9,000. Record the adjusting entry for…

A: The objective of the question is to record the adjusting entry for income taxes that the company has…

Q: P8-6 (Algo) Defining and Analyzing Changes in Current Liabilities LO8-1 International Business…

A: A warranty is an element of a contract that outlines the terms and conditions under which the…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- During 2019, Carl (a single taxpayer) has a salary of $91,500 and interest income of $11,000. Calculate the maximum contribution Carl is allowed for an educational savings account. $0 $400 $1,000 $2,000 Some other amountLO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on its estimated state income tax for the year. During 2019, the company received a 4,000 refund upon filing its 2018 state income tax return. The company filed its 2019 state income tax return in August 2020 and paid the 7,000 state income tax due for 2019. In December 2019, the company received a notice from the state tax commission that an additional 6,000 of income tax was due for 2017 because of an error on the return. The company acknowledged the error in December 2019 and paid the additional 6,000 in tax in February 2020. What is Ospreys 2019 Federal income tax deduction for state income taxes?How do the all events and economic performance requirements apply to the following transactions by an accrual basis taxpayer? a. The company guarantees its products for six months. At the end of 2019, customers had made valid claims for 600,000 that were not paid until 2020. Also, the company estimates that another 400,000 in claims from 2019 sales will be filed and paid in 2020. b. The accrual basis taxpayer reported 200,000 in corporate taxable income for 2019. The state income tax rate was 6%. The corporation paid 7,000 in estimated state income taxes in 2019 and paid 2,000 on 2018 state income taxes when it filed its 2018 state income tax return in March 2019. The company filed its 2019 state income tax return in March 2020 and paid the remaining 5,000 of its 2019 state income tax liability. c. An employee was involved in an accident while making a sales call. The company paid the injured victim 15,000 in 2019 and agreed to pay the victim 15,000 a year for the next nine years.