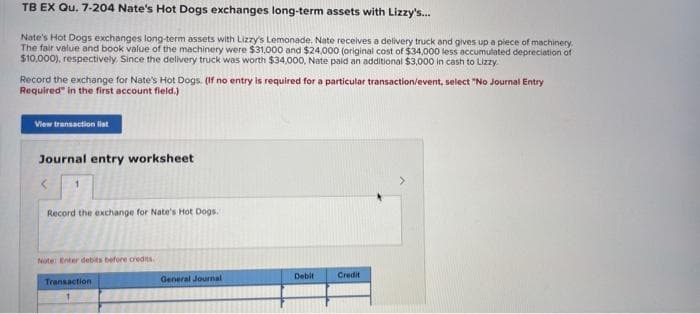

TB EX Qu. 7-204 Nate's Hot Dogs exchanges long-term assets with Lizzy's. Nate's Hot Dogs exchanges long-term assets with Lizzy's Lemonade. Nate receives a delivery truck and gives up a piece of machinery. The fair value and book value of the machinery were $31,000 and $24,000 (original cost of $34,000 less accumulated depreciation of $10,000), respectively. Since the delivery truck was worth $34,000, Nate paid an additional $3.000 in cash to Lizzy Record the exchange for Nate's Hot Dogs. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list:

TB EX Qu. 7-204 Nate's Hot Dogs exchanges long-term assets with Lizzy's. Nate's Hot Dogs exchanges long-term assets with Lizzy's Lemonade. Nate receives a delivery truck and gives up a piece of machinery. The fair value and book value of the machinery were $31,000 and $24,000 (original cost of $34,000 less accumulated depreciation of $10,000), respectively. Since the delivery truck was worth $34,000, Nate paid an additional $3.000 in cash to Lizzy Record the exchange for Nate's Hot Dogs. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list:

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 47P

Related questions

Question

please show work how its solved thanks.

Transcribed Image Text:TB EX Qu. 7-204 Nate's Hot Dogs exchanges long-term assets with Lizzy's.

Nate's Hot Dogs exchanges long-term assets with Lizzy's Lemonade. Nate receives a delivery truck and gives up a piece of machinery.

The fair value and book value of the machinery were $31,000 and $24,000 (original cost of $34,000 less accumulated depreciation of

$10,000), respectively. Since the delivery truck was worth $34,000, Nate paid an additional $3,000 in cash to Lizzy.

Record the exchange for Nate's Hot Dogs. (If no entry is required for a particular transaction/event, select "No Journal Entry

Required" in the first account field.)

View transaction list

Journal entry worksheet

Record the exchange for Nate's Hot Dogs

Note Enter debits before credits

Debit

Credit

Transaction

General Journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning