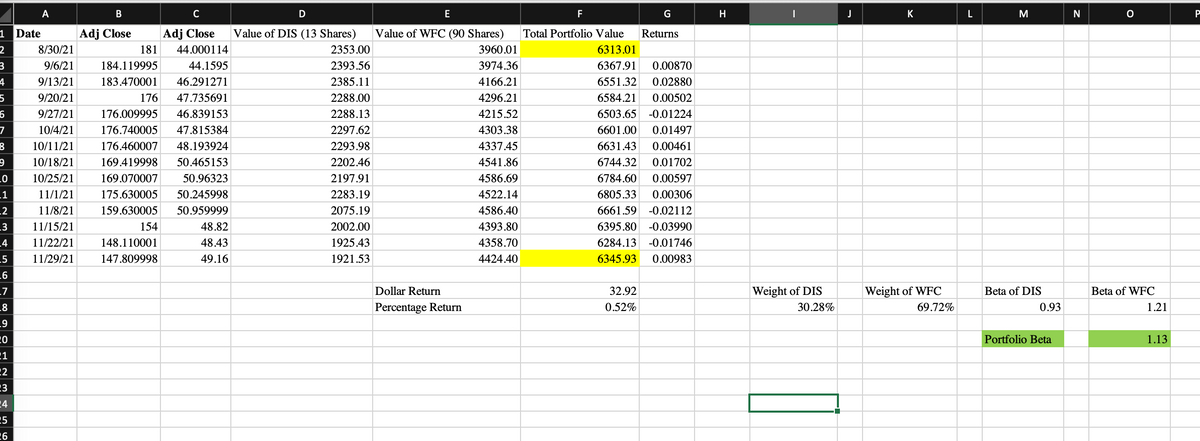

te Adj Close 181 Adj Close Value of DIS (13 Shares) 44.000114 2353.00 2393.56 2385.11 2288.00 8/30/21 9/6/21 184.119995 44.1595 9/13/21 183.470001 46.291271 9/20/21 176 47.735691 9/27/21 176.009995 46.839153 10/4/21 176.740005 47.815384 10/11/21 176.460007 48.193924 10/18/21 169.419998 50.465153 10/25/21 169.070007 50.96323 11/1/21 175.630005 50.245998 11/8/21 159.630005 50.959999 11/15/21 154 11/22/21 148.110001 11/29/21 147 809998 48.82 48.43 49.16 2288.13 2297.62 2293.98 2202.46 2197.91 2283.19 2075.19 2002.00 1925.43 1921 53 Value of WFC (90 Shares) 3960.01 3974.36 4166.21 4296.21 4215.52 4303.38 4337.45 4541.86 4586.69 4522.14 4586.40 4393.80 4358.70 4424 40 Total Portfolio Value Returns 6313.01 6367.91 0.00870 6551.32 0.02880 6584.21 0.00502 6503.65 -0.01224 6601.00 0.01497 6631.43 0.00461 6744.32 0.01702 6784.60 0.00597 6805.33 0.00306 6661.59 -0.02112 6395.80 -0.03990 6284.13 -0.01746 6345 93 0.00983

te Adj Close 181 Adj Close Value of DIS (13 Shares) 44.000114 2353.00 2393.56 2385.11 2288.00 8/30/21 9/6/21 184.119995 44.1595 9/13/21 183.470001 46.291271 9/20/21 176 47.735691 9/27/21 176.009995 46.839153 10/4/21 176.740005 47.815384 10/11/21 176.460007 48.193924 10/18/21 169.419998 50.465153 10/25/21 169.070007 50.96323 11/1/21 175.630005 50.245998 11/8/21 159.630005 50.959999 11/15/21 154 11/22/21 148.110001 11/29/21 147 809998 48.82 48.43 49.16 2288.13 2297.62 2293.98 2202.46 2197.91 2283.19 2075.19 2002.00 1925.43 1921 53 Value of WFC (90 Shares) 3960.01 3974.36 4166.21 4296.21 4215.52 4303.38 4337.45 4541.86 4586.69 4522.14 4586.40 4393.80 4358.70 4424 40 Total Portfolio Value Returns 6313.01 6367.91 0.00870 6551.32 0.02880 6584.21 0.00502 6503.65 -0.01224 6601.00 0.01497 6631.43 0.00461 6744.32 0.01702 6784.60 0.00597 6805.33 0.00306 6661.59 -0.02112 6395.80 -0.03990 6284.13 -0.01746 6345 93 0.00983

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 10MCQ

Related questions

Question

Please explain the price movements of each stock's DIS AND WFC from the past three months. Do the calculations on the spreadsheet show that the company's stock went up or down? Why? Demonstrate a clear understanding of the concept beta of each stock.

Transcribed Image Text:| M

A

E

F

H

K

1 Date

Adj Close

Adj Close

Value of DIS (13 Shares)

Value of WFC (90 Shares)

Total Portfolio Value

Returns

8/30/21

181

44.000114

2353.00

3960.01

6313.01

9/6/21

184.119995

44.1595

2393.56

3974.36

6367.91

0.00870

4

9/13/21

183.470001

46.291271

2385.11

4166.21

6551.32

0.02880

9/20/21

176

47.735691

2288.00

4296.21

6584.21

0.00502

9/27/21

176.009995

46.839153

2288.13

4215.52

6503.65 -0.01224

7

10/4/21

176.740005

47.815384

2297.62

4303.38

6601.00

0.01497

10/11/21

176.460007

48.193924

2293.98

4337.45

6631.43

0.00461

10/18/21

169.419998

50.465153

2202.46

4541.86

6744.32

0.01702

10/25/21

169.070007

50.96323

2197.91

4586.69

6784.60

0.00597

_1

11/1/21

175.630005

50.245998

2283.19

4522.14

6805.33

0.00306

_2

_3

11/8/21

159.630005

50.959999

2075.19

4586.40

6661.59 -0.02112

11/15/21

154

48.82

2002.00

4393.80

6395.80 -0.03990

_4

11/22/21

148.110001

48.43

1925.43

4358.70

6284.13

-0.01746

.5

11/29/21

147.809998

49.16

1921.53

4424.40

6345.93

0.00983

_6

Dollar Return

32.92

Weight of DIS

Weight of WFC

Beta of DIS

Beta of WFC

Percentage Return

0.52%

30.28%

69.72%

0.93

1.21

Portfolio Beta

1.13

2

23

24

25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning