te Fields and St ers's inve ent operating capital. Note: Enter your answer in millions of dollars. (i.e., Enter 10,000,000 as 10.) Investment in operating capital million Calculate Fields and Struthers's free cash flow. Note: Enter your answer in millions of dollars rounded to 2 decimal places. (i.e., Enter 5,500,000 a Free cash flow million

te Fields and St ers's inve ent operating capital. Note: Enter your answer in millions of dollars. (i.e., Enter 10,000,000 as 10.) Investment in operating capital million Calculate Fields and Struthers's free cash flow. Note: Enter your answer in millions of dollars rounded to 2 decimal places. (i.e., Enter 5,500,000 a Free cash flow million

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 20P

Related questions

Question

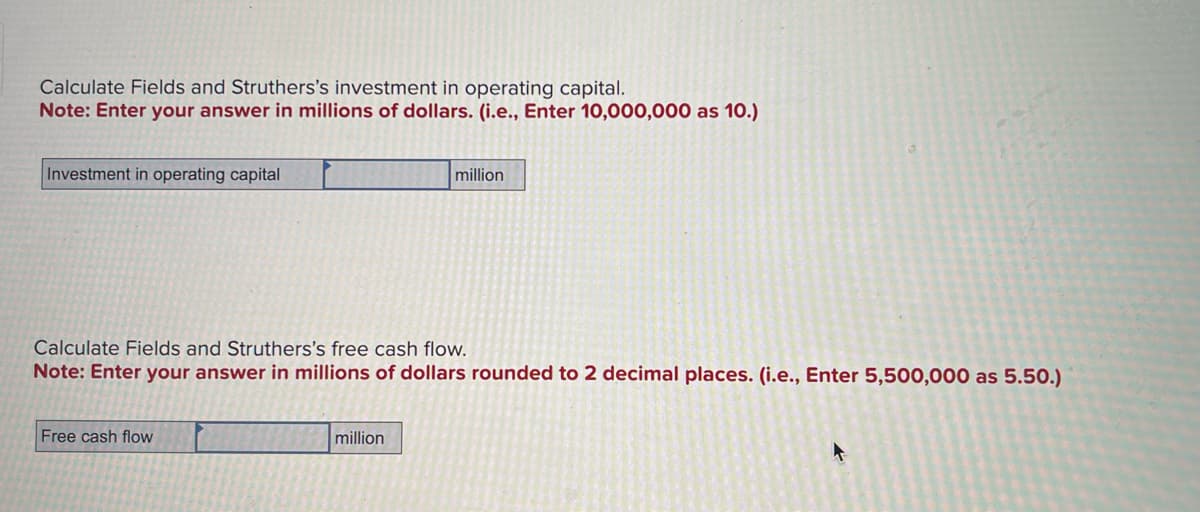

Transcribed Image Text:Calculate Fields and Struthers's investment in operating capital.

Note: Enter your answer in millions of dollars. (i.e., Enter 10,000,000 as 10.)

Investment in operating capital

million

Calculate Fields and Struthers's free cash flow.

Note: Enter your answer in millions of dollars rounded to 2 decimal places. (i.e., Enter 5,500,000 as 5.50.)

Free cash flow

million

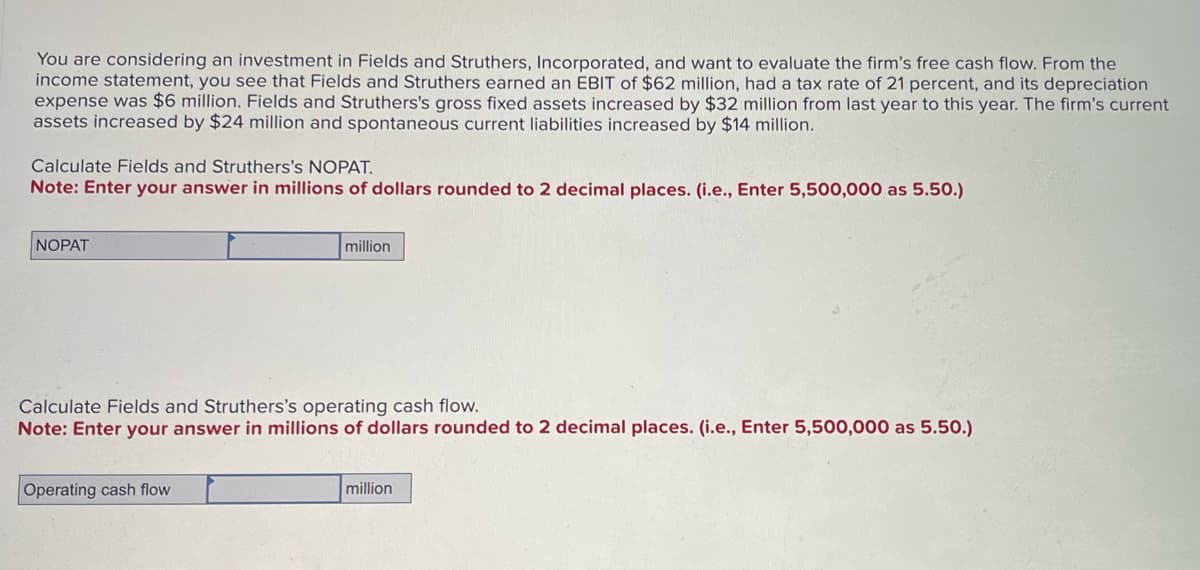

Transcribed Image Text:You are considering an investment in Fields and Struthers, Incorporated, and want to evaluate the firm's free cash flow. From the

income statement, you see that Fields and Struthers earned an EBIT of $62 million, had a tax rate of 21 percent, and its depreciation

expense was $6 million. Fields and Struthers's gross fixed assets increased by $32 million from last year to this year. The firm's current

assets increased by $24 million and spontaneous current liabilities increased by $14 million.

Calculate Fields and Struthers's NOPAT.

Note: Enter your answer in millions of dollars rounded to 2 decimal places. (i.e., Enter 5,500,000 as 5.50.)

NOPAT

million

Calculate Fields and Struthers's operating cash flow.

Note: Enter your answer in millions of dollars rounded to 2 decimal places. (i.e., Enter 5,500,000 as 5.50.)

Operating cash flow

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning