te (Social Security viedica With aing!

Q: Relevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic…

A: Answer a) Calculation of variable cost per unit Variable cost per unit = Total Variable Costs/…

Q: Mckinney & Co. estimates its uncollectible accounts as a percentage of credit sales. Mckinney…

A: Uncollectible accounts seem to be debts, mortgages, or even other receivables that have very little…

Q: 1. When an item of asset is transferred to and from the classification investment property, carried…

A: Hi student Since there are multiple questions, we will answer only first question. If you want…

Q: Needed in 20 minutes 6. Q Company has the following information on December 31, 20x1 before any…

A: Account receivables means the amount which is due from outsider for the goods or services rendered…

Q: Prepare the following financial statements for Sea View Tour Income Statement for the yearended 31…

A: Introduction : An income statement is a financial statement that shows the income and expenses of a…

Q: on receipt of the budget, the team nager, has now informed you that, in eping with industry players,…

A: Budget is consider to important for businesses. and investors in order to understand and take…

Q: On June 30, Year 3, Franza Company’s total current assets were $900,000 and its total current…

A: Formulas: Working Capital = Total Current assets - Total Current liabilities Current ratio = Total…

Q: The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a…

A: Answer:- Income statement definition:- Income statement can be defines as a statement which shows…

Q: what is the controversy in IFRS 8 Operating Segment?

A: Introduction: An essential piece of an entity that is a moneymaker has discrete financial available…

Q: Kabe owns a fleet of light delivery vehicles. One of his delivery vehicles with a market value of…

A:

Q: Prepare the following financial statements for Sea View Tour. Income Statement for the year ended 31…

A: Financial statements are those statements which are prepared at the end of accounting period in…

Q: Assume that the entity is a medium-size and the company policy is to account this type of investment…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Accounting The following totals for the month of June were taken from the payroll register of Mike…

A: Answer:- Net Payroll meaning:- Net payroll can be defined as the amount taken home by the employees…

Q: The Kyle Manufacturing Company produces various types of fertilizers. No beginning work in process…

A:

Q: Q1: Mater Pasta Inc. has projected a sales volume of $1,432 for the second year of a proposed…

A: Operating cash flow can be calculated by deducting tax and adding up depreciation from net income.

Q: Chevy Company owns 50% of another entity’s preference share capital and 40% of its ordinary share…

A: Since dividend is not declared for year 2021 , Chevy Company will only earn dividend income on…

Q: On November 1, 2019, Edwin Inc. borrowed cash and signed a $60,000, 1-year note payable.…

A: Every business transaction should indeed be documented in at least two locations, according to the…

Q: Operations anuary Purchase on credit of goods from Boréal Itée, conditions 2/10, n/30: $1,000 plus…

A: SI. No Transaction Debit Credit 1) Purchases A/c Dr $1000 To Boreal itte A/c $1000…

Q: At the end of the current year, Accounts Receivable has a balance of $425,000, Allowance for…

A: Formula: Net realizable value = Accounts receivable - Allowance for doubtful accounts

Q: On May 1, 2014 Barton Corporation purchased for cash of S37.500 a patent with a useful ife of 10…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: 0 in 12 years. Your hotel wants to start investing today in an a

A: Present value refers to the current valuation for a future sum. Investors determine the present…

Q: e budgeted production (in units) for Tasty Foods for April should be: Multiple Choice O 142,600.…

A: Introduction:- A production budget is used to calculate the number of units to be manufactured…

Q: Activity Costing, Assigning Resource Costs, Primary andSecondary ActivitiesElmo Clinic has…

A: Activity-based costing (ABC) is a cost-calculating approach used in production. It categorizes…

Q: Bitter Company acquired a machinery on April 1, 2020. Problem 27-9 (ACP) siter Company acquired a…

A: The amount of depreciation in the double-declining balance method changes more depreciation in…

Q: Required: [Dikehendaki:] a. Prepare a Statement of Comprehensive Income for the year ended 31 March…

A: Statement of comprehensive income means the statement which shows all the nominal account and…

Q: Oriole Corporation has 74.000 shares of common stock outstanding It declares a $2 per share cash…

A: The journal entries are prepared to keep the record of day to day transactions of the business. The…

Q: Taxable Income €500,000 330,000 400,000 1. Year 2018 2019 2020 2. On January 2, 2018, heavy…

A: Given : In this question all the values related to Tax Depreciation of the year 2018 to 2021. The…

Q: ONLY ANSWER QUESTION (B) AS I HAVE ANSWER FOR (A) ALREADY SALLAT Household Furnishings & Appliances…

A: Cash budget is an important and basic type of accounting.It is a document produced to help a…

Q: 1. On January 1, 2021 Dona Company purchased 10% of another entity’s outstanding ordinary shares…

A: Income Statement: An accounting report that indicates the company's profitability structure…

Q: Required: a. - d. Prepare the pro forma income statement that would appear in the master budget and…

A:

Q: A. Suppose that Taco John’s equity is currently selling for $55 per share, with 4million shares…

A: Solution:- Given, A). Taco John's equity is currently selling = $55 per share Shares outstanding =…

Q: Bill and Kim Johnson are purchasing a house for $263,000. Their bank requires them to pay a 20% down…

A: A mortgage refers to a loan used to buy or maintain and repair a building, land, or other real…

Q: FIFO and weighted average. But what if a company wants to use LIFO to report its inventory because…

A: Introduction Dollar value of LIFO is an accounting method for valuation of inventory, this method…

Q: Scenario 2 On January 1, 2020, Harvey Inc. made available $100,000 of 20 years, 10% bonds at par…

A: Long-term liabilities are those liabilities that are payable beyond one year. The payment for these…

Q: At the end of last year, Edwin Inc. reported the following income statement (in millions of…

A: An income statement is a statement that shows a company's income and costs. It also displays if a…

Q: Sheridan Homes Ltd., a private company reporting under ASPE, reported the following for the year…

A: cash flow from investing activities includes the inflow and out flow of all the cash from the…

Q: Compute the company's current ratio for 2018, 2019, and 2020. (Round your answers to 2 decimal…

A: Financial ratios are those which provide a summary of the accounts of a company and helps an…

Q: H. The following information was obtained from the records of Diwata Traders: P 254,000 119,000…

A: Balance Sheet - The balance sheet is the financial statement that includes balances of assets and…

Q: Prepare the current assets section of the balance sheet at June 30, 2022. (LIst Current Assets in…

A: Current assets means the assets which can be easily convertible in to cash generally with in one…

Q: Consider the following simplified production process for an electronic device. Demand = 50,000…

A: Demand = 50,000 devices/year Price = $50 each Raw Material = $5/device Employee Wage = $25/hr.…

Q: On January 1, 2016, Matthew Company's work in process inventory account had a balance of $46,000.…

A: A cost sheet is a method of allocating total costs into different categories. It helps to identify…

Q: Is it really vital for a manufacturing company to prepare a budgeted income statement and balance…

A: A budgeted income statements statement that forecasts earnings, revenue, and expenses for the coming…

Q: Karim Corporation requires a minimum $9,000 cash balance. Loans taken to meet this requirement cost…

A: In the given question, Karim Corporation's cash receipts and payments are mentioned. We have to…

Q: What is the net present value ? And should the van be purchased? unit VIII Question 15 part a

A: Net present value NPV is the method of capital budgeting which calculates the present worth of net…

Q: Discuss the major characteristics of a theory.

A: Discussion of major characteristics of a theory

Q: Mr Ventura engaged in a Milling business to serve the needs of farmers in the rural areas of…

A: Accounting books: Accounting books are the records of company in which they recognize regular…

Q: n addition to receipts for the above items, the petty cash box contained P10 in coins and an IOU of…

A: Preparation of Petty Cash Book

Q: Q8 ABC Bakers is a partnership concern owned and operated by Mr. X and Mr. Y. Identify the option…

A: There are variety of the way during which a partnership could also be defined, but there are four…

Q: Q1: Mater Pasta Inc. has projected a sales volume of $1,432 for the second year of a proposed…

A: Operating cash flow = [(Sales – Costs) × (1 – Tax rate)] + (Tax rate × Depreciation expense) where,…

Step by step

Solved in 2 steps

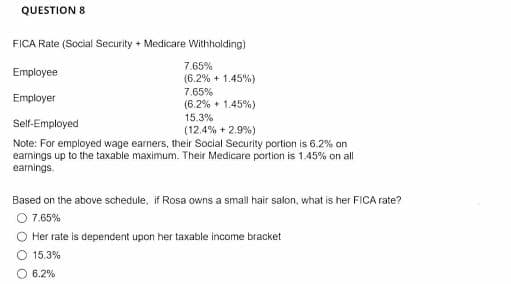

- An employee earns $8,000 in the first pay period. The FICA Social Security Tax rate is 6.2%, and the FICA Medicare tax rate is 1.45%. What is the employees FICA taxes responsibility? A. $535.50 B. $612 C. None, only the employer pays FICA taxes D. $597.50 E. $550Reference Figure 12.15 and use the following information to complete the requirements. A. Determine the federal income tax withholdings amount per monthly pay period for each employee. B. Record the employee payroll entry (all employees) for the month of January assuming FICA Social Security is 6.2%, FICA Medicare is 1.45%, and state income tax is equal to 3% of gross income. (Round to the nearest cent if necessary.)Employee's Rates Matching Rates Paid bythe Employer Self-Employed Rates 7.65% on first $118,500 of income 1.45% on income above $118,500 7.65% on first $118,500 paid in wages 1.45% on wages above $118,500 13.3% on first $118,500 of net earnings 2.9% on earnings above $118,500 1FICA taxes include Social Security and Medicare. The Social Security tax applies to the first $118,500 of income, while the Medicare tax applies to all income. Suppose Holly has $227,100 of income from work and is not self-employed. How much will Holly have to pay in FICA taxes?

- Employee's Rates Matching Rates Paid bythe Employer Self-Employed Rates 7.65% on first $118,500 of income 1.45% on income above $118,500 7.65% on first $118,500 paid in wages 1.45% on wages above $118,500 13.3% on first $118,500 of net earnings 2.9% on earnings above $118,500 1FICA taxes include Social Security and Medicare. The Social Security tax applies to the first $118,500 of income, while the Medicare tax applies to all income. Suppose Mondaire has $96,700 of income from work and is not self-employed. How much will Mondaire have to pay in FICA taxes?52. Subject : - Accounting Rachel receives employer provided health insurance. The employer's cost of the health insurance is $6,100 annually. What is her employer's after-tax cost of providing the health insurance, assuming that the employer's marginal tax rate is 21 percent and is profitable?1. What is the total Medicare tax rate for an employee who is subject to both standard Medicare tax and Additional Medicare tax? Answer: A. 2.35% B. 2.45% C. 6.2% D. 7.65% 2. Prior to the current period, Jamie Pratt, whose tax return filing status is single, had earnings subject to Medicare tax of $248,000. This week, Jamie has gross earnings of $3,700. His employer will withhold $_______ in total Medicare tax. 3. What type of institution might offer a 403(b) plan to its employees? Answer: A. A small business B. Private colleges C. Fortune 500 companies D. Public education institutions and certain tax-exempt organizations E. All of these options

- Calculate the Social Security and Medicare deduction for the following employee (assume a tax rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare): (round your answer to the nearest cent.) Employee Cumulative Earnings before this pay period Pay Amount this Period Social Security Medicare Logan $128,300 $3,0001. The original Social Security tax rate was _____ of taxable earnings. Answer: A. 10% B. 1% C. 5% D. 7% 2. The 2021 Social Security wage base is _____. Answer: A. $100,000 B. $113,700 C. $125,000 D. $142,800 3. What is the earnings threshold over which an employee whose filing status is Married Filing Separately will be subject to the additional Medicare tax? Answer: A. $117,000 B. $125,000 C. $200,000 D. $250,000Part I. An employee earns $22 per hour and 2 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 50 hours during the week. Assume further that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and federal income tax to be withheld was $177.10. a. Determine the gross pay for the week. b. Determine the net pay for the week. Part II. Assume that the social security tax rate is 6% and the Medicare tax rate is 1.5%. In the fol-lowing summary of data for a payroll period, some amounts have been intentionally omitted: Earnings: At regular rate ? At overtime rate $80,000 Total earnings ? Deductions: Social security tax $32,400 Medicare tax $8,100 Federal income tax withheld $135,000 Medical insurance $18,900 Union dues ? Total deductions $201,150 Net amount paid $338,850 Accounts debited: Factory Wages $285,000 Sales Salaries ? Office Salaries $120,000 a. Determine the amounts omitted in lines (1), (3), (8), and (12). b.…

- The required deduction for Social Security is 6.2% OASDI (Old Age Survivors and Disability Insurance) of wages earned, to a maximum of $97,500 and 1.45% HI (Hospital Insurance, commonly known as "Medicare") for all earnings. Refer to the Social Security and Medicare information. Employers are required to match the employee's deductions and send the total to the IRS. Compute the maximum percent that can be sent to the IRS for any one employee during the period of a year. 13.3% 13.5% 15.3% 15.5%LO 12.5An employee and employer cost-share pension plan contributions and health insurance premium payments. If the employee covers 35% of the pension plan contribution and 25% of the health insurance premium, what would be the employee’s total benefits responsibility if the total pension contribution was $900, and the health insurance premium was $375? Include the journal entry representing the payroll benefits accumulation for the employer in the month of February.Solve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit, for Medicare tax. What are the social security and Medicare withholdings (in $) for an executive whose annual gross earnings are $135,500? Social Security$ Medicare$