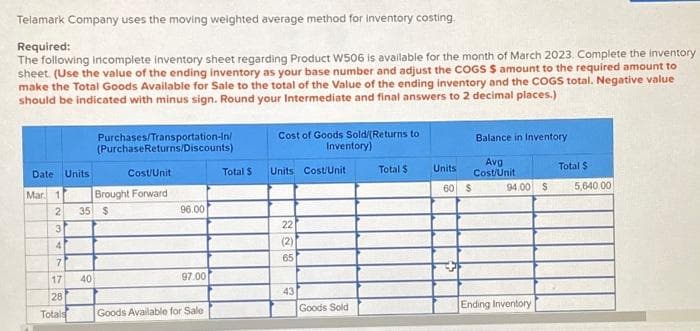

Telamark Company uses the moving weighted average method for inventory costing Required: The following incomplete inventory sheet regarding Product W506 is available for the month of March 2023. Complete the invento sheet. (Use the value of the ending inventory as your base number and adjust the COGS $ amount to the required amount to make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value should be indicated with minus sign. Round your Intermediate and final answers to 2 decimal places.) Date Units Mar. 1 2347 17 28 Totals Purchases/Transportation-In/ (Purchase Returns/Discounts) 40 Cost/Unit Brought Forward 35 $ 96.00 97.00 Goods Available for Sale Total S Cost of Goods Sold/(Returns to Inventory) Units Cost/Unit 22 (2) 65 43 Goods Sold Total $ Units 60 $ Balance in Inventory Avg Cost/Unit 94.00 $ Ending Inventory Total $ 5,640.00

Telamark Company uses the moving weighted average method for inventory costing Required: The following incomplete inventory sheet regarding Product W506 is available for the month of March 2023. Complete the invento sheet. (Use the value of the ending inventory as your base number and adjust the COGS $ amount to the required amount to make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value should be indicated with minus sign. Round your Intermediate and final answers to 2 decimal places.) Date Units Mar. 1 2347 17 28 Totals Purchases/Transportation-In/ (Purchase Returns/Discounts) 40 Cost/Unit Brought Forward 35 $ 96.00 97.00 Goods Available for Sale Total S Cost of Goods Sold/(Returns to Inventory) Units Cost/Unit 22 (2) 65 43 Goods Sold Total $ Units 60 $ Balance in Inventory Avg Cost/Unit 94.00 $ Ending Inventory Total $ 5,640.00

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 33BE

Related questions

Topic Video

Question

100%

ss

Transcribed Image Text:Telamark Company uses the moving weighted average method for inventory costing.

Required:

The following incomplete inventory sheet regarding Product W506 is available for the month of March 2023. Complete the inventory

sheet. (Use the value of the ending inventory as your base number and adjust the COGS S amount to the required amount to

make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value

should be indicated with minus sign. Round your Intermediate and final answers to 2 decimal places.)

Date Units

Mar. 1

23

47

17

28

Totals

Purchases/Transportation-In/

(Purchase Returns/Discounts)

40

Cost/Unit

Brought Forward

35 $

96.00

97.00

Goods Available for Sale

Total $

Cost of Goods Sold/(Returns to

Inventory)

Units Cost/Unit

22

(2)

65

43

Goods Sold

Total $

Units

60 $

Balance in Inventory

Avg

Cost/Unit

Total $

94.00 $ 5,640.00

Ending Inventory

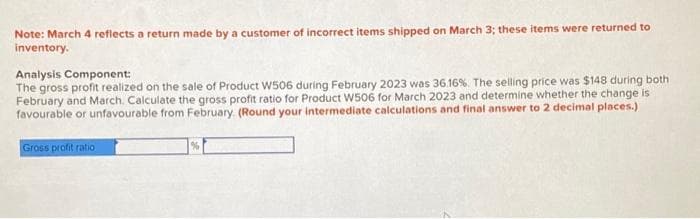

Transcribed Image Text:Note: March 4 reflects a return made by a customer of incorrect items shipped on March 3; these items were returned to

inventory.

Analysis Component:

The gross profit realized on the sale of Product W506 during February 2023 was 36.16%. The selling price was $148 during both

February and March. Calculate the gross profit ratio for Product W506 for March 2023 and determine whether the change is

favourable or unfavourable from February. (Round your intermediate calculations and final answer to 2 decimal places.)

Gross profit ratio

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College