ter Corp acquired dinary shares with yment of cash of F

Chapter7: Corporations: Reorganizations

Section: Chapter Questions

Problem 23P

Related questions

Question

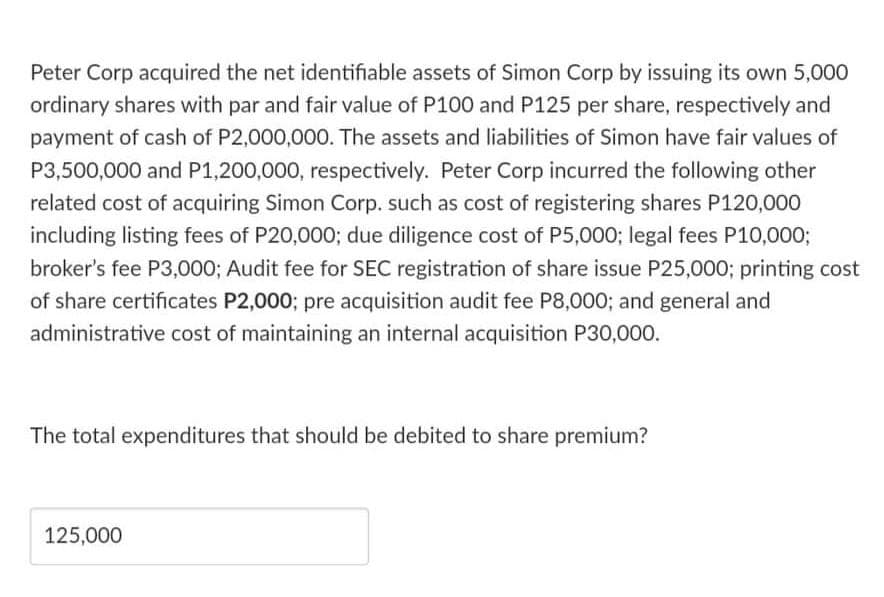

Transcribed Image Text:Peter Corp acquired the net identifiable assets of Simon Corp by issuing its own 5,000

ordinary shares with par and fair value of P100 and P125 per share, respectively and

payment of cash of P2,000,000. The assets and liabilities of Simon have fair values of

P3,500,000 and P1,200,000, respectively. Peter Corp incurred the following other

related cost of acquiring Simon Corp. such as cost of registering shares P120,000

including listing fees of P20,0003; due diligence cost of P5,000; legal fees P10,000;

broker's fee P3,000; Audit fee for SEC registration of share issue P25,000; printing cost

of share certificates P2,000; pre acquisition audit fee P8,000; and general and

administrative cost of maintaining an internal acquisition P30,000.

The total expenditures that should be debited to share premium?

125,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning