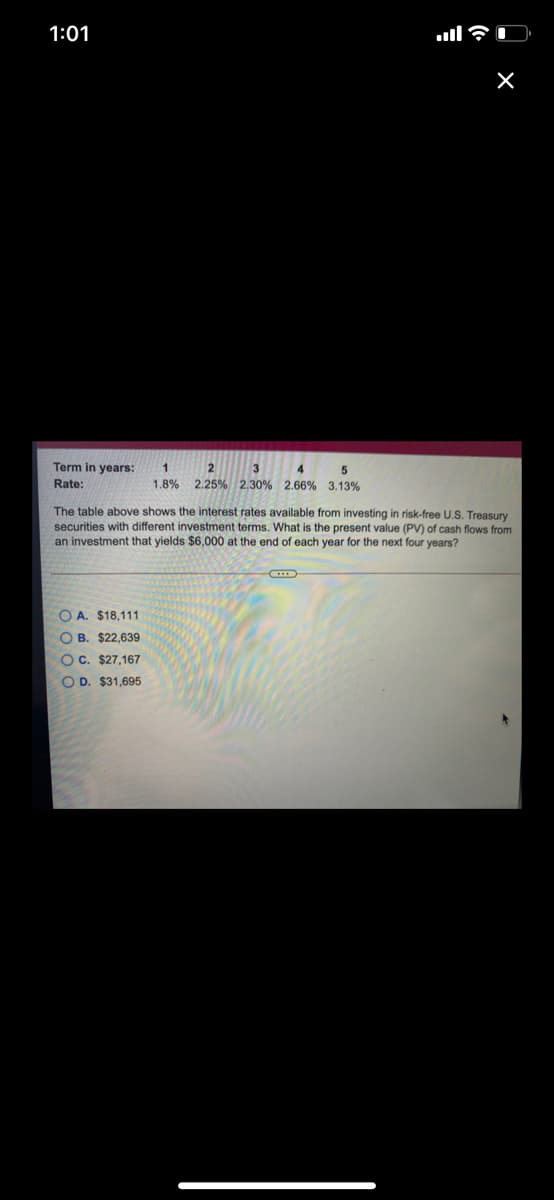

Term in years: 3 4. Rate: 1.8% 2.25% 2.30% 2.66% 3.13% The table above shows the interest rates available from investing in risk-free U.S. Treasury securities with different investment terms. What is the present value (PV) of cash flows from an investment that yields $6,000 at the end of each year for the next four years? O A. $18,111 O B. $22,639 OC. $27,167 D. $31,695

Term in years: 3 4. Rate: 1.8% 2.25% 2.30% 2.66% 3.13% The table above shows the interest rates available from investing in risk-free U.S. Treasury securities with different investment terms. What is the present value (PV) of cash flows from an investment that yields $6,000 at the end of each year for the next four years? O A. $18,111 O B. $22,639 OC. $27,167 D. $31,695

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 11P: Brook Corporation’s free cash flow for the current year (FCF0) was $3.00 million. Its investors...

Related questions

Question

Transcribed Image Text:1:01

Term in years:

Rate:

1

3

4.

1.8% 2.25% 2,30% 2.66% 3.13%

The table above shows the interest rates available from investing in risk-free U.S. Treasury

securities with different investment terms. What is the present value (PV) of cash flows from

an investment that yields $6,000 at the end of each year for the next four years?

O A. $18,111

O B. $22,639

O c. $27,167

O D. $31,695

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning