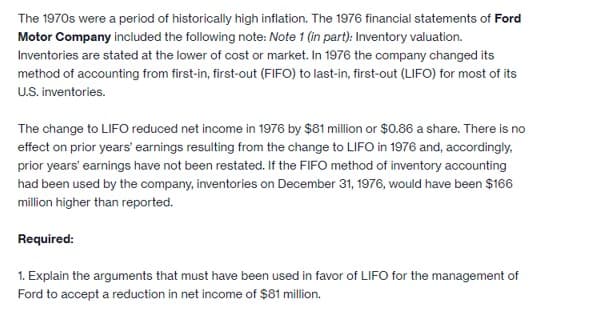

The 1970s were a period of historically high inflation. The 1976 financial statements of Ford Motor Company included the following note: Note 1 (in part): Inventory valuation. Inventories are stated at the lower of cost or market. In 1976 the company changed its method of accounting from first-in, first-out (FIFO) to last-in, first-out (LIFO) for most of its U.S. inventories. The change to LIFO reduced net income in 1976 by $81 million or $0.86 a share. There is no effect on prior years' earnings resulting from the change to LIFO in 1976 and, accordingly, prior years' earnings have not been restated. If the FIFO method of inventory accounting had been used by the company, inventories on December 31, 1976, would have been $166 million higher than reported. Required: 1. Explain the arguments that must have been used in favor of LIFO for the management of Ford to accept a reduction in net income of $81 million.

The 1970s were a period of historically high inflation. The 1976 financial statements of Ford Motor Company included the following note: Note 1 (in part): Inventory valuation. Inventories are stated at the lower of cost or market. In 1976 the company changed its method of accounting from first-in, first-out (FIFO) to last-in, first-out (LIFO) for most of its U.S. inventories. The change to LIFO reduced net income in 1976 by $81 million or $0.86 a share. There is no effect on prior years' earnings resulting from the change to LIFO in 1976 and, accordingly, prior years' earnings have not been restated. If the FIFO method of inventory accounting had been used by the company, inventories on December 31, 1976, would have been $166 million higher than reported. Required: 1. Explain the arguments that must have been used in favor of LIFO for the management of Ford to accept a reduction in net income of $81 million.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 5C

Related questions

Question

Transcribed Image Text:The 1970s were a period of historically high inflation. The 1976 financial statements of Ford

Motor Company included the following note: Note 1 (in part): Inventory valuation.

Inventories are stated at the lower of cost or market. In 1976 the company changed its

method of accounting from first-in, first-out (FIFO) to last-in, first-out (LIFO) for most of its

U.S. inventories.

The change to LIFO reduced net income in 1976 by $81 million or $0.86 a share. There is no

effect on prior years' earnings resulting from the change to LIFO in 1976 and, accordingly.

prior years' earnings have not been restated. If the FIFO method of inventory accounting

had been used by the company, inventories on December 31, 1976, would have been $166

million higher than reported.

Required:

1. Explain the arguments that must have been used in favor of LIFO for the management of

Ford to accept a reduction in net income of $81 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,