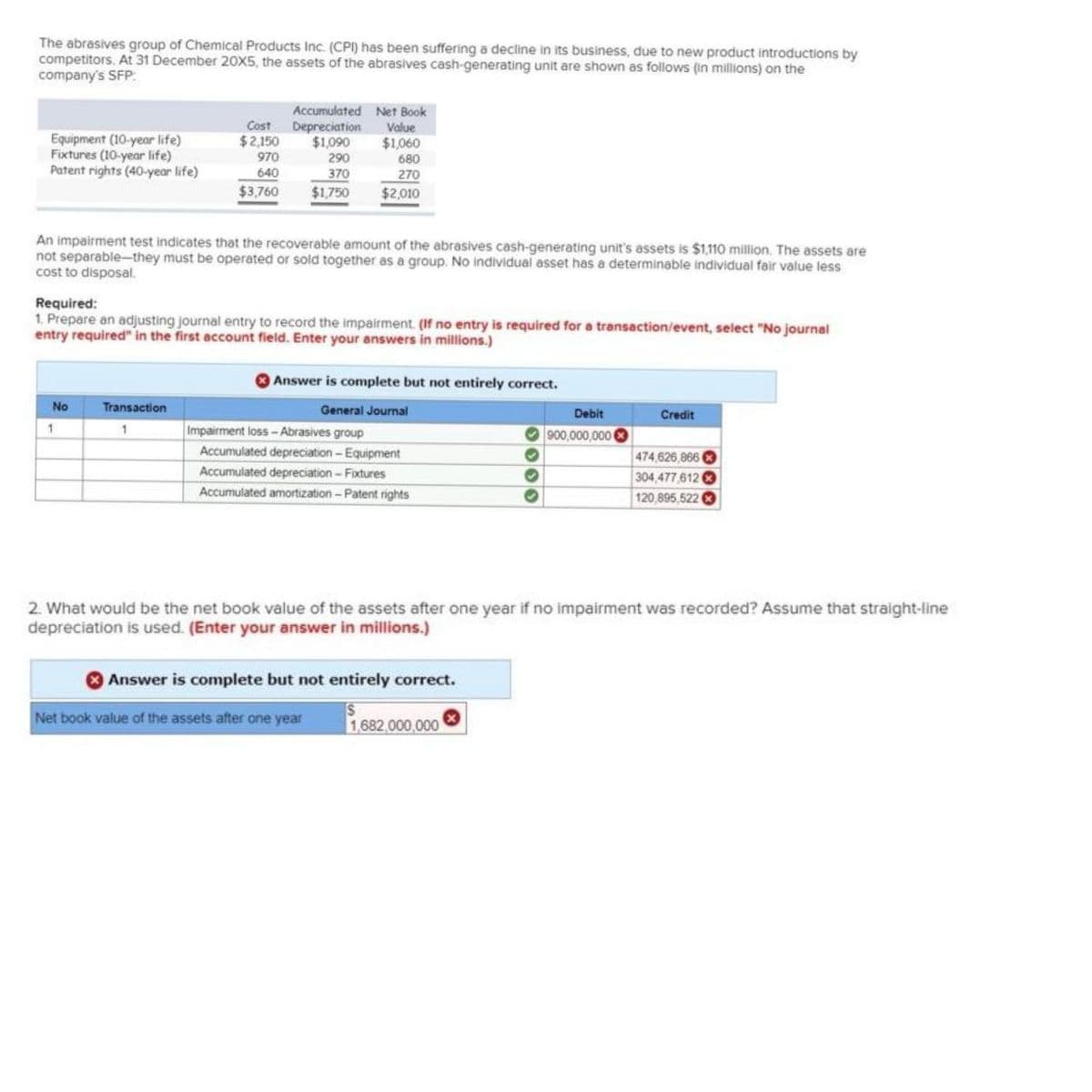

The abrasives group of Chemical Products Inc. (CPI) has been suffering a decline in its business, due to new product introductions by competitors. At 31 December 20X5, the assets of the abrasives cash-generating unit are shown as follows (in millions) on the company's SFP: Equipment (10-year life) Fixtures (10-year life) Patent rights (40-year life) No Cost $2,150 1 970 640 $3,760 Transaction 1 Accumulated Depreciation $1,090 An impairment test indicates that the recoverable amount of the abrasives cash-generating unit's assets is $1,110 million. The assets are not separable-they must be operated or sold together as a group. No individual asset has a determinable individual fair value less cost to disposal. Required: 1. Prepare an adjusting journal entry to record the impairment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions.) 290 370 $1,750 Net Book Value $1,060 680 270 $2,010 Answer is complete but not entirely correct. General Journal Impairment loss-Abrasives group Accumulated depreciation - Equipment Accumulated depreciation - Fixtures Accumulated amortization - Patent rights Net book value of the assets after one year Answer is complete but not entirely correct. ✔ ♥ ✪ 1,682,000,000 Debit 900,000,000 2. What would be the net book value of the assets after one year if no impairment was recorded? Assume that straight-line depreciation is used. (Enter your answer in millions.) Credit 474,626,866 304,477,612 120,895,522

The abrasives group of Chemical Products Inc. (CPI) has been suffering a decline in its business, due to new product introductions by competitors. At 31 December 20X5, the assets of the abrasives cash-generating unit are shown as follows (in millions) on the company's SFP: Equipment (10-year life) Fixtures (10-year life) Patent rights (40-year life) No Cost $2,150 1 970 640 $3,760 Transaction 1 Accumulated Depreciation $1,090 An impairment test indicates that the recoverable amount of the abrasives cash-generating unit's assets is $1,110 million. The assets are not separable-they must be operated or sold together as a group. No individual asset has a determinable individual fair value less cost to disposal. Required: 1. Prepare an adjusting journal entry to record the impairment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions.) 290 370 $1,750 Net Book Value $1,060 680 270 $2,010 Answer is complete but not entirely correct. General Journal Impairment loss-Abrasives group Accumulated depreciation - Equipment Accumulated depreciation - Fixtures Accumulated amortization - Patent rights Net book value of the assets after one year Answer is complete but not entirely correct. ✔ ♥ ✪ 1,682,000,000 Debit 900,000,000 2. What would be the net book value of the assets after one year if no impairment was recorded? Assume that straight-line depreciation is used. (Enter your answer in millions.) Credit 474,626,866 304,477,612 120,895,522

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

Don't give answer in image

Transcribed Image Text:The abrasives group of Chemical Products Inc. (CPI) has been suffering a decline in its business, due to new product introductions by

competitors. At 31 December 20X5, the assets of the abrasives cash-generating unit are shown as follows (in millions) on the

company's SFP:

Equipment (10-year life)

Fixtures (10-year life)

Patent rights (40-year life)

No

Cost

$2,150

1

970

640

$3,760

Transaction

1

Accumulated

Depreciation

$1,090

290

370

$1,750

An impairment test indicates that the recoverable amount of the abrasives cash-generating unit's assets is $1,110 million. The assets are

not separable-they must be operated or sold together as a group. No individual asset has a determinable individual fair value less

cost to disposal.

Required:

1. Prepare an adjusting journal entry to record the impairment. (If no entry is required for a transaction/event, select "No journal

entry required" in the first account field. Enter your answers in millions.)

Net Book

Value

$1,060

680

270

$2,010

Answer is complete but not entirely correct.

General Journal

Impairment loss-Abrasives group

Accumulated depreciation - Equipment

Accumulated depreciation - Fixtures

Accumulated amortization-Patent rights

Net book value of the assets after one year

Answer is complete but not entirely correct.

S

✔

♥

1,682,000,000

Debit

900,000,000 X

2. What would be the net book value of the assets after one year if no impairment was recorded? Assume that straight-line

depreciation is used. (Enter your answer in millions.)

Credit

474,626,866

304,477,612

120,895,522

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College