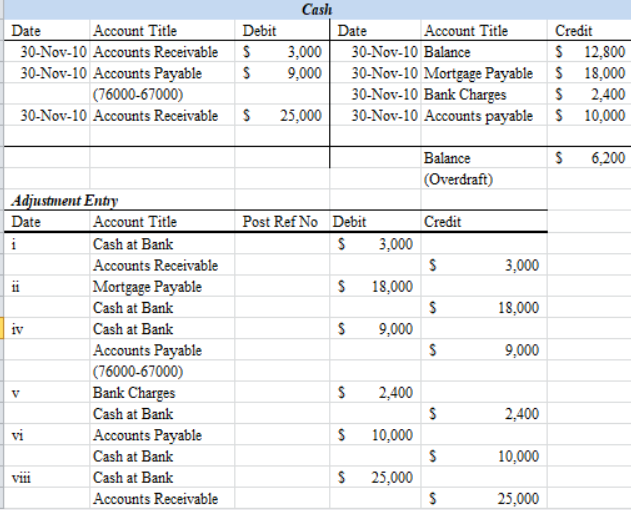

The accountant at Fidel Trading has received the November 2010 bank statement. She immediately investigates the difference between the bank account balance of the cash book and the balance of the bank statement. The accountant has found the following discrepancies: i. A cheque for $3,000 received from a debtor was deposited at the bank but no journal entry was made to record the transaction in the cash book. ii. The repayment of a mortgage is made on behalf of the business by the bank on the authority of a standing order. The payment of $18,000 for the month of November 2010 was not recorded in the cash book. iii. A $36,900 deposit made to the bank on November 30, 2010, did not appear on the bank statement. iv. A cheque for $67,000 which was paid to a creditor was incorrectly recorded in the cash book as $76,000. v. Bank charges of $2,400 appeared on the bank statement only. vi. The direct transfer of $10,000 from Fidel’s bank to the bank of the supplier was not recorded in the cash book. vii. Cheques amounting to $41,000 that were paid to suppliers and creditors did not appear on the bank statement. viii. A deposit of $25,000 made by Federal Trading appeared on the bank statement of Fidel Trading. ix. The bank account in the cash book of Fidel Trading reflected an overdraft of $12,800 on November 30, 2010. a. prepare fidel adjusted cash book for November 20 2020 (part a has already been completed and is shown in the image provided please help with part b & c) b. Prepare the necessary journal entries for Fidel Trading. c.Prepare Fidel Trading’s bank reconciliation statement for November 30th, 2010

The accountant at Fidel Trading has received the November 2010 bank statement. She immediately investigates the difference between the bank account balance of the

i. A cheque for $3,000 received from a debtor was deposited at the bank but no

ii. The repayment of a mortgage is made on behalf of the business by the bank on the authority of a standing order. The payment of $18,000 for the month of November 2010 was not recorded in the cash book.

iii. A $36,900 deposit made to the bank on November 30, 2010, did not appear on the bank statement.

iv. A cheque for $67,000 which was paid to a creditor was incorrectly recorded in the cash book as $76,000.

v. Bank charges of $2,400 appeared on the bank statement only.

vi. The direct transfer of $10,000 from Fidel’s bank to the bank of the supplier was not recorded in the cash book.

vii. Cheques amounting to $41,000 that were paid to suppliers and creditors did not appear on the bank statement.

viii. A deposit of $25,000 made by Federal Trading appeared on the bank statement of Fidel Trading.

ix. The bank account in the cash book of Fidel Trading reflected an overdraft of $12,800 on November 30, 2010.

a. prepare fidel adjusted cash book for November 20 2020

(part a has already been completed and is shown in the image provided please help with part b & c)

b. Prepare the necessary journal entries for Fidel Trading.

c.Prepare Fidel Trading’s

Trending now

This is a popular solution!

Step by step

Solved in 2 steps