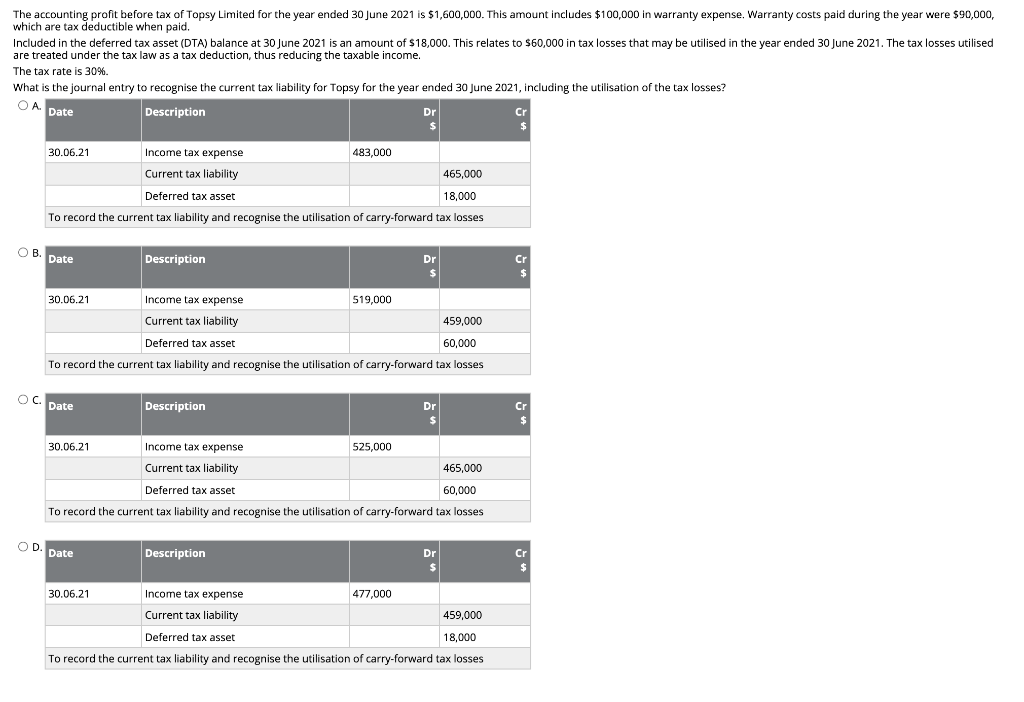

The accounting profit before tax of Topsy Limited for the year ended 30 June 2021 is $1,600,000. This amount includes $100,000 in warranty expense. Warranty costs paid during the year were $90,000, which are tax deductible when paid. Included in the deferred tax asset (DTA) balance at 30 June 2021 is an amount of $18,000. This relates to $60,000 in tax losses that may be utilised in the year ended 30 June 2021. The tax losses utilised are treated under the tax law as a tax deduction, thus reducing the taxable income. The tax rate is 30%. What is the journal entry to recognise the current tax liability for Topsy for the year ended 30 June 2021, including the utilisation of the tax losses?

The accounting profit before tax of Topsy Limited for the year ended 30 June 2021 is $1,600,000. This amount includes $100,000 in warranty expense. Warranty costs paid during the year were $90,000, which are tax deductible when paid. Included in the deferred tax asset (DTA) balance at 30 June 2021 is an amount of $18,000. This relates to $60,000 in tax losses that may be utilised in the year ended 30 June 2021. The tax losses utilised are treated under the tax law as a tax deduction, thus reducing the taxable income. The tax rate is 30%. What is the journal entry to recognise the current tax liability for Topsy for the year ended 30 June 2021, including the utilisation of the tax losses?

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 32P

Related questions

Question

Give answer with full explanation

Transcribed Image Text:The accounting profit before tax of Topsy Limited for the year ended 30 June 2021 is $1,600,000. This amount includes $100,000 in warranty expense. Warranty costs paid during the year were $90,000,

which are tax deductible when paid.

Included in the deferred tax asset (DTA) balance at 30 June 2021 is an amount of $18,000. This relates to $60,000 in tax losses that may be utilised in the year ended 30 June 2021. The tax losses utilised

are treated under the tax law as a tax deduction, thus reducing the taxable income.

The tax rate is 30%.

What is the journal entry to recognise the current tax liability for Topsy for the year ended 30 June 2021, including the utilisation of the tax losses?

OA.

Date

Description

Dr

Cr

30.06.21

Income tax expense

483,000

Current tax liability

465,000

Deferred tax asset

18,000

To record the current tax liability and recognise the utilisation of carry-forward tax losses

O B.

Date

Description

Dr

Cr

30.06.21

Income tax expense

519,000

Current tax liability

459,000

Deferred tax asset

60,000

To record the current tax liability and recognise the utilisation of carry-forward tax losses

Oc.

Date

Description

Dr

Cr

$

30.06.21

Income tax expense

525,000

Current tax liability

465,000

Deferred tax asset

60,000

To record the current tax liability and recognise the utilisation of carry-forward tax losses

OD.

Date

Description

Dr

Cr

30.06.21

Income tax expense

477,000

Current tax liability

459,000

Deferred tax asset

18,000

To record the current tax liability and recognise the utilisation of carry-forward tax losses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT