The accumulated tax depreciation for machines at 30 June 2021 was $50 000. The tax rate is 30%. Required Prepare a deferred tax worksheet to identify the temporary differences arising in respect of the assets and liabilities in the statement of financial position, and to calculate the balance of the deferred tax liability and deferred tax asset accounts at 30 June 2021. Assume the opening balances of the deferred tax accounts were $2,000 for Deferred Tax Assets and $1,500 for Deferred Tax Liability. Prepare the journal entry to adjust the deferred tax account.

The accumulated tax depreciation for machines at 30 June 2021 was $50 000. The tax rate is 30%. Required Prepare a deferred tax worksheet to identify the temporary differences arising in respect of the assets and liabilities in the statement of financial position, and to calculate the balance of the deferred tax liability and deferred tax asset accounts at 30 June 2021. Assume the opening balances of the deferred tax accounts were $2,000 for Deferred Tax Assets and $1,500 for Deferred Tax Liability. Prepare the journal entry to adjust the deferred tax account.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.1DC: Reading 3M Companys Balance Sheet: Accounts Receivable The following current asset appears on the...

Related questions

Question

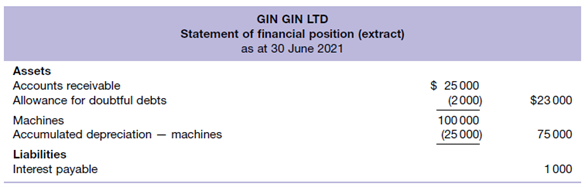

The following information was extracted from the records of Gin Gin Ltd for the year ended 30 June 2021.

Additional information

- The accumulated tax

depreciation for machines at 30 June 2021 was $50 000. - The tax rate is 30%.

Required

- Prepare a

deferred tax worksheet to identify the temporary differences arising in respect of the assets and liabilities in thestatement of financial position , and to calculate the balance of thedeferred tax liability and deferred tax asset accounts at 30 June 2021. Assume the opening balances of the deferred tax accounts were $2,000 forDeferred Tax Assets and $1,500 for Deferred Tax Liability. - Prepare the

journal entry to adjust the deferred tax account.

Transcribed Image Text:GIN GIN LTD

Statement of financial position (extract)

as at 30 June 2021

Assets

$ 25000

(2000)

100 000

(25 000)

Accounts receivable

Allowance for doubtful debts

$23 000

Machines

Accumulated depreciation – machines

75000

Liabilities

Interest payable

1000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning