The adjusted share capital as of December 31, 2020. b. The total share premium as of Dec. 31, 2020 c. The unappropriated retained earnings as of Dec. 31, 2020. d. The adjusted total equity on Dec. 31, 2020

Q: What are the differences between an external audit and an internal audit?

A: Internal audit is performed within organization by the auditor appointed by management.

Q: Use the Stockholders' Equity section of FSB's Balance Sheet to answer the questions below. FSB…

A: Introduction: Stock refers to the documenting of transactions engaged in by a commercial operation…

Q: Topper Sports, Incorporated, produces high-quality sports equipment. The company's Racket Division…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.…

Q: How do you call a deductible temporary difference? a. Current tax asset. b. Deferred tax asset.…

A: As per IAS 12 The amount of the income taxes which will be Recoverable in future period in respect…

Q: Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct…

A: The individual parts of a product are referred to as direct materials. Direct materials for a baker,…

Q: why is there a need to re evaluate impairment of assets due to trigger events?

A: The impairment refers to the decrease in the value of assets of the company. This reduction is…

Q: true? O Sustainability is defined as meeting the needs of the present generation without…

A: Introduction: Sustainability, GRI, CSR and SASB's are all the standards established to provide…

Q: ROBLEM 1. 4111 Company had the following items in its "Cash and cash equivalents" account as of…

A: Hi There, Thanks for choosing Bartleby. As per the Honor code we are supposed to answer the first…

Q: Wendy decides to open her own business and earns 70,000 in accounting profit the first year. When…

A: Introduction: An implicit cost is a cost of opportunity that a corporation does not declare as a…

Q: Describe stakeholder orientation at REI.

A: Introduction: A stakeholder is a person that has an interest in a company and has the ability to…

Q: Lava Lake Inc. bottles and distributes spring water. On February 11 of the current year, Lava Lake…

A: Treasury Stock: Treasury stocks, which are often referred to as treasury shares, are the part of a…

Q: Finch Bank’s start-up division establishes new branch banks. Each branch opens with three tellers.…

A: Fixed costs are those type of costs which do not change with change in activity level. Variable…

Q: Data for Finishing Department are as follows: Cost Data: Beginning Work in Process Costs…

A: Multiple part question has been posted, so as per Bartleby policy only first three sub parts are…

Q: Which of the following GRI standards is topic-specific related? O GRI 102 O GRI 200 O GRI 103 GRI…

A: GRI Standards is one of the modular system that is being used. It contains three series of standards…

Q: Sweet Catering completed the following selected transactions during May 2016: • May 5: Received and…

A: Introduction: Cash Method: Income is not recorded until payment has been made, and costs are not…

Q: Mr. and Mrs. Grnager are both full-time employees. Their three children are 16, 6, and 3 years old.…

A: Here the details of qualified expenses which can be used for claiming the child and depend care…

Q: An invoice for $3200, dated March 20, terms 3/10 E.O.M., was received on March 23. What payment…

A: Terms 3/10 E.O.M means that 3% discount will be provided to customer if payment is being made by…

Q: Find break-even point where a manager has determined that a potential new product can be sold at a…

A: Break even point is the situation where companies total cost will be equal to its total revenue…

Q: Cooper and Dane exchanged properties with each other. Cooper exchanged a commercial building and…

A: Realized Gain is the amount realized or profit from the sale of capital asset.

Q: INSTRUCTIONS: Create a pro-forma income statement based on the given problem. Supply the given items…

A: Here given the details of the preparation of the pro forma income statement which can be useful to…

Q: Tradewinds Construction Company had 4 dump trucks, 2 excavators, and other construction machinery…

A: In order to determine the net investment, the depreciation is required to be deducted from the gross…

Q: Microbiotics currently sells all of its frozen dinners cash-on-delivery but believes it can increase…

A: Sales Promotion: When the companies gives benefits to its customer by way of different types of…

Q: Question: Alternative High Low 90 -10 Buy Rent 70 40 Lease 60 55 Prior Probability .4 .6 Based on…

A: Introduction: The maximax rule entails choosing the choice that maximizes the maximum payout…

Q: Question. Tradewinds Construction Company had 4 dump trucks, 2 excavators, and other construction…

A: Introduction: The total expenses or investment made by a company to obtain capital goods is defined…

Q: On April 2, 2020, enson Ltd. acquired 2,500 shares of Lam Corp. for $5o,000: ihts investment…

A: Introduction: Journal entries should not be used to record basic transactions such as customer…

Q: Explain how FASB Statement #141 changed the accounting for business combinations.

A: Introduction: Accounting for the initial business acquisition can be complex and time-consuming. The…

Q: Questions: 1. What is the total cost assigned to Capping Department? 2. What is the total cost…

A: when there is distribution of overhead by the support department to the production department by…

Q: Karen Corporation has engaged Gelai, CPA, to issue a report on the accuracy of product quality…

A: Attestation Service: An engagement consisting of an examination, review, or application of…

Q: Miller Company's most recent income statement follows: Total Per Unit $672,000 $28 Sales (24,000…

A: Lets understand the basics. In this question, we are required to calculate net income after various…

Q: NASDAQ is the largest stock exchange in the world. © a) True ( b) False

A: Stocks and securities are very important things to be traded in business. Stock brokers are persons…

Q: Question: David Austin recently purchased a chain of dry cleaners in northern Wisconsin. Although…

A: Introduction: The accounting breakeven point is the sales level at which a company produces exactly…

Q: 2. Computer for the Net Present Value using the present value of an annuity. Get the value using…

A: Present value of annuity is used for calculation of present value of equal cash flows. But in case…

Q: BTB (Pty) Limited is a distributor of PPE to rural health clinics in KZN. Turnover has been good and…

A: Cash disbursement refers to the total amount in cash moved out from the business to earn revenue.…

Q: Crane Inc. uses the average cost formula in a perpetual inventory system. (Use unrounded numbers in…

A: The question is related to a weighted Average cost Method. Under this method, issue price is…

Q: Explain why transactions between members of a consolidated firm should not be reflected in the…

A: Introduction: Consolidated financial statements are the consolidated audited financials of a company…

Q: True or False: Depreciation is the decline in the market value of tangible fixed assets.

A: Fixed assets are the non-current assets that are owned by an entity for the purpose of using them…

Q: Pregnancy Test- 10,000 (Php 175 each) Syringe- 125 boxes (Php 250 each) HbsAg- 15,000 (Php 225 each)…

A: Format of Income Statement CATEGORY AMOUNT Service Income…

Q: Question. A corporation purchases 89000 shares of its own $30 par common stock for $47 per share,…

A: Introduction: Shares signify equity ownership in a firm or financial asset held by investors who…

Q: accounting

A: Partnership : It is an arrangement by two or more parties for operating the business.…

Q: A company just starting its business made the following four inventory purchases in June: Date…

A: Gross profit is the amount earned by an entity after deducting the cost of sales from the revenue…

Q: Why is there a need to re-evaluate impairments due to trigger events?

A: When-ever there are any types of assets which are non-tangible assets as well as tangible assets…

Q: In a review engagement the public accountant provides negative assurance in the report which is…

A: An limited assurance or negative engagement or review engagements are conducted by the auditor after…

Q: Which of the following differences would result in future taxable amounts? a. Revenues or gains…

A: Revenues or gains that are taxable after they are recognized in financial income. Should be results…

Q: ABC and XYZ formed a partnership on January 1, 2022, and agreed to share net income and losses 90…

A: Partnership means the agreement between the two or more person to do the business together and share…

Q: 1. A p C Over direc Igno

A: Lets understand the basics. When there are more than one process is required for the production of…

Q: Funky Dance sold inventory for $250,000, terms 1/10, n/30. Cost of goods sold was $168,000. How much…

A: Formula used: Reported sales value = Sales revenue - Discount amount.

Q: The following information pertains to the inventory of Parvin Company for Year 3: Jan. 1 Beginning…

A: Net income is the amount of money earned by the entity after deducting the expenses from the…

Q: The group's debtors are equity stockholders." explain

A: Characteristics of Equity shareholders are as follows: Equity shareholders are permanent in nature…

Q: Biscayne Bay Water Inc. bottles and distributes spring water. On May 14 of the current year,…

A: Treasury StockEntity's own outstanding shares Gain or loss on sale of treasury stock1. Gain is…

Q: Net fixed assets" 403,000 Land 49,440 49,600 Total assets 618,000 620,000 30,900 24,800 Notes…

A: Cash flows statement is one of the financial statement for the business. This shows all cash inflows…

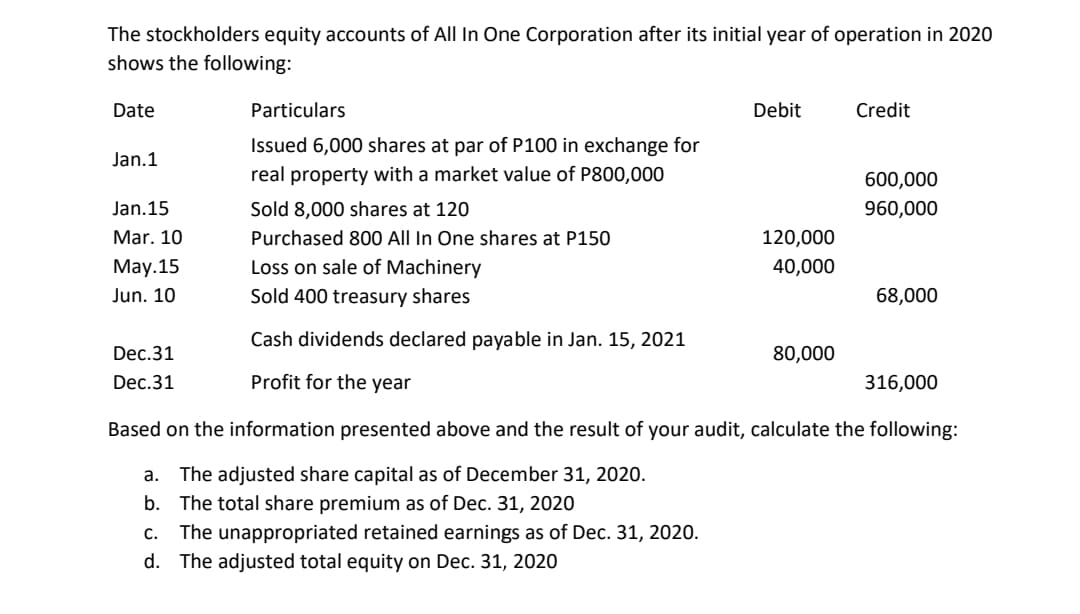

Based on the information presented above and the result of your audit, calculate the following:

a. The adjusted share capital as of December 31, 2020.

b. The total share premium as of Dec. 31, 2020

c. The unappropriated

d. The adjusted total equity on Dec. 31, 2020

Step by step

Solved in 2 steps

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.

- Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000

- Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.

- Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its preferred and common stock: Preferred stock, S30 par, 12% cumulative; 300,000 shares authorized; 150,000 shares issued and outstanding Common stock, $2 par; 2,500,000 shares authorized; 1,200,000 shares issued; 1,000,000 outstanding As of December 31, 2019, Lemon was 3 years in arrears on its dividends. During 2020, Lemon declared and paid dividends. As a result, the common stockholders received dividends of $0.45 per share. Required: What was the total amount of dividends declared and paid? What journal entry was made at the date of declaration?On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Calculating the Number of Shares Issued Castalia Inc. issued shares of its $0.80 par value common stock on September 4, 2019, for $8 per share. The Additional Paid-In Capital-Common Stock account was credited for 5612,000 in the journal entry to record this transaction. Required: How many shares were issued on September 4, 2019?