The annual net income of a company for the period 2007-2011 could be approximated by P(t) = 1.6t2 11t + 48 billion dollars (2 st≤ 6), where t is the time in years since the start of 2005. According to the model, during what year in this period was the company's net income the lowest? (Round your answer to four decimal places.) What was the corresponding net income in billions of dollars? (Round your answer to one decimal place.) billion dollars Would you trust this model to continue to be valid long past this period? Why or why not? O Over time the model predicts that income will eventually decrease, therefore, we should not trust the model past 2011 as the net income will fall back to a reasonable level. O Over time the model predicts that income will eventually decrease, therefore, we should trust the model past 2011 as the net income will become unrealistically large. O Over time the model predicts that income will continue to increase, therefore, we should trust the model past 2011 as the net income will fall back to a reasonable level. O Over time the model predicts that income will eventually decrease, therefore, we should trust the model past 2011 as the net income will fall back to a reasonable level. O Over time the model predicts that income will continue to increase, therefore, we should not trust the model past 2011 as the net income will become unrealistically large.

The annual net income of a company for the period 2007-2011 could be approximated by P(t) = 1.6t2 11t + 48 billion dollars (2 st≤ 6), where t is the time in years since the start of 2005. According to the model, during what year in this period was the company's net income the lowest? (Round your answer to four decimal places.) What was the corresponding net income in billions of dollars? (Round your answer to one decimal place.) billion dollars Would you trust this model to continue to be valid long past this period? Why or why not? O Over time the model predicts that income will eventually decrease, therefore, we should not trust the model past 2011 as the net income will fall back to a reasonable level. O Over time the model predicts that income will eventually decrease, therefore, we should trust the model past 2011 as the net income will become unrealistically large. O Over time the model predicts that income will continue to increase, therefore, we should trust the model past 2011 as the net income will fall back to a reasonable level. O Over time the model predicts that income will eventually decrease, therefore, we should trust the model past 2011 as the net income will fall back to a reasonable level. O Over time the model predicts that income will continue to increase, therefore, we should not trust the model past 2011 as the net income will become unrealistically large.

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter5: Inverse, Exponential, And Logarithmic Functions

Section5.6: Exponential And Logarithmic Equations

Problem 64E

Related questions

Question

100%

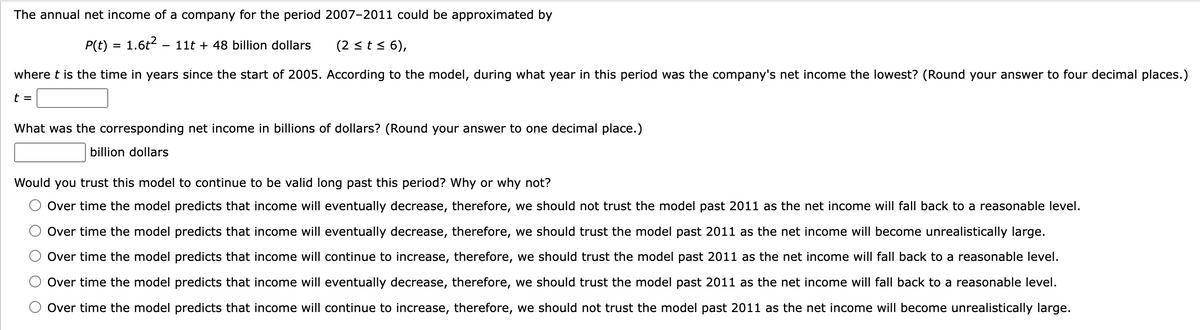

Transcribed Image Text:The annual net income of a company for the period 2007-2011 could be approximated by

P(t) = 1.6t² — 11t + 48 billion dollars

-

(2 ≤ t ≤ 6),

where t is the time in years since the start of 2005. According to the model, during what year in this period was the company's net income the lowest? (Round your answer to four decimal places.)

t =

What was the corresponding net income in billions of dollars? (Round your answer to one decimal place.)

billion dollars

Would you trust this model to continue to be valid long past this period? Why or why not?

Over time the model predicts that income will eventually decrease, therefore, we should not trust the model past 2011 as the net income will fall back to a reasonable level.

Over time the model predicts that income will eventually decrease, therefore, we should trust the model past 2011 as the net income will become unrealistically large.

Over time the model predicts that income will continue to increase, therefore, we should trust the model past 2011 as the net income will fall back to a reasonable level.

Over time the model predicts that income will eventually decrease, therefore, we should trust the model past 2011 as the net income will fall back to a reasonable level.

Over time the model predicts that income will continue to increase, therefore, we should not trust the model past 2011 as the net income will become unrealistically large.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Trigonometry (MindTap Course List)

Trigonometry

ISBN:

9781337278461

Author:

Ron Larson

Publisher:

Cengage Learning