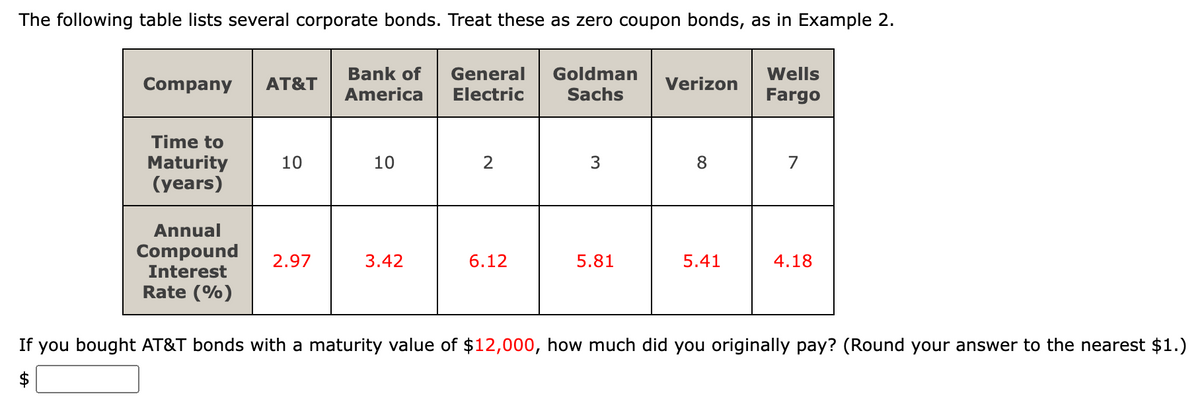

The following table lists several corporate bonds. Treat these as zero coupon bonds, as in Example 2. Bank of General Goldman America Electric Sachs Company AT&T Time to Maturity (years) 10 Annual Compound 2.97 Interest Rate (%) 10 3.42 2 6.12 3 5.81 Verizon 8 5.41 Wells Fargo 7 4.18 If you bought AT&T bonds with a maturity value of $12,000, how much did you originally pay? (Round your answer to the nearest $1.) $

The following table lists several corporate bonds. Treat these as zero coupon bonds, as in Example 2. Bank of General Goldman America Electric Sachs Company AT&T Time to Maturity (years) 10 Annual Compound 2.97 Interest Rate (%) 10 3.42 2 6.12 3 5.81 Verizon 8 5.41 Wells Fargo 7 4.18 If you bought AT&T bonds with a maturity value of $12,000, how much did you originally pay? (Round your answer to the nearest $1.) $

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:The following table lists several corporate bonds. Treat these as zero coupon bonds, as in Example 2.

Company AT&T

LA

Time to

Maturity

(years)

10

Annual

Compound 2.97

Interest

Rate (%)

Bank of General Goldman

America Electric

Sachs

10

3.42

2

6.12

3

5.81

Verizon

8

5.41

Wells

Fargo

7

4.18

If you bought AT&T bonds with a maturity value of $12,000, how much did you originally pay? (Round your answer to the nearest $1.)

Expert Solution

Step 1: Introduction:

A bond is an instrument where the company borrows capital from investors and pays back coupons and face value in return. It is one of the most used methods of debt financing.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

The answer $8955 (after rounding to the nearest dollar) came back correct. Can you please show me the written steps to solve this problem without technology? Thank you!

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College