the appropriate discount rate is 6.8 percent, what is the present value of your winnings? (Do not round Intermedilate calculations and round your answer to 2 decimal plecN, eg, 32.16)

the appropriate discount rate is 6.8 percent, what is the present value of your winnings? (Do not round Intermedilate calculations and round your answer to 2 decimal plecN, eg, 32.16)

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 1QTD

Related questions

Question

Show work please. Thank you

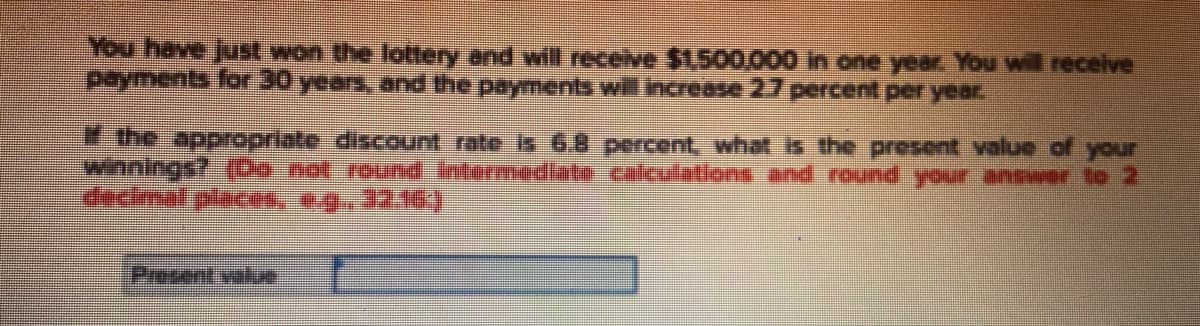

Transcribed Image Text:You have just won the lottery and wil receive $1500,000 in one year. You wil receive

payments for 30 years, and the payments will increase 27 percent per year

7the appropriate discount rate is 6.8 percent, what is the present value of your

winnings? (Do not round Intermediate calculations and round your answer to 2

decimal plac, 4 9,42.16

Present value

Expert Solution

Step 1

Present Value:

It represents the present worth of the future periodic annuity payments. It is calculated by discounting these future annuity payments by an appropriate discount rate.

Information Provided:

Lottery amount (pmt) = $1,500,000

Number of payments (n) = 30

Growth rate (g) = 2.70%

Discount rate (r)= 6.80%

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning