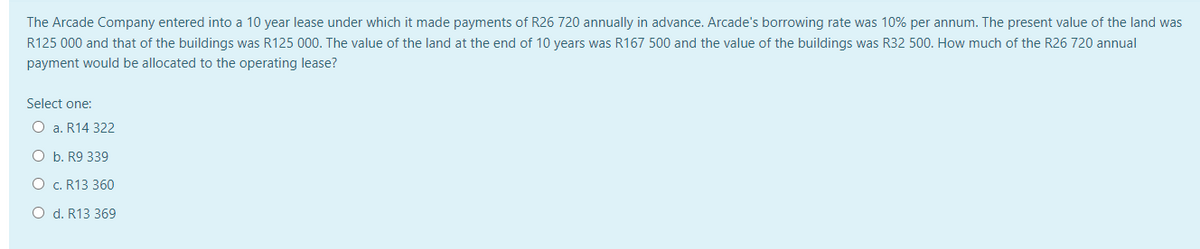

The Arcade Company entered into a 10 year lease under which it made payments of R26 720 annually in advance. Arcade's borrowing rate was 10% per annum. The present value of the land was R125 000 and that of the buildings was R125 000. The value of the land at the end of 10 years was R167 500 and the value of the buildings was R32 500. How much of the R26 720 annual payment would be allocated to the operating lease? Select one: O a. R14 322 O b. R9 339 O c. R13 360 O d. R13 369

The Arcade Company entered into a 10 year lease under which it made payments of R26 720 annually in advance. Arcade's borrowing rate was 10% per annum. The present value of the land was R125 000 and that of the buildings was R125 000. The value of the land at the end of 10 years was R167 500 and the value of the buildings was R32 500. How much of the R26 720 annual payment would be allocated to the operating lease? Select one: O a. R14 322 O b. R9 339 O c. R13 360 O d. R13 369

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 10MC: On August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring...

Related questions

Question

Transcribed Image Text:The Arcade Company entered into a 10 year lease under which it made payments of R26 720 annually in advance. Arcade's borrowing rate was 10% per annum. The present value of the land was

R125 000 and that of the buildings was R125 000. The value of the land at the end of 10 years was R167 500 and the value of the buildings was R32 500. How much of the R26 720 annual

payment would be allocated to the operating lease?

Select one:

O a. R14 322

O b. R9 339

O c. R13 360

O d. R13 369

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT