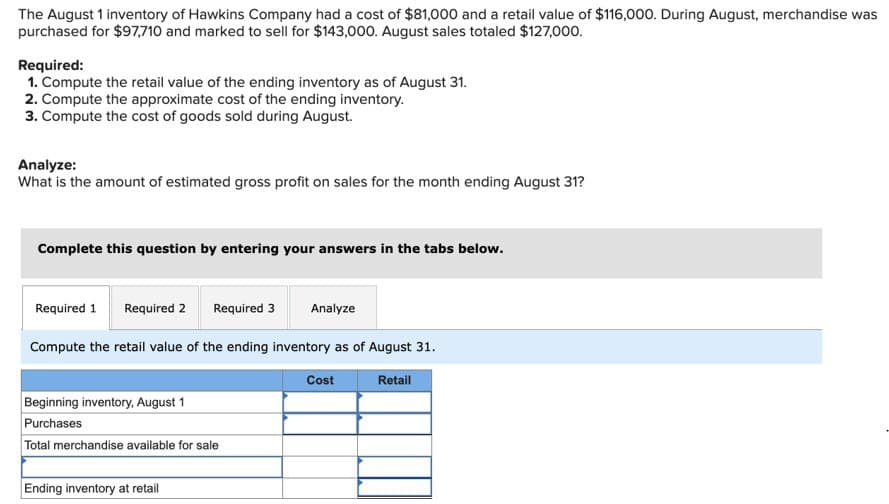

The August 1 inventory of Hawkins Company had a cost of $81,000 and a retail value of $116,000. During August, merchandise was purchased for $97,710 and marked to sell for $143,000. August sales totaled $127,000. Required: 1. Compute the retail value of the ending inventory as of August 31. 2. Compute the approximate cost of the ending inventory. 3. Compute the cost of goods sold during August. Analyze: What is the amount of estimated gross profit on sales for the month ending August 31? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Analyze Compute the retail value of the ending inventory as of August 31. Beginning inventory, August 1 Purchases Total merchandise available for sale Ending inventory at retail Cost Retail

The August 1 inventory of Hawkins Company had a cost of $81,000 and a retail value of $116,000. During August, merchandise was purchased for $97,710 and marked to sell for $143,000. August sales totaled $127,000. Required: 1. Compute the retail value of the ending inventory as of August 31. 2. Compute the approximate cost of the ending inventory. 3. Compute the cost of goods sold during August. Analyze: What is the amount of estimated gross profit on sales for the month ending August 31? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Analyze Compute the retail value of the ending inventory as of August 31. Beginning inventory, August 1 Purchases Total merchandise available for sale Ending inventory at retail Cost Retail

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Question

please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no

Transcribed Image Text:The August 1 inventory of Hawkins Company had a cost of $81,000 and a retail value of $116,000. During August, merchandise was

purchased for $97,710 and marked to sell for $143,000. August sales totaled $127,000.

Required:

1. Compute the retail value of the ending inventory as of August 31.

2. Compute the approximate cost of the ending inventory.

3. Compute the cost of goods sold during August.

Analyze:

What is the amount of estimated gross profit on sales for the month ending August 31?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Analyze

Compute the retail value of the ending inventory as of August 31.

Beginning inventory, August 1

Purchases

Total merchandise available for sale

Ending inventory at retail

Cost

Retail

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,