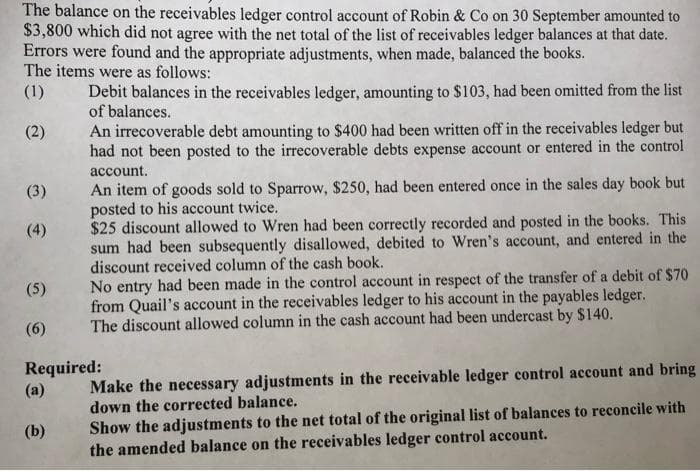

The balance on the receivables ledger control account of Robin & Co on 30 September amounted to $3,800 which did not agree with the net total of the list of receivables ledger balances at that date. Errors were found and the appropriate adjustments, when made, balanced the books. The items were as follows: (1) Debit balances in the receivables ledger, amounting to $103, had been omitted from the list of balances. (2) An irrecoverable debt amounting to $400 had been written off in the receivables ledger but had not been posted to the irrecoverable debts expense account or entered in the control account. An item of goods sold to Sparrow, $250, had been entered once in the sales day book but posted to his account twice. $25 discount allowed to Wren had been correctly recorded and posted in the books. This sum had been subsequently disallowed, debited to Wren's account, and entered in the discount received column of the cash book. No entry had been made in the control account in respect of the transfer of a debit of $70 from Quail's account in the receivables ledger to his account in the payables ledger. The discount allowed column in the cash account had been undercast by $140. Make the necessary adjustments in the receivable ledger control account and bring down the corrected balance. Show the adjustments to the net total of the original list of balances to reconcile with the amended balance on the receivables ledger control account. (3) (5) (6) Required: (a) (b)

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Step by step

Solved in 3 steps