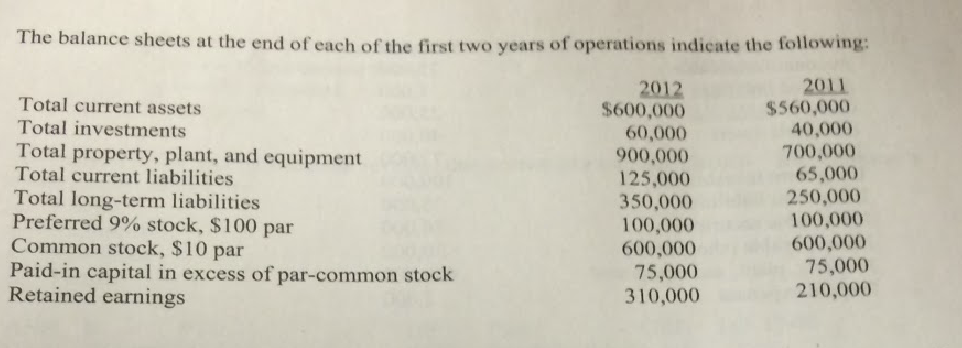

The balance sheets at the end of each of the first two years of operations indicate the following: 2011 $560,000 40,000 2012 $600,000 60,000 900,000 125,000 350,000 100,000 600,000 75,000 310,000 Total current assets Total investments Total property, plant, and equipment Total current liabilities 700,000 65,000 250,000 100,000 600,000 75,000 Total long-term liabilities Preferred 9% stock, $100 par Common stock, $10 par Paid-in capital in excess of par-common stock Retained earnings 210,000 If net income is $115,000 and interest expense is $30,000 for 2012, what is the rate earned on stockholders' equity for 2012 (round percent to one decimal point)? 10.6% 3. a. 11.1% b. 12.4% c. 14.0% d. LO: 17-03 OBJ: Easy Bloom's: Knowledge DIF: PTS: 1 ANS: B KEY: NAT: BUSPROG: Analytic

The balance sheets at the end of each of the first two years of operations indicate the following: 2011 $560,000 40,000 2012 $600,000 60,000 900,000 125,000 350,000 100,000 600,000 75,000 310,000 Total current assets Total investments Total property, plant, and equipment Total current liabilities 700,000 65,000 250,000 100,000 600,000 75,000 Total long-term liabilities Preferred 9% stock, $100 par Common stock, $10 par Paid-in capital in excess of par-common stock Retained earnings 210,000 If net income is $115,000 and interest expense is $30,000 for 2012, what is the rate earned on stockholders' equity for 2012 (round percent to one decimal point)? 10.6% 3. a. 11.1% b. 12.4% c. 14.0% d. LO: 17-03 OBJ: Easy Bloom's: Knowledge DIF: PTS: 1 ANS: B KEY: NAT: BUSPROG: Analytic

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 19P

Related questions

Question

Practice Pack

Transcribed Image Text:The balance sheets at the end of each of the first two years of operations indicate the following:

2011

$560,000

40,000

2012

$600,000

60,000

900,000

125,000

350,000

100,000

600,000

75,000

310,000

Total current assets

Total investments

Total property, plant, and equipment

Total current liabilities

700,000

65,000

250,000

100,000

600,000

75,000

Total long-term liabilities

Preferred 9% stock, $100 par

Common stock, $10 par

Paid-in capital in excess of par-common stock

Retained earnings

210,000

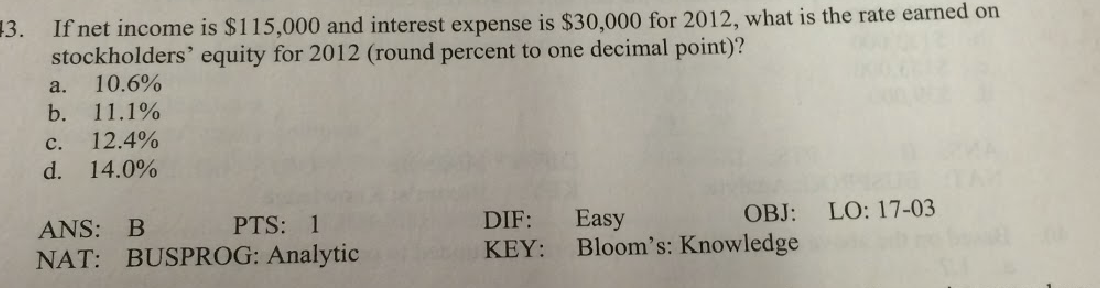

Transcribed Image Text:If net income is $115,000 and interest expense is $30,000 for 2012, what is the rate earned on

stockholders' equity for 2012 (round percent to one decimal point)?

10.6%

3.

a.

11.1%

b.

12.4%

c.

14.0%

d.

LO: 17-03

OBJ:

Easy

Bloom's: Knowledge

DIF:

PTS: 1

ANS: B

KEY:

NAT: BUSPROG: Analytic

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning