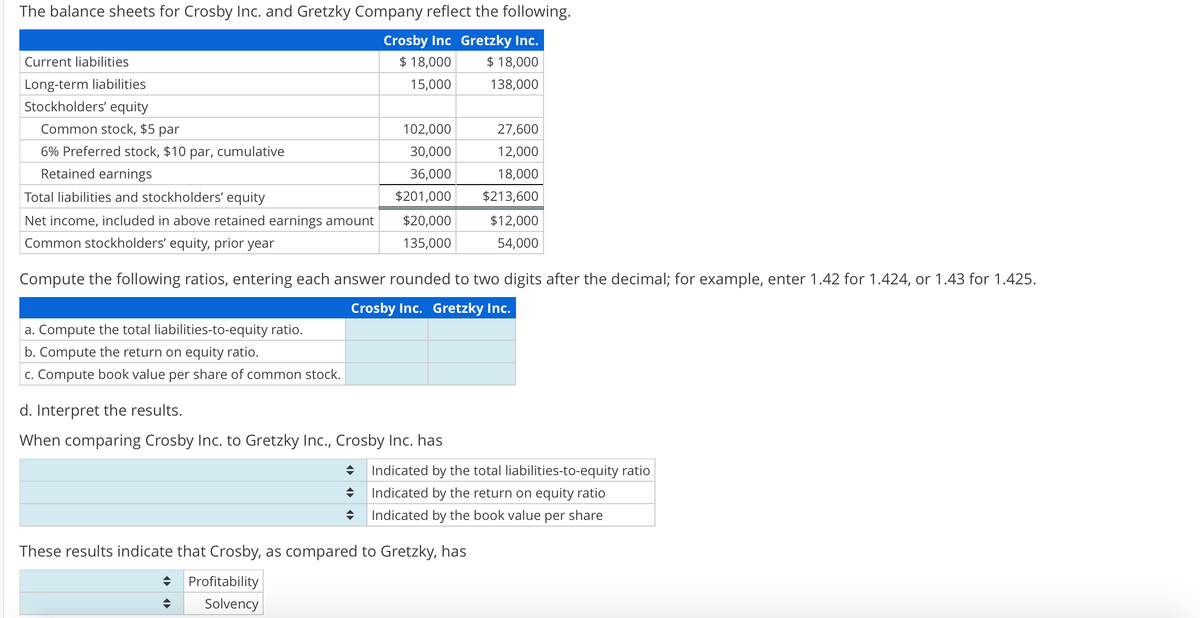

The balance sheets for Crosby Inc. and Gretzky Company reflect the following. Crosby Inc Gretzky Inc. $ 18,000 Current liabilities $ 18,000 Long-term liabilities Stockholders' equity 15,000 138,000 Common stock, $5 par 102,000 27,600 6% Preferred stock, $10 par, cumulative 30,000 12,000 Retained earnings 36,000 18,000 Total liabilities and stockholders' equity $201,000 $213,600 Net income, included in above retained earnings amount $20,000 $12,000 Common stockholders' equity, prior year 135,000 54,000 Compute the following ratios, entering each answer rounded to two digits after the decimal; for example, enter 1.42 for 1.424, or 1.43 for 1.425. Crosby Inc. Gretzky Inc. a. Compute the total liabilities-to-equity ratio. b. Compute the return on equity ratio. c. Compute book value per share of common stock. d. Interpret the results. When comparing Crosby Inc. to Gretzky Inc., Crosby Inc. has Indicated by the total liabilities-to-equity ratio • Indicated by the return on equity ratio Indicated by the book value per share These results indicate that Crosby, as compared to Gretzky, has + Profitability Solvency

The balance sheets for Crosby Inc. and Gretzky Company reflect the following. Crosby Inc Gretzky Inc. $ 18,000 Current liabilities $ 18,000 Long-term liabilities Stockholders' equity 15,000 138,000 Common stock, $5 par 102,000 27,600 6% Preferred stock, $10 par, cumulative 30,000 12,000 Retained earnings 36,000 18,000 Total liabilities and stockholders' equity $201,000 $213,600 Net income, included in above retained earnings amount $20,000 $12,000 Common stockholders' equity, prior year 135,000 54,000 Compute the following ratios, entering each answer rounded to two digits after the decimal; for example, enter 1.42 for 1.424, or 1.43 for 1.425. Crosby Inc. Gretzky Inc. a. Compute the total liabilities-to-equity ratio. b. Compute the return on equity ratio. c. Compute book value per share of common stock. d. Interpret the results. When comparing Crosby Inc. to Gretzky Inc., Crosby Inc. has Indicated by the total liabilities-to-equity ratio • Indicated by the return on equity ratio Indicated by the book value per share These results indicate that Crosby, as compared to Gretzky, has + Profitability Solvency

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 19E: Lyon Company shows the following condensed income statement information for the year ended December...

Related questions

Question

Solvency Section on Bottom : Selections are "Higher" or "Lower"

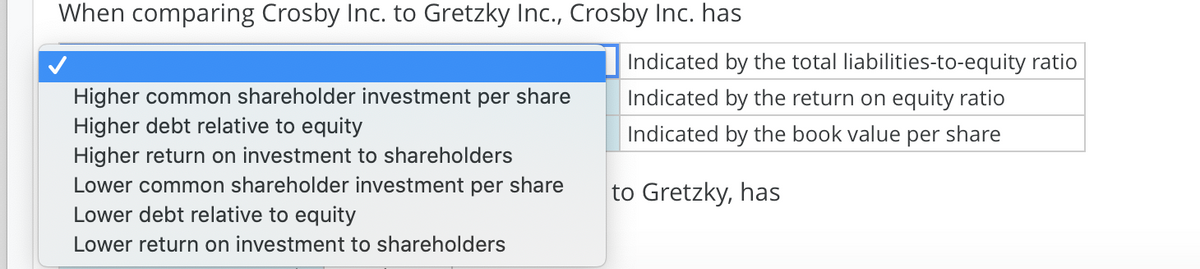

Transcribed Image Text:When comparing Crosby Inc. to Gretzky Inc., Crosby Inc. has

Indicated by the total liabilities-to-equity ratio

Higher common shareholder investment per share

Higher debt relative to equity

Higher return on investment to shareholders

Lower common shareholder investment per share

Lower debt relative to equity

Indicated by the return on equity ratio

Indicated by the book value per share

to Gretzky, has

Lower return on investment to shareholders

Transcribed Image Text:The balance sheets for Crosby Inc. and Gretzky Company reflect the following.

Crosby Inc Gretzky Inc.

Current liabilities

$ 18,000

$ 18,000

Long-term liabilities

Stockholders' equity

15,000

138,000

Common stock, $5 par

102,000

27,600

6% Preferred stock, $10 par, cumulative

30,000

12,000

Retained earnings

36,000

18,000

Total liabilities and stockholders' equity

$201,000

$213,600

Net income, included in above retained earnings amount

$20,000

$12,000

Common stockholders' equity, prior year

135,000

54,000

Compute the following ratios, entering each answer rounded to two digits after the decimal; for example, enter 1.42 for 1.424, or 1.43 for 1.425.

Crosby Inc. Gretzky Inc.

a. Compute the total liabilities-to-equity ratio.

b. Compute the return on equity ratio.

c. Compute book value per share of common stock.

d. Interpret the results.

When comparing Crosby Inc. to Gretzky Inc., Crosby Inc. has

Indicated by the total liabilities-to-equity ratio

Indicated by the return on equity ratio

Indicated by the book value per share

These results indicate that Crosby, as compared to Gretzky, has

Profitability

Solvency

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

The average of the

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning