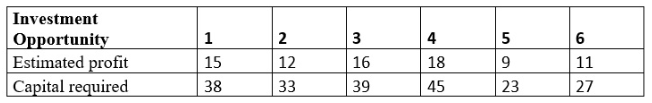

The board of directors of the General Wheeis Co. is considering six major capital investments. Each investment can be made only once. These investments differ in the estimated long-term profit (net present value) they will generate, as well as the amount of capital each requires, as shown in the following table (in millions of dollars): Total capital of $100 million is available for these investments. Investment opportunities 1 and 2 are mutually exclusive, as are 3 and 4. Furthermore, opportunity 3 or 4 cannot be taken unless one of the first two options is invested in. There are no such restrictions on investment opportunities 5 and 6. The objective is to choose the combination of capital investments that maximizes the estimated long-term return (net present value). a) Formulate the BIM model for this problem. b) Use the computer to solve this model.

The board of directors of the General Wheeis Co. is considering six major capital investments. Each investment can be made only once. These investments differ in the estimated long-term profit (net present value) they will generate, as well as the amount of capital each requires, as shown in the following table (in millions of dollars):

Total capital of $100 million is available for these investments. Investment opportunities 1 and 2 are mutually exclusive, as are 3 and 4. Furthermore, opportunity 3 or 4 cannot be taken unless one of the first two options is invested in. There are no such restrictions on investment opportunities 5 and 6. The objective is to choose the combination of capital investments that maximizes the estimated long-term return (net present value).

a) Formulate the BIM model for this problem.

b) Use the computer to solve this model.

Step by step

Solved in 4 steps