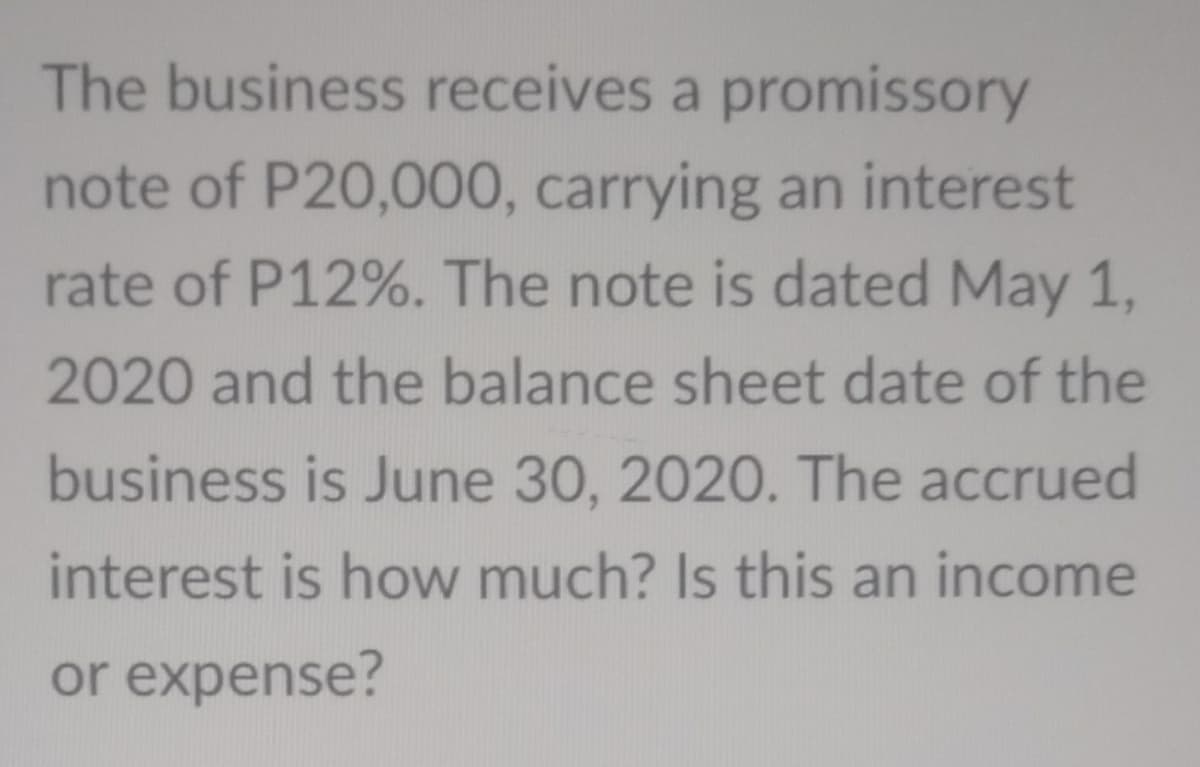

The business receives a promissory hote of P20,000, carrying an interest rate of P12%. The note is dated May 1, 2020 and the balance sheet date of the business is June 30, 2020. The accrued interest is how much? Is this an income or expense?

Q: On January 1, 2020, MP's customer issued a 3 year 8% note, PHP 3,000,000 for services billed to be…

A: Carrying amount is also known as carrying value or book value. The carrying amount of a note issued…

Q: Consider the following information from the record of Ornamental Green Garden at the end of the…

A: Total liabilities = account payable + interest payable + accrued interest + notes payable = 600000 +…

Q: MNO Bank granted a loan to a borrower on January 1, 2020. The interest on the loan is 10% payable…

A: Loan receivables refer to the net balance that is being held in the borrower's account in the books…

Q: On August 1, 2020, PHINEAS Company borrowed P9,000,000 from a lender, which is to be paid on January…

A: When the loan is borrowed from the lender, the interest charge on the loan or the borrowed…

Q: On December 31, 2011 , Bunny Co. received a 10% note with face amount of P1,500,000. Both principal…

A: Interest receivable on December 31, 2012 = Face value of notes x rate of interest x no. of months in…

Q: Wildhorse Co. issued a five-year interest-bearing note payable for $324000 on January 1, 2019. Each…

A: Balance sheet is the financial statement which involves the total debt, liabilities, assets and…

Q: On June 30, 2019, Franz Inc. borrowed P1,800,000 for one year from the bank with an interest of 12%.…

A: Bank charges = accounts receivable x 8.46% = 2500000 x 8.46% = P211,500

Q: 2. For the year ended Dec. 31, 2020, Taehyung Company paid interest totaling P prepaid interest…

A: Answer: Given is the interest paid for year ended 2020 and some adjustments of prepaid expenses.…

Q: require an annual fee of 50,000 and an interest of 1% per month. On March 1, 2020, 3,000,000 is used…

A: Interest on remaining period on purchase value in credit line Purchase value = 30,00,000 used upto…

Q: What amount should Jeba report as a liability for accrued interest at December 31, 2022?

A: The accrued liability would be calculated from 01st April 2021 to December 31, 2022. The accrued…

Q: Entei Bank granted a P5,000,000 loan to Raikou Company on January 1, 2020. The annual interest on…

A: Here in this question we are required to find out the total interest income to be presented on the…

Q: FDNACCT Co. purchased merchandise and issued a twelve-month promissory note with 8% interest and…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: On April 1, 2019, Char Company borrowed P5,000,000 and signed a 2-year note bearing interest at 12%…

A: Interest accrued for April 1, 2019 to March 31, 2020 = Amount borrowed x rate of interest x no. of…

Q: On May 1, 2020, Zachary Corporation borrowed $2,500 on a two-year, 6% note payable. Interest is due…

A: The company borrowed amount on the dated May 1, 2020. Interest will be payable after six months.…

Q: On January 1, 2020, MP's customer issued a 3 year 8% note, PHP 3,000,000 for services billed to be…

A: Carrying amount: It is the original cost of the asset that is reflected or shown in the balance…

Q: On March 1, 2020, LINGATONG Company has received a P10,000, two year note bearing interest at 12%…

A: Lingatong Company Receive P10,000 Accrued Interest Receivable at 31st Dec,2021 is Interest Expense…

Q: On Jan. 1, 2020, EC Company reported a note payable of P 1,200,000. The note is dated Oct. 1, 2019,…

A: Given that, Notes payable as on Jan 1 2020 = P1200000 Rate of interest = 12%

Q: On January 1, 2019, a company acquired transportation equipment by paying cash of P400,000 and…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: On June 30, 2019, Franz Inc. borrowed P1,800,000 for one year from the bank with an interest of 12%.…

A: Answer: correct answer is option C C. P 1,588,500; P 319,500

Q: On December 1, 2021, Davenport Company sold merchandise to a customer for $20,000. In payment for…

A: Interest revenue recognize during 2021 = Notes receivable x rate of interest x 1/12 months =…

Q: For the year ended Dec. 31, 2020, The Company paid interest totaling P100,000. The prepaid interest…

A: Interest expense refers to the cost which is incurred through the entity for the borrowed funds. It…

Q: On 1 September 2019, J & J Co. issued a note payable to National Bank in the amount of P900,000,…

A: The amount borrowed from a bank by signing a formal written contract is reported as notes payable in…

Q: The following transactions apply to Walnut Enterprises for 2018, its first year of operations:…

A: Balance sheet is the financial statement of a company. It helps in maintaining the records of…

Q: Ajam Inc. shows the following selected adjusted account balances at March 31, 2019: $ 58,000…

A: Ajam Inc. Balance Sheet March'31, 2019 Liabilities Current Liabilities: Accounts…

Q: The business is expected to make principal payments totalling $400,000 towards the loan during the…

A: Note payable is a liability account so by paying the principal amount of $ 400000 will reduce the…

Q: On December 31, 2020, Glare Company provided the following information: Accounts payable, including…

A: A liability occurs when a company has undergone a transaction that has generated an expectation for…

Q: On September 1, 2020, a company borrowed cash and signed a 1-year interest bearing note on which…

A: Current liabilities: Liabilities which have to be paid within one year or one operating cycle,…

Q: In connection with this note, how much Jane Co. would pay at March 31, 2019?

A: Given information is: Jane's Donut Co. borrowed OMR 50,000 on March 1, 2018, and signed a one-year…

Q: For the next two items: A company sold a factory on January 1, 2016 for P7,000,000. The entity…

A: When a factory is sold the payment can be received outrightly or over a period of when credit is…

Q: The business receives a promissory note of P50,000, carrying an interest rate of P10%. The note is…

A: Accrued income is that income which are earned by the business but the amount is yet to be received…

Q: On September 1, 2020, a company borrowed on a P5,400,000 note payable from a bank. The note bears…

A: Accrued interest payable on December 31, 2021 = Note payable outstanding on September 1, 2021 x rate…

Q: On January 1, 2019, a company acquired transportation equipment by paying cash of P400,000 and…

A: Carrying value of note payable is the present value of all the payments to be made on the note…

Q: On December 31, 2023, Sandy Company has a Note Receivable of $6,000. The note will be collected in…

A: Current asset can be converted into cash within 12 months whereas long term assets has a life of…

Q: On October 1, 2021, Smash Company discounted its own note of P500,000 at 10% for 1 year. In its…

A: When a business makes discounting of its own note, then Notes payable will become a liability for…

Q: Able Inc. borrowed $60,000 on October 1, 2019 and agreed to pay back $75,000 on October 1, 2022. How…

A: Interest: It refers to the charge which is paid by a borrower to the lender for using his funds.

Q: On July 1, 2021, Guarin Co. obtained fire insurance for a three-year period at an annual premium of…

A: As per the honor code, We’ll answer the first question since the exact one wasn’t specified. Please…

Q: current liabilities section

A: The first annual payment of P200,000 is made on June 30, 2020. The balance of note payable will be…

Q: The following balances were reported by Nagpapangap Company on December 31, 2020 and 2019: 2020:…

A: Gross Purchase refers to Total Purchase it including cost of goods returned and Discounts also.…

Q: A company acquires assets recorded at $240,000 by paying $120,000 cash and taking on a 12 year…

A: Loan =240000-120000=120000/24=$5000 So instalment $5000 semi annual…

Q: For the year ended Dec. 31, 2019, Nando Company paid interest totaling P100,000. The prepaid…

A: Interest expense is an expense that is due on the amount borrowed from the lender. It is reported in…

Q: On December 31, 2020, Olaer Company received two P5,000,000 notes receivable from customers in…

A: financial statement is statement that shows the company financial information of company activities…

Q: On April 1, 2019, Flamengo Co. signed a one-year, 8% interest-bearing note payable for $50,000.…

A: Since you have asked multiple questions we will solve the first question for you as per the policy.…

Q: On September 1, 2019, Tange company borrowed on a P5,400,000 note payable from a bank. The note…

A: An interest bearing note represents funds loaned by a lender to a borrower, on which interest is…

Q: On September 1, 2021, Zara Company issued a 6-month note to supplier amounting to P300,000, 12%…

A: Adjusting entries are those journal entries which are passed at the end of accounting period for the…

Q: On October 1, 2021, Chrysanthemum Co. purchased equipment by issuing a 9% promissory note with face…

A: Interest payable on Decemeber 31,2022 = 9% x (1500000-400000) x3/12= 24750

Q: On December 1, 2021, Nicole Company gave Dawn Company a P2,000,000, 12% loan. Nicole Company paid…

A: The following calculations are done for Nicole Company.

Q: The following transactions occurred during December 31, 2021, for the Microchip Company. On…

A: Interest=$90,000×8%×312=$1,800

Q: On September 30, 2022 World Company borrowed P1, 000, 000 on a 9% note payable. The entity paid the…

A: >Note Payables are the liabilities. >It can be issued in case of: --when goods are…

Q: MNO Bank granted a loan to a borrower on January 1, 2020. The interest on the loan is 10% payable…

A: Carrying value of loan on January 1, 2020 =Principal value of loan +Direct orgination cost…

Q: On December 31, 2020, the bookkeeper of ABC Company provided the following information: PARTICULARS…

A: Current liabilities are the liabilities that are payable or settled in the next 12 months from the…

Step by step

Solved in 2 steps

- In December 2019, Swanstrom Inc. receives a cash payment of $3,500 for services performed in December 2019 and a cash payment of S4,500 for services to be performed in January 2020. Swanstrom also receives the December utility bill for S600 but does not pay this bill until 2020. For 2019, under the accrual basis of accounting, Swanstrom would recognize: a. $8,000 of revenue and $600 of expense. b. $8,000 of revenue and $0 of expense. c. $3,500 of revenue and $600 of expense. d. $3,500 Of revenue and $0 of expense.On January 1, 2018, King Inc. borrowed $150,000 and signed a 5-year, note payable with a 10% interest rate. Each annual payment is in the amount of $39,569 and payment is due each Dec. 31. What is the journal entry on Jan. 1 to record the cash received and on Dec. 31 to record the annual payment? (You will need to prepare the first row in the amortization table to determine the amounts.)Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?

- Cee Co.s fiscal year begins April 1. At the beginning of its fiscal year, Cee Co. estimates that it will owe 17,400 in property taxes for the year. On June 1, its property taxes are assessed at 17,000, which it pays immediately. Prepare the related journal entries for April 1, May 1, and June 1. Then compute the monthly property tax expense that Cee Co. would record during June through March.Chemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?Jain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual interest rate of 3.5%, due in 6 months. What journal entry is created when Jain honors the note?

- Homeland Plus specializes in home goods and accessories. In order for the company to expand its business, the company takes out a long-term loan in the amount of $650,000. Assume that any loans are created on January 1. The terms of the loan include a periodic payment plan, where interest payments are accumulated each year but are only computed against the outstanding principal balance during that current period. The annual interest rate is 8.5%. Each year on December 31, the company pays down the principal balance by $80,000. This payment is considered part of the outstanding principal balance when computing the interest accumulation that also occurs on December 31 of that year. A. Determine the outstanding principal balance on December 31 of the first year that is computed for interest. B. Compute the interest accrued on December 31 of the first year. C. Make a journal entry to record interest accumulated during the first year, but not paid as of December 31 of that first year.On January 1, 2019, Northfield Corporation becomes delinquent on a 100,000, 14% note to First National Bank, on which 16,651 of interest has accrued. On January 2, 2019, the bank agrees to restructure the note. It forgives the accrued interest, extends the repayment date to December 31, 2021, and reduces the interest rate to 10%. Required: Prepare a schedule for Northfield to compute the annual interest expense in regard to the preceding note for each year of the restructuring agreement.A company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expense

- On July 1, 2019, Aldrich Company purchased as an available-for-sale security 200,000 face value, 9% U.S. Treasury notes for 194,000. The notes mature July 1, 2020, and pay interest semiannually on January 1 and July 1. The notes were sold on December 1, 2019, for 199,000. Aldrich normally uses straight-line amortization on all of its notes. In its income statement for the year ended December 31, 2019, what amount should Aldrich report as a gain on the sale of the available-for-sale security? a. 2,500 b. 3,500 c. 5,000 d. 6,000Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)Suppose that Blake Companys total pretax difference from a change to FIFO was 100,000 and the company pays a bonus of 5% of its income before income taxes and bonus to employees. If Blake pays an additional bonus | based on the change in income, would it recognize any expense? If so, when and how much?