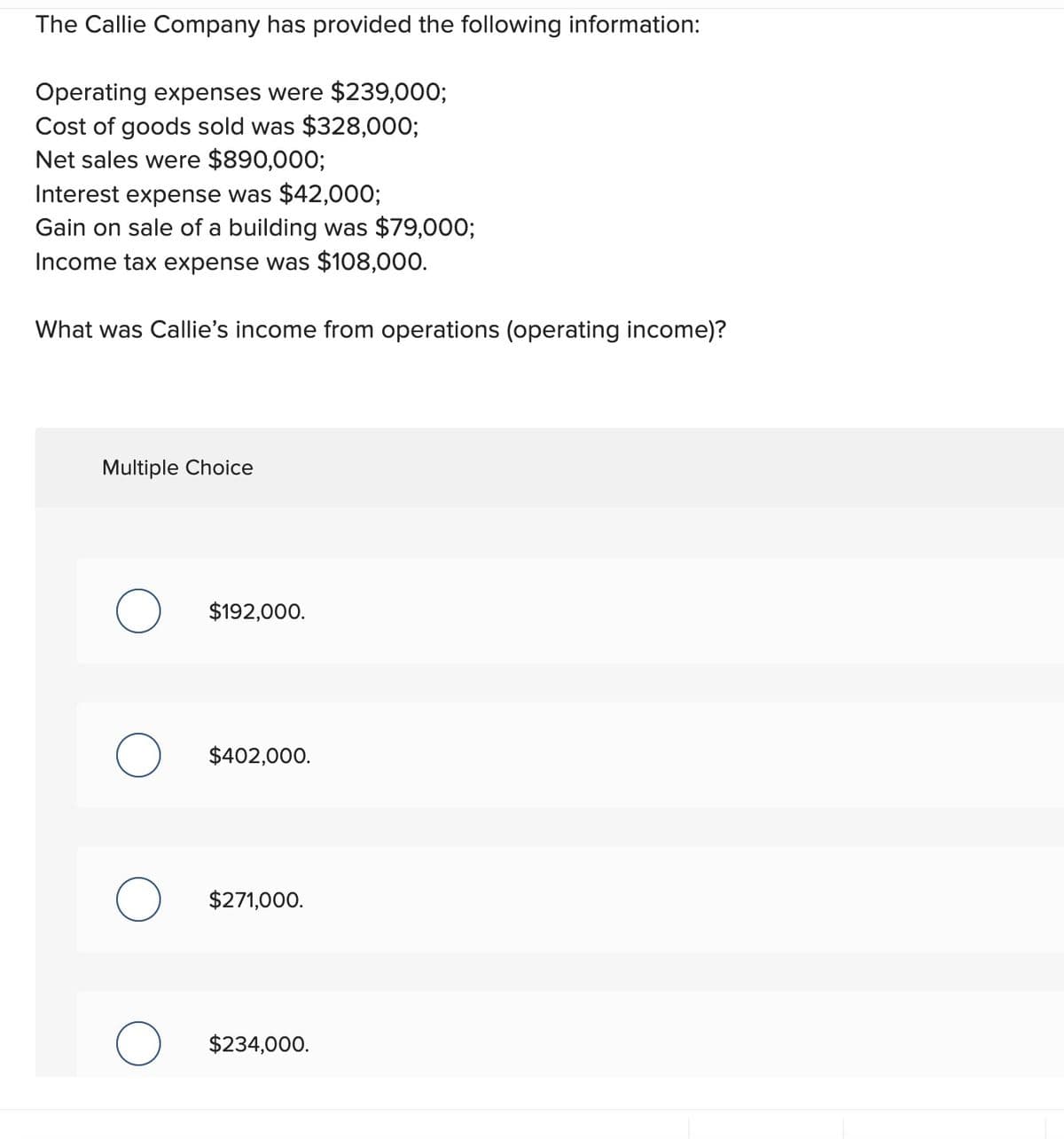

The Callie Company has provided the following information: Operating expenses were $239,000; Cost of goods sold was $328,000; Net sales were $890,000; Interest expense was $42,000; Gain on sale of a building was $79,000; Income tax expense was $108,000. What was Callie's income from operations (operating income)? Multiple Choice $192,000. О $402,000. $271,000. О $234,000.

The Callie Company has provided the following information: Operating expenses were $239,000; Cost of goods sold was $328,000; Net sales were $890,000; Interest expense was $42,000; Gain on sale of a building was $79,000; Income tax expense was $108,000. What was Callie's income from operations (operating income)? Multiple Choice $192,000. О $402,000. $271,000. О $234,000.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter1: Introduction To Business Activities And Overview Of Financial Statements And The Reporting Process

Section: Chapter Questions

Problem 23E

Question

Alpesh

Transcribed Image Text:The Callie Company has provided the following information:

Operating expenses were $239,000;

Cost of goods sold was $328,000;

Net sales were $890,000;

Interest expense was $42,000;

Gain on sale of a building was $79,000;

Income tax expense was $108,000.

What was Callie's income from operations (operating income)?

Multiple Choice

$192,000.

О

$402,000.

$271,000.

О

$234,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College