The capital structure of Red Ribbon Corporation on December 31,2019 follows: 12% Preference share capital, P 200 par, 30,000 shares issued and outstanding P 6,000,000 Ordinary share capital, P 50 par, 100,000 shares issued and outstanding 5,000,000 Share Premium- Preference 1,800,000 Share Premium- Ordinary 1,500,000 Retained Earnings 2,200,000 During 2020, the following selected transactions occurred: 1. Purchased and retired 4,000 preference shares at P 280 per share. 2. Purchased 8,000 shares of its own ordinary share at P 80 per share. A 2-for-l share split on the ordinary share was approved by the shareholders, thereby reducing the pa value to P 25. 3. 4. Reissued 6,000 treasury shares at P 45 each.

The capital structure of Red Ribbon Corporation on December 31,2019 follows: 12% Preference share capital, P 200 par, 30,000 shares issued and outstanding P 6,000,000 Ordinary share capital, P 50 par, 100,000 shares issued and outstanding 5,000,000 Share Premium- Preference 1,800,000 Share Premium- Ordinary 1,500,000 Retained Earnings 2,200,000 During 2020, the following selected transactions occurred: 1. Purchased and retired 4,000 preference shares at P 280 per share. 2. Purchased 8,000 shares of its own ordinary share at P 80 per share. A 2-for-l share split on the ordinary share was approved by the shareholders, thereby reducing the pa value to P 25. 3. 4. Reissued 6,000 treasury shares at P 45 each.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 16E: Contributed Capital Adams Companys records provide the following information on December 31, 2019:...

Related questions

Question

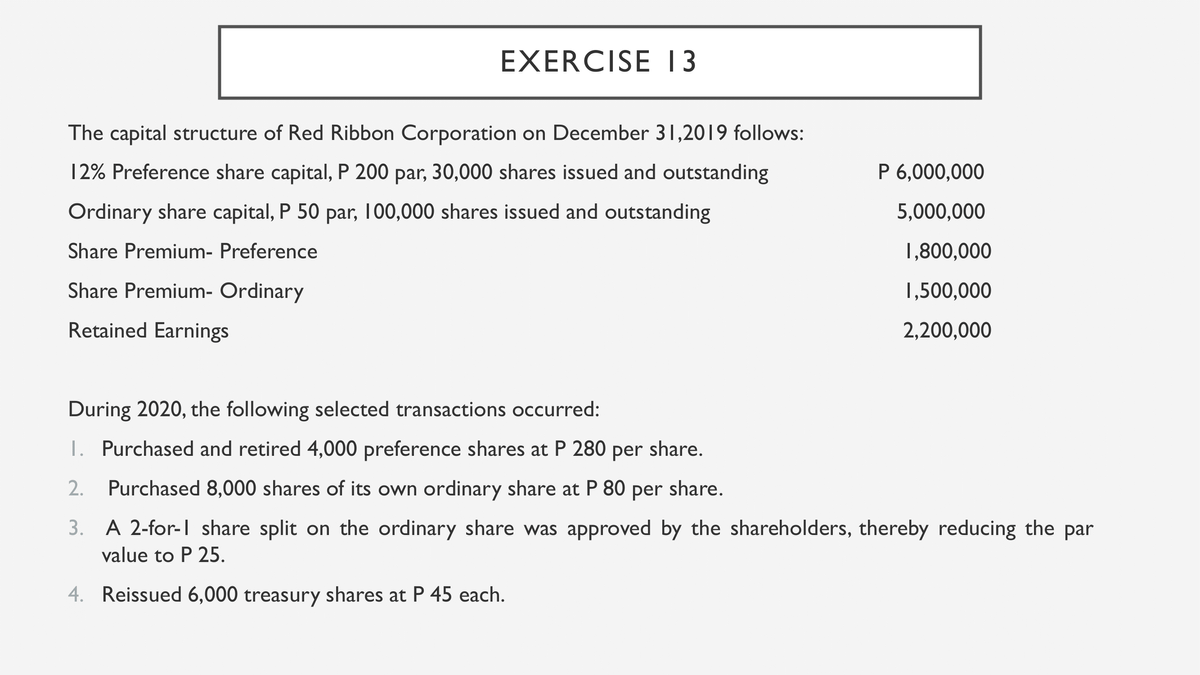

Transcribed Image Text:EXERCISE I 3

The capital structure of Red Ribbon Corporation on December 31,2019 follows:

12% Preference share capital, P 200 par, 30,000 shares issued and outstanding

P 6,000,000

Ordinary share capital, P 50 par, 100,000 shares issued and outstanding

5,000,000

Share Premium- Preference

1,800,000

Share Premium- Ordinary

1,500,000

Retained Earnings

2,200,000

During 2020, the following selected transactions occurred:

1. Purchased and retired 4,000 preference shares at P 280 per share.

2.

Purchased 8,000 shares of its own ordinary share at P 80 per share.

3. A 2-for-l share split on the ordinary share was approved by the shareholders, thereby reducing the par

value to P 25.

4. Reissued 6,000 treasury shares at P 45 each.

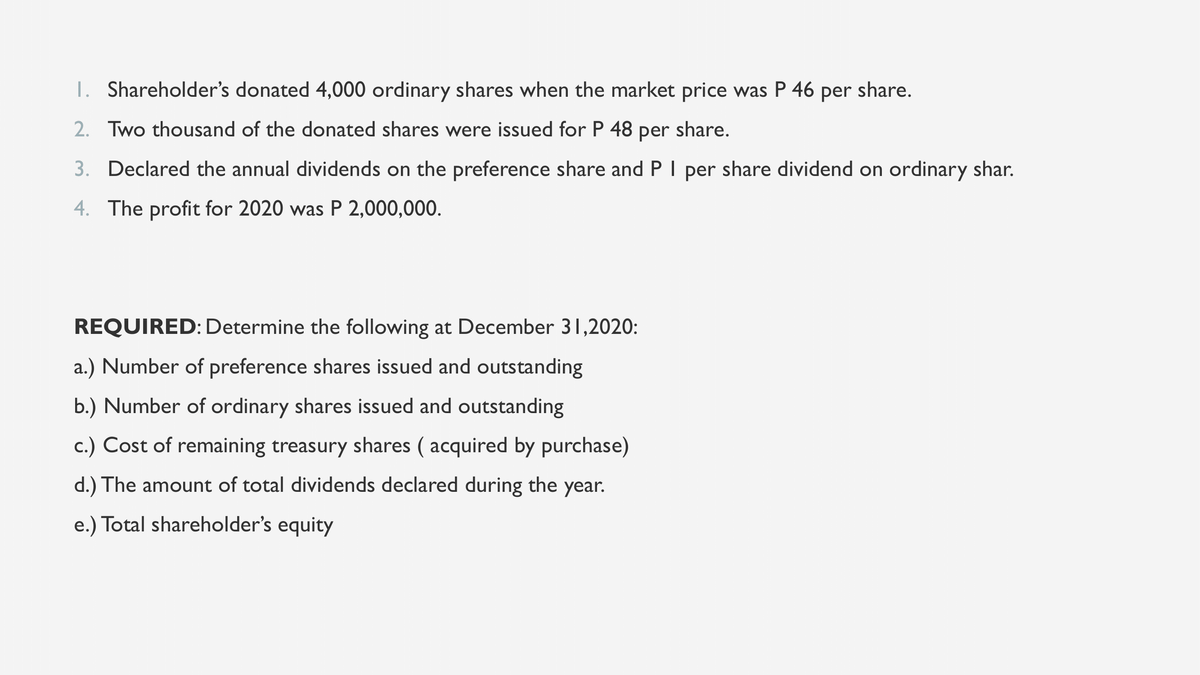

Transcribed Image Text:I. Shareholder's donated 4,000 ordinary shares when the market price was P 46

per

share.

2. Two thousand of the donated shares were issued for P 48 share.

per

3. Declared the annual dividends on the preference share and PI per share dividend on ordinary shar.

4.

The profit for 2020 was P 2,000,000.

REQUIRED: Determine the following at December 31,2020:

a.) Number of preference shares issued and outstanding

b.) Number of ordinary shares issued and outstanding

c.) Cost of remaining treasury shares ( acquired by purchase)

d.) The amount of total dividends declared during the year.

e.) Total shareholder's equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning